The reflation trade is fading. Here’s what to avoid, and where to seek refuge, in commodities.

Slumbering markets seemed to have woken up this week, and not in a particularly good mood.

It’s true that the S&P 500 SPX,

Tom Price, head of commodities strategy at U.K. brokerage Liberum, said there are three factors contributing to what he says is the end of the reflation trade.

The first is the Federal Reserve’s planned tapering of its bond purchases this year, which created upside risks for inflation-adjusted rates and the dollar, and downside risks for globally traded commodities. Another is China’s continued actions to restrict domestic activity, including credit controls, property taxes and the release of strategic stockpiles, that he said is intended to reduce growth to between 6% and 7%, from 8% in the second quarter. And finally, there is the coronavirus, with the delta variant impacting the U.S., Australia and other countries.

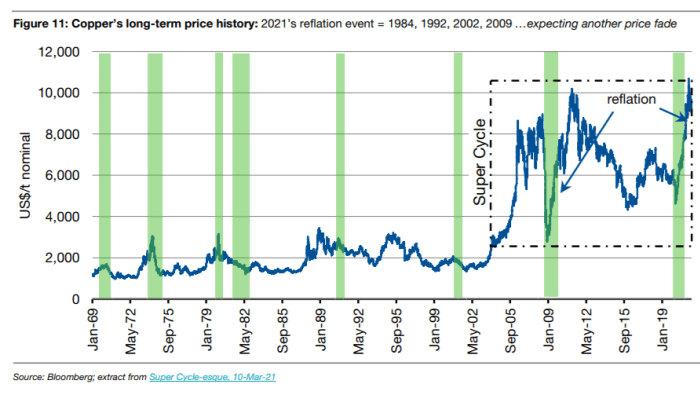

Price has for months dissented with the commodity supercycle view, espoused by many on Wall Street. “Reopening of the global economy saw a synchronized resurrection of demand and restocking activity, at odds with a still-dormant supply-chain,” he said. The broad-based rally resembles those of 1984, 1991, 2001 and 2009 — and typically lasts six to 18 months.

Price said traders should stay from commodities that have attracted lots of speculative inflow — namely copper and iron ore.

On copper HG00,

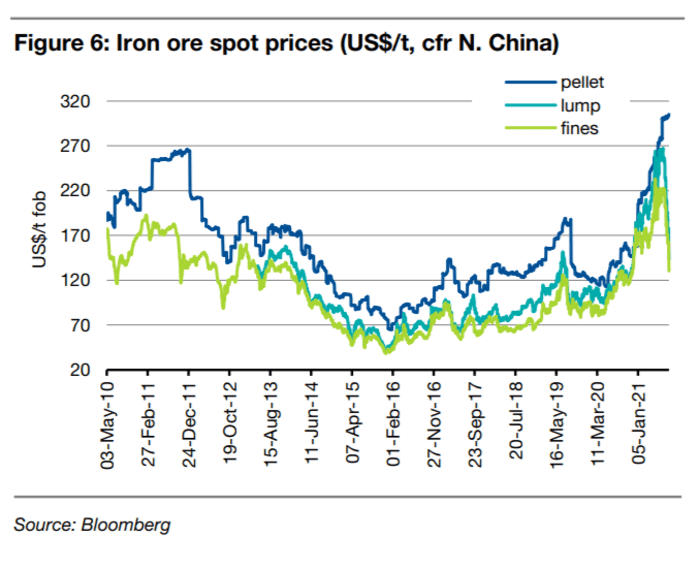

Iron ore is having an even tougher time than copper, hurt both by the Fed taper risk as well as China-led steel production cap, as he highlighted a sell rating on Rio Tinto RIO,

Also read: Why iron-ore prices are on track to suffer their largest monthly loss on record

As to which commodities offer correction protection, he offered up four. One is thermal and metallurgical coal, as China has been boosting imports, highlighting commodities trader Glencore GLEN,

Price also likes crude oil CL.1,

The buzz

Tesla TSLA,

Chip equipment maker Applied Materials AMAT,

Foot Locker FL,

The U.K. approved an antibody cocktail for COVID developed by Regeneron REGN,

Johnson & Johnson JNJ,

The markets

U.S. stock futures ES00,

The Hang Seng HSI,

Random reads

A theater putting on “The Rocky Horror Show” accidentally ordered 52 cans of hot dogs instead of “Frank-N-Furter” wigs.

There’s never a great time to encounter a python, but a supermarket is surely an unusual place to do so.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.