The case for sinking Cathie Wood’s Ark—here’s how one ETF provider outlines the short thesis

Happy Thursday! I’ll be walking you through some of the big themes that MarketWatch is spotting in exchange-traded funds this week.

Everybody was jumping on the bandwagon of star stock picker Cathie Wood and her Ark Investment suite of funds in 2020, including the flagship Ark Innovation ETF ARKK,

Send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on.

Sign up here for ETF Wrap.

The good and the bad

| Top 5 gainers of the past week | %Performance |

| Vanguard Extended Duration Treasury ETF EDV, |

2.7 |

| iShares 20+ Year Treasury Bond ETF TLT, |

2.1 |

| Vanguard Long-Term Treasury Index ETF VGLT, |

2.0 |

| SPDR Portfolio Long Term Treasury ETF SPTL, |

2.0 |

| Aberdeen Standard Physical Gold Shares ETF SGOL, |

1.9 |

| Source: FactSet, through Thursday midday, Aug. 19, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

| Top 5 decliners of the past week | %Performance |

| Invesco WilderHill Clean Energy ETF PBW, |

-9.7 |

| SPDR S&P Oil & Gas Exploration & Production ETF XOP, |

-9.5 |

| VanEck Vectors Rare Earth/Strategic Metals ETF REMX, |

-8.6 |

| Invesco China Technology ETF CQQQ, |

-8.0 |

| Global X Copper Miners ETF COPX, |

-7.7 |

| Source: FactSet |

The knock on Wood

On Monday, we caught up with Matthew Tuttle, Tuttle Capital CEO, a fund provider that looks after less than a dozen funds with about $230 billion under management. Earlier this month, Tuttle filed to launch the actively managed short Ark ETF, which would use the ticker symbol SARK and would be structured as an inverse ETF that uses a complex strategy of options contracts, like swaps, to bet against Wood’s flagship fund.

Tuttle declined to talk about the fund specifically, aiming to avoid running afoul of regulators, because the application for SARK is still being reviewed by the Securities and Exchange Commission and wouldn’t likely be approved, if at all, until mid-October.

Speaking broadly about the shorting strategy, Tuttle said that there is clearly appetite from individual investors who want access to a simple way to take the other side of Wood’s bullish bets on companies like Tesla Inc. TSLA,

“What Ark has done is almost created a whole new sector…you can think of it as unprofitable tech,“ Tuttle told MarketWatch.

However, shorting individual technology or biotechnology stocks may not give you the type of short exposure you might be looking for.

Traders who sell shares “short,“ usually borrow them and then sell them, betting they can profit by buying the stocks back later at lower prices. As such, short interest is often taken as an indicator of the degree of negative sentiment among investors in the stocks. Earlier this month, 12% of the total volume of Ark Innovation shares were being sold short, marking a record high short interest, the Financial Times (paywall) wrote, citing data from S3 Partners.

Ultimately, Tuttle said: “For every major sector or industry there is a long ETF and a short ETF,“ so short Ark Innovation vehicles could be seen more about rounding out the market and offering a wider array of opportunities, to individual investors in particular, than as some vendetta against Wood.

As for Burry’s short bets, Tuttle cautioned that public disclosures about Scion Asset Management, the hedge-fund managers fund, may not reflect his current holdings, since it is just a snapshot at a point in time, as is the case with 13F filings.

“A 13F is a picture of history. It is not a real-time snapshot. Theoretically when he bought them, he could have made his money and gotten out,“ Tuttle said.

He also noted that Wood’s investment thesis is based on long-term thinking. “She is saying ‘Hey, where is the future?…and buying those companies.“ Tuttle warned that betting against Ark Innovation also isn’t a surefire moneymaker.

“There are lots of forces in the market that could keep things moving in a [bullish] direction,“ he said.

Ark Innovation is down 7.6% so far in 2021. The Dow Jones Industrial Average DJIA,

SPY-ing lower costs

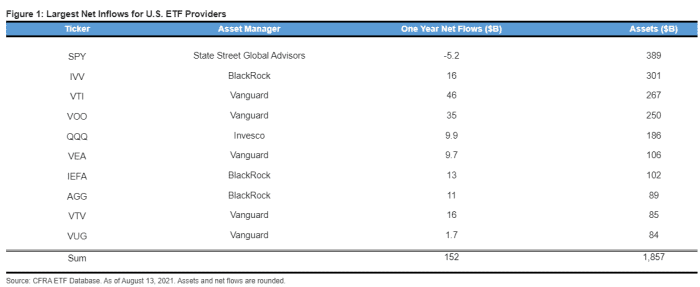

This year so far, the granddaddy of ETFs, the SPDR S&P 500 ETF Trust SPY,

It’s hard to beat SPYs expense ratio at 0.09%, which means that investors will pay 90 cents annually for every $1,000 invested. However, the iShares Core S&P 500 ETF IVV,

Notably, the Vanguard Total Stock Market ETF VTI,

Buy the dip?

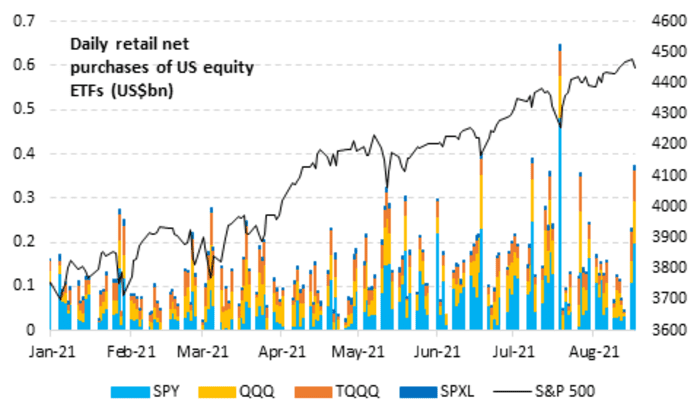

Analysts at Vanda Research note that investors are buying stock market dips more than not and doing so via ETFs.

“Buying the dip through broad market and leveraged ETFs remains the norm for retail investors,” wrote the Vanda analyst in a research report dated Wednesday. The researchers noted that investors bought $375million in the four most popular S&P and Nasdaq ETFs, including SPY, the Invesco QQQ Trust QQQ,

Good ETF reads

- The age of ETFs is looming, writes the Financial Times (paywall). The publication says that the latest sign of the growing power of ETFs is J.P. Morgan Asset Management converting four actively managed mutual funds into ETFs, which ETF Wrap wrote about here.

- For Bitcoin Futures ETFs, the Future Is Here. Where Bloomberg writes about the prospect for a bitcoin ETF coming to fruition via futures. We wrote about that here.

- Global ETF Assets Hit $9 trillion (via WSJ).