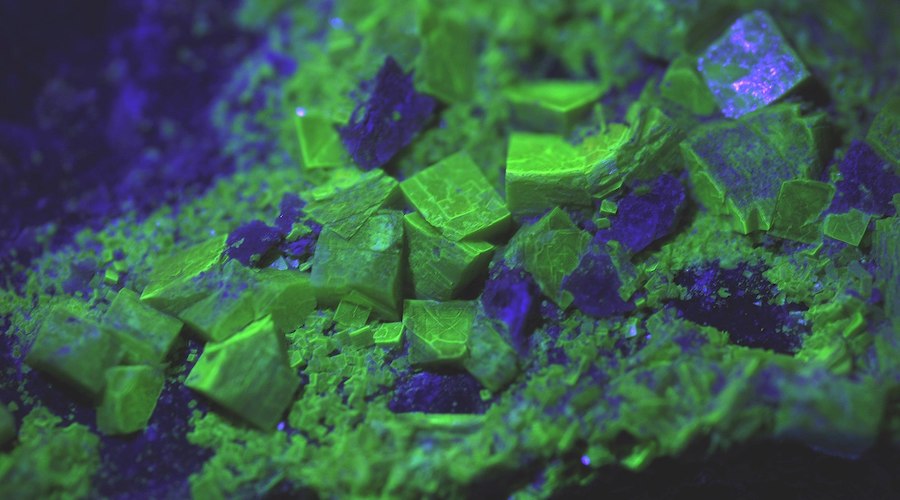

Mining

Uranium tops Morgan Stanley’s commodity thermometer

“Further price upside near term as commercial inventories are drawn down, investment demand continues, and mine supply remains below 2019 levels. Longer term, growth continues to push price higher,” read a slide shared by a social media user.

Morgan Stanley? places #Uranium at the very top of its “Metals & #Mining Commodity Thermometer”?️ as Most Bullish Thesis of 17 mined commodities they cover.? “Further price upside near term… Longer term, demand growth continues to push price higher.”

? #Nuclear #ESG ?

pic.twitter.com/slAp3RVuiR

— John Quakes (@quakes99) August 15, 2021

The gap between uranium spot and contract prices has narrowed for a third consecutive month, reaching $32.40 and $33.50 per lb. at end July, respectively.