The pressure is on for Powell and the Federal Reserve to manage the exit from ultra-easy policies

Federal Reserve Chair Jerome Powell testifies during a U.S. House Oversight and Reform Select Subcommittee hearing on coronavirus crisis, on Capitol Hill in Washington, June 22, 2021.

Graeme Jennings | Pool | Reuters

For the Federal Reserve, implementing the easiest monetary policy in the institution’s history was tough enough. Getting out will be no treat, either.

That is what the central bank faces on its road ahead.

Investors on Friday will hear more on what Fed Chairman Jerome Powell thinks about the economy, and they’re also expecting to get at least a few more clues on how he will guide the central bank’s exit from the measures it took to rescue the nation from the Covid-19 pandemic. He will deliver a speech in conjunction with the Fed’s annual Jackson Hole conference, which again will be held virtually this year.

First on the Fed’s docket is pulling back on the money printing – the $120 billion or so of bonds it buys each month in an effort to stimulate demand and drive down long-term interest rates.

After that, the road gets rougher.

At some point, the Fed will be looking to raise short-term interest rates off the near-zero anchor where they’ve sat since March 2020. Getting rates back to normal didn’t end well for the Fed the last time it attempted to do so from 2015-18 as it had to stop in mid-cycle amid a slumping economy.

Markets, then, could be excused for being at least a little nervous this time around. The Fed not only has to turn around its most aggressive easing policies ever, it must do so with precision and hopes that it doesn’t break anything in the process.

“Every Fed change in monetary policy is important,” said Priya Misra, global head of rates strategy for TD Securities. “But I think it’s particularly more meaningful today because we know growth is slowing and the Fed is trying to exit.”

Indeed, the economy is still well within a strong recovery from the depths of the pandemic, which yielded the steepest but shortest recession in U.S. history. But the rebound has seemed if not declining at least to be stalling. The Citi Economic Surprise Index, which measures actual data against Wall Street estimates, was at a record high in mid-July but now has slumped to levels last seen in June 2020, in the nascent days of Covid-19.

Fed officials themselves expect noticeably slower growth in the years ahead at a time when both monetary and fiscal policy will be tighter. That raises more questions about whether Powell and his cohorts can get the exit right.

Misgivings in the market

“Are they exiting at the right place? Are they exiting at the right time, at the right magnitude? Given the slowing of the economy, we have questions around both,” Misra said. “The market is pricing in a policy mistake.”

What Misra means by a policy mistake is that the current pricing in fed funds futures, the market that trades around the Fed’s rate moves, is indicating the Fed will only be able to raise its rate a few times to maybe 1.25%, then will have to stop as growth stalls.

Rates that low scare Fed officials because they give them little wiggle room to loosen policy in times of crisis. That was around where the funds rate stood at the beginning of the pandemic crisis, coming down substantially from the 2.25%-2.5% target range where the Fed finished its last rate-hiking cycle in December 2018.

The calculus for how to manage it all will fall on Powell from a communication standpoint, and for the other Federal Open Market Committee members in terms of actual mechanics.

“Tapering is important because it’s a very good measure of not only the credibility of the Fed but in terms of communication, how good is the strategy and how transparent it is,” said Deepak Puri, chief investment officer for the Americas at Deutsche Bank Wealth Management. “In 2013, the Fed made mistakes in how to communicate on tapering.”

That 2013 episode – the so-called Taper Tantrum as it’s known now – is the only template the market has for how the Fed might proceed.

Misra, the TD Securities strategist, pointed out the Fed already is showing that it learned a lesson from the earlier episode in that it now is easing the market into tapering. The 2013 proclamation from then-Fed Chairman Ben Bernanke was seen as abrupt, and it sent interest rates surging and stocks lower for several months before those trends reversed.

“They’re doing a good job in the sense that they’re really trying to not surprise markets. That avoids a mistake they made in 2013. That’s a positive,” said Shawn Snyder, head of investment strategy at Citi U.S. Consumer Wealth Management. “They’re in a little bit of a tough position, because the delta variant is acting as a wildcard.”

Depending on the Fed

The Fed and markets have been joined at the hip for a long time, but especially in the era of quantitative easing and zero interest rates that began in 2008. Stocks slumped badly at the start of the pandemic but then rebounded as soon as the Fed ramped up the bond buying.

During the first taper, the market ultimately recovered its losses even after the taper began and through the rate hike cycle – up until late 2018 when a series of Powell communication missteps sent investors reeling.

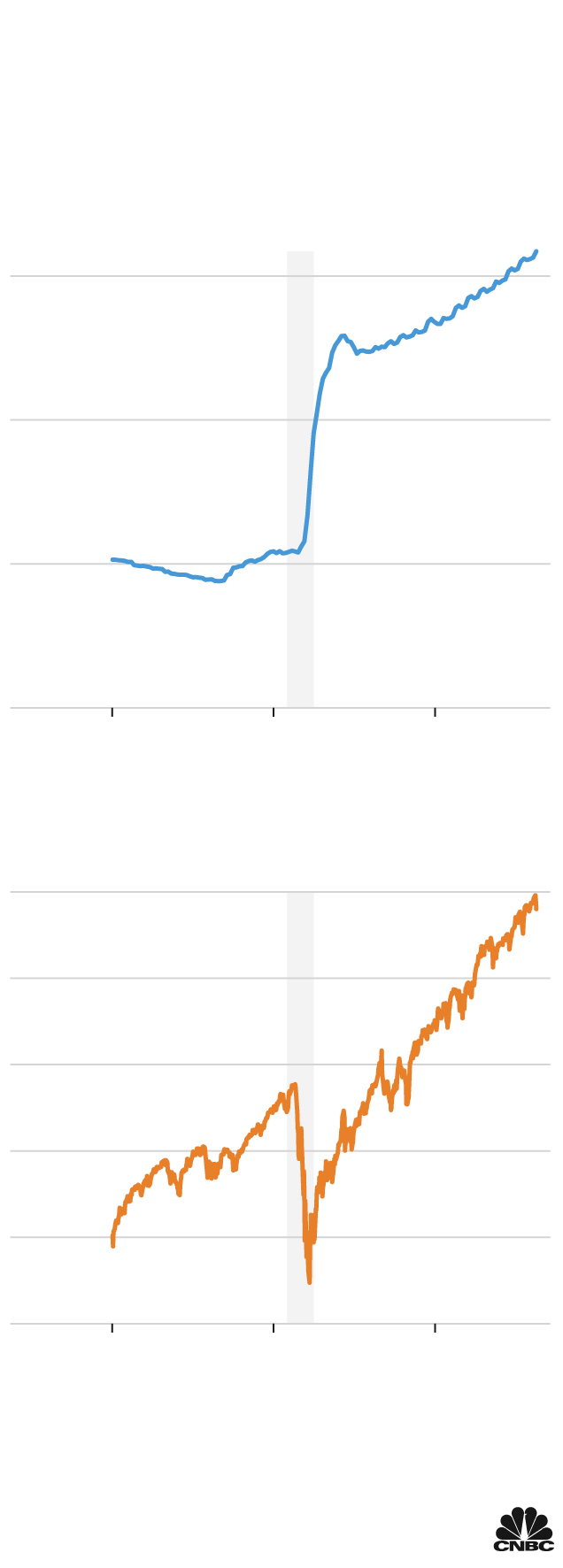

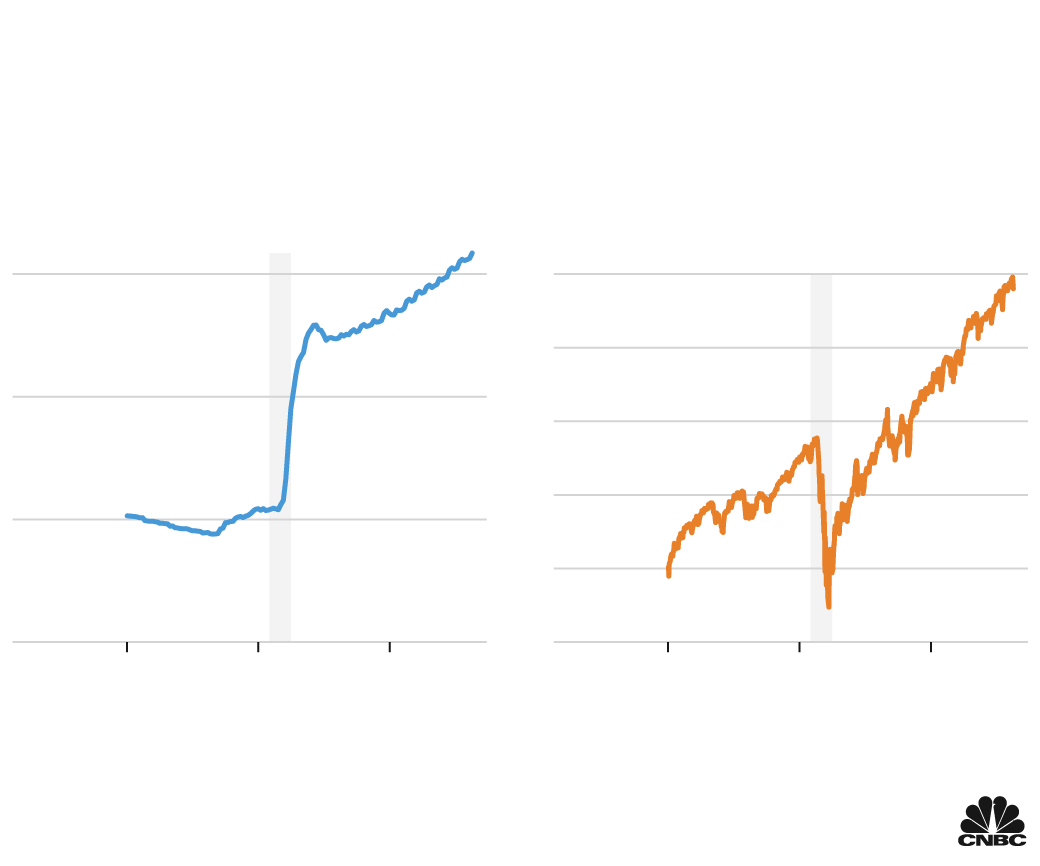

Fed balance sheet, stock market soar

As the Federal Reserve built up its balance sheet, the S&P 500 index bounced back

from the Covid crash to reach record levels

Total assets of the Federal Reserve

Note: Shaded area represents U.S. recession. Fed balance sheet data is unadjusted.

Source: Board of Governors of the Federal Reserve System, via Federal Reserve Bank of St. Louis

(assets), FactSet (S&P 500). Data as of Aug. 18, 2021.

Fed balance sheet, stocks soar

As the Federal Reserve built up its balance

sheet, the S&P 500 index bounced back

from the Covid crash to reach record levels

Total assets of the Federal Reserve

Note: Shaded area represents U.S. recession. Fed

balance sheet data is unadjusted.

Source: Board of Governors of the Federal Reserve

System, via Federal Reserve Bank of St. Louis

(assets), FactSet (S&P 500). Data as of 8/18/21.

Fed balance sheet, stock market soar

As the Federal Reserve built up its balance sheet, the S&P 500 index

bounced back from the Covid crash to reach record levels

Total assets of the Federal Reserve

Note: Shaded area represents U.S. recession. Fed balance sheet data is unadjusted.

Source: Board of Governors of the Federal Reserve System, via Federal Reserve

Bank of St. Louis (assets), FactSet (S&P 500). Data as of Aug. 18, 2021.

On the economy, Fed officials have put less stress on their policies and more on fiscal aid and the path of the virus.

The Covid strain is casting some doubt on where growth is headed. But several regional Fed presidents who spoke to CNBC this week said the virus seems to be having little impact on growth and for now isn’t weighing on their economic forecasts.

“Consumers and businesses are becoming more adaptable, more resilient, and I think people are expecting that [the virus] is going to go in fits and starts,” said Dallas Fed President Robert Kaplan, one of those in favor of removing policy accommodation slowly.

The informal consensus now in the market is that the Fed starts tapering before the end of the year and wraps up the process in eight to 10 months. After that, it will evaluate were things stand before moving on rates.

Landmines for Powell

Complicating matters for Powell are some touchy political dynamics both inside and outside the Fed.

The rising hawkish bent from regional presidents such as Kaplan and James Bullard at the St. Louis Fed is clashing with more dovish members such as Governor Lael Brainard and San Francisco Fed President Mary Daly.

On top of that, Powell is up for renomination in February, as are several other Fed officials, and President Joe Biden has not made his preferences known yet. Powell already knows what it’s like to be leaned on to keep rates low after his experience with former President Donald Trump, but he still to some extent will have to herd cats to keep a Fed consensus together as economic and pandemic conditions shift.

An image of U.S. President Joe Biden is broadcast on a screen after his address to the nation regarding the situation in Afghanistan as traders work on the trading floor of the New York Stock Exchange (NYSE) in Manhattan, New York City, U.S., August 17, 2021.

Andrew Kelly | Reuters

“The worry for both the Fed and economy is the danger of applying political pressure to get outcomes that one desires on the political spectrum, and thus undermining the Fed’s independence,” Charles Plosser, the former Philadelphia Fed president, told CNBC in a broadcast interview. “Powell’s in a delicate spot.”

For his part, Powell used his 2020 Jackson Hole speech to outline a dramatic shift in policy regarding the way the Fed views inflation. The new framework reflects a desire to achieve full and inclusive employment even if that means running inflation hot, and the policy has been blamed in some quarters for surging prices this year.

“We are in a period of time where monetary and fiscal policy are at its most stimulative level we’ve seen in 75 years,” Plosser said. “They need to ask the question, what role does policy play in making this inflation more persistent than it otherwise would prove to be.”

Powell’s speech Friday is expected to yield no such major breakthroughs in the Fed approach, focusing instead on current and future expected conditions with a little hint of how he and his fellow policymakers will try to manage it all.

But it likely will set the stage for how the central bank gets back to normal, so the pressure will still be on.

“The real question to me is what happens next year,” said Snyder, the Citi strategist. “Do we found ourselves looking at moderating economy and moderating inflation that will make it difficult for the Fed to achieve liftoff on rates? … I think people are very worried about the idea that maybe this isn’t going to work out the way we planned.”

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today.