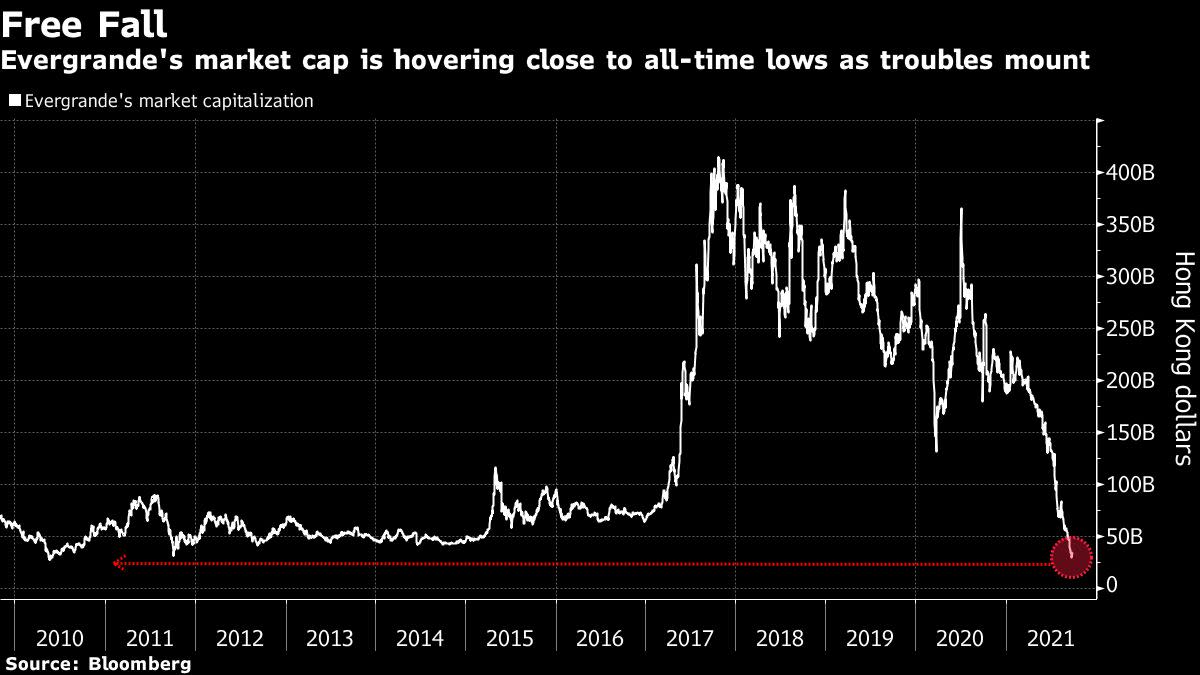

Backer Dumps Shares, PBOC Vows Healthy Market: Evergrande Update

(Bloomberg) — One of China Evergrande Group’s major long-term backers is trying to minimize its exposure to the heavily indebted property developer in the event of its collapse.

Most Read from Bloomberg

Chinese Estates Holdings, a firm controlled by the billionaire family of Joseph Lau, sold about HK$350 million ($45 million) of Evergrande’s shares, according to a Hong Kong filing on Monday. The sale cuts Chinese Estates’ stake to 4.7%, while Chief Executive Officer Chan Hoi Wan dumped all of her personal stake, according to the same filing.

The monetary policy committee of the People’s Bank of China vowed to ensure the healthy development of the real-estate market and the rights of home buyers, according to a statement. The central bank also injected a net 100 billion yuan ($15 billion) amid rising borrowing costs and deteriorating market sentiment.

Evergrande’s stock rose as much as 8.9%, while its 8.25% dollar bond due 2022 was indicated lower, according to Bloomberg-compiled prices. Shares of Evergrande’s electric-car unit pared losses after plunging as much as 26%. The firm scrapped plans for a listing amid what it said is a “serious shortage of funds.”

Sunac China Holdings Ltd.’s shares and dollar bonds extended declines after the property developer requested help from a local government to ease pressure on sales. Another Chinese real-estate company, Fantasia Holdings Group Co., saw its dollar bond due Oct. 4 claw back some of last week’s losses, though its other offshore notes dropped further on Monday.

PBOC Vows ‘Healthy’ Property Market (7:14 a.m. NY)

The People’s Bank of China will work to safeguard the healthy development of the real-estate market and protect home buyers’ lawful rights, the bank’s monetary policy committee said at its quarterly meeting Friday, according to a statement released Monday.

The central bank will step up efforts to coordinate monetary, fiscal, industrial policies and regulations to support the economy with finance and prevent risks. It also pledged to drive real lending rates lower.

Chinese Estates Sold 130.7 Million of Evergrande Shares (5:56 a.m. NY)

Chinese Estates Holdings sold 130.7 million shares at an average price of HK$2.68, reducing its stake to 4.7% from 5.7%.

The move is the latest sign that long-term Evergrande backers are seeking to cut losses ahead of a possible debt restructuring. Chan Hoi Wan, Chief Executive Officer of Chinese Estates and wife of Joseph Lau, has also sold her whole personal stake in Evergrande, according to the filing.

Chinese Estate said last week it could take a HK$9.5 billion loss for the disposal of all its Evergrande’s holdings.

Moody’s Says China to Safeguard Stability (4:28 p.m. HK)

China will seek to avoid social and financial instability stemming from the resolution of Evergrande’s troubles but the economic costs could be large, Moody’s Investors Service said in a statement.

While authorities will try to protect “the company’s home-buyers, suppliers and contractors,” Evergrande’s “financial strife could restrict funding access for property companies and Chinese issuers, damage the asset quality of certain banks, and disrupt the real estate market,” said Michael Taylor, a Moody’s managing director and APAC chief credit officer.

Sunac Shares, Bond Fall After Request for Help (4:23 p.m. HK)

Sunac faced turbulence in the equity and debt markets after it asked the government of the eastern city of Shaoxing for help to ease pressure on sales.

Shares of the Hong Kong-listed developer fell 9.4% Monday, adding to Friday’s 6.9% loss. Its 6.5% bond due 2026 dropped 5 cents on the dollar to 81.4 cents, on pace for a fresh closing low, according to prices compiled by Bloomberg.

Evergrande Could Raise $600 Million From Insurer Stake (11:14 a.m. HK)

Evergrande may have another asset to sell in its scramble to raise cash: its fast-growing life insurance business.

The developer’s 50% stake in Evergrande Life Assurance Co. may fetch $600 million at 0.5 times book value, according to Bloomberg Intelligence analyst Steven Lam. The insurer has boosted its market share more than nine-fold since the year after Evergrande’s 2015 acquisition and been profitable in each of the past four years.

If that sounds like a bargain to potential buyers, there are some catches. The fast expansion has come at the expense of a low solvency ratio that stood at 110% at the end of June, compared with the 239% average of six large peers, Lam wrote in a note Monday. That means whoever takes over Evergrande’s stake may have to come up with another $2.2 billion to lift the ratio beyond 200%.

Here are Evergrande dollar bond interest deadlines for this month and next:

Evergrande Impact on Builders Manageable: Fitch (9:30 a.m. HK)

The impact from an Evergrande credit event on rated Chinese construction issuers will be manageable because they have limited exposure to the developer, Fitch Ratings said in statement.

DBS CEO Doesn’t See Evergrande Woes as Systemic Risk (9:12 a.m. HK)

DBS Group Holdings Ltd. has no exposure to Evergrande and doesn’t see the developer’s crisis as a systemic risk to the region’s banking industry, its chief executive officer said Monday.

“I don’t think a lot of Asian banks have a lot of exposure,” Piyush Gupta said in an interview with Bloomberg Television. “I don’t think it’s going to destroy the Asian banking industry.”

Sunac Unit Asks for Policy Support (8:57 a.m. HK)

In a sign of the stresses mounting among developers, Sunac China Holdings Ltd. has asked for support from local authorities, saying tighter housing measures have crushed sentiment in the market.

The Hong Kong-listed real estate firm made the plea to the city of Shaoxing after housing curbs there hurt sales at one of its projects, according to a letter from a subsidiary seen by Bloomberg. The market is almost frozen, the company said in the document. “We face huge pressure.”

The Sunac group as a whole has also “run into big hurdles and difficulties in terms of cash flow and liquidity,” it said. Sunac’s dollar bonds slumped on Friday after the letter circulated among credit traders.

Evergrande Fallout Spreads to Wealthy Investors (8:24 a.m. HK)

Tens of thousands of Chinese households risk being sucked into the spectacular unraveling of Evergrande after the developer missed the payments on funds sold through non-bank lenders.

Some of these lenders, known as trusts, have already dipped into their own pockets to repay wealthy investors on Evergrande’s behalf, according to people familiar with the matter. Others are negotiating payment extensions with Evergrande, said the people, asking not to be identified discussing private matters. It’s not clear how much of the funds are in arrears and there’s no evidence that trusts are passing payment delays on to customers who bought fixed-income products tied to Evergrande.

Evergrande NEV Ends Proposed Shanghai Star Board Listing

Evergrande’s electric-car unit will not proceed with its proposed issue of yuan-denominated shares on the Science and Technology Innovation Board of the Shanghai Stock Exchange, according to a filing to the Hong Kong stock exchange.

The company said late Friday that it “is encountering a serious shortage of funds” and “has suspended paying some of its operating expenses and some suppliers have suspended supplying for projects.” The company said it couldn’t guarantee that it can meet its financial obligations as it keeps hunting for strategic investors.

These Funds Hold Evergrande’s Distressed Debt

In credit markets otherwise short on juicy yields and big distressed situations, Evergrande’s woes have caught the attention of U.S. investment funds looking for new bets.

Funds including Boaz Weinstein’s Saba Capital Management and Ruben Kliksberg’s Redwood Capital Management began to build positions in the company’s bonds, while European banks assured investors that they have limited exposure to the troubled developer. Other big-name credit investors had exposure to the company before its latest woes, with some opting to hold on to large chunks of their positions. The list doesn’t represent a comprehensive or real-time picture of debt holders.

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.