What’s driving the dollar rally? It’s more about China than the Fed, analyst says

Here’s another argument for how global economic growth worries are fueling a consensus-defying rally for the U.S. dollar, which is sending ripples through financial markets this week and contributing to a painful selloff for oil, metals and other commodities.

“We show the bulk of USD (U.S. dollar) appreciation since June can be attributed to China growth concerns and this likely matters more near-term than Fed taper expectations,” wrote Adarsh Sinha, a Hong Kong-based currency strategist at Bank of America, in a Friday note.

The ICE U.S. Dollar Index DXY,

Read: The Fed’s not boring anyone into submission after all. The dollar might be to blame.

This week’s moves have seen the dollar reasserting its status as a safe haven, analysts have argued, rising even as gains for Treasurys rallied pulled down yields. Typically, weaker government bond yields make a currency less attractive to investors. But the dollar and yields have had a negative correlation in recent months, a phenomenon also tied to China’s deteriorating reflation picture, according to Sinha.

Investors are also assessing the timing around when the Federal Reserve will begin to scale back its monetary stimulus. The minutes of the Fed’s July policy meeting, released earlier this week, showed “most” officials were in favor of beginning to taper monthly asset purchases later this year.

See: Delta variant is creating cascade of reasons to question U.S. recovery in the second half

China, the world’s second largest economy, looms large in the outlook for the “reflation” trade, a bet that a recovery from the COVID-19 pandemic would see assets more closely correlated to growth and inflation outpace their peers.

Sinha has argued that China was “the reflation blind spot” for markets in general, but specifically for the U.S. dollar. The U.S. currency has had a strong, stable, inverse correlation with China reflation sentiment over the past decade, he said, likely due to the U.S. having less export exposure to China than other major economies. Also, reflation in China is associated with portfolio inflows and currency intervention, which means subsequent rebalancing of currency reserves can support major currencies versus the dollar.

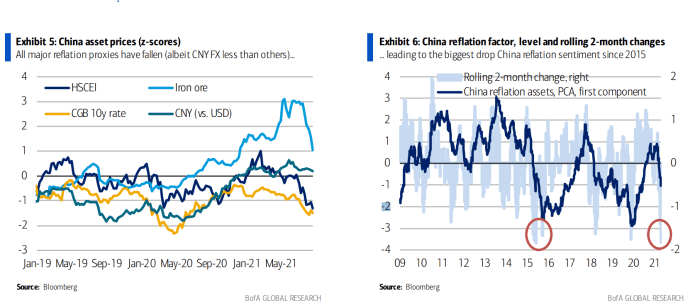

Measures of China reflation were mixed earlier this year, but all major asset prices, with the exception of the country’s renminbi currency USDCNY,

BofA’s China reflation metric peaked mid-June and has collapsed since then with a particularly sharp drop this week following “abysmal” July data, he wrote. “While the reflation factor is still far from levels observed during major slowdowns (2009, 2016, 2020), the change is large, with the two-month drop the largest observed since August/September 2015” following a devaluation of the renminbi (see charts below).

Sinha’s analysis estimated that 52% of the DXY appreciation can be attributed to the drop in the China reflation factor. A similar exercise attributed a large chunk of the fall in Treasury yields since the end of May to the falling reflation factor, as well.

“In the near term, weak China data is likely to be the dominant driver of FX markets,

reinforcing the negative correlation between the USD and U.S. yields. However, broader policy easing measures should eventually support China growth sentiment albeit not before 4Q, coinciding with the potential announcement of Fed taper,” he said.