Berkeley Lights stock bounces back after biotech, analysts dispute short seller’s ‘misleading’ report

Shares of Berkeley Lights Inc. bounced sharply Friday, after the cell biology company responded to a short seller’s report that had helped fuel a brutal selloff to record lows, and as analysts also came to the company’s defense.

The stock BLI,

The plunge was punctuated by a 28.2% tumble the previous two days, after short seller Scorpion Capital published a report on Sept. 15 alleging it had heard from a “trail of customers” that said they were “tricked, misled or over-promised” into buying Berkeley Lights’ (BLI) Beacon platform for $2 million.

“The reality is so far from BLI’s grandiose hype that we believe its product claims and practices may constitute outright fraud,” the Scorpion report said.

Scorpion, which says it’s in the “activist short selling” business, said it’s downside target for Berkeley Lights shares is $0.

In an 8-K filing with the Securities and Exchange Commission on Friday, BLI said it had “continued confidence” in its business, customer relationships and its technology, which enables its customers to find the biology that cures disease.

“The report from Scorpion, a self-proclaimed short seller, contains highly misleading statements, groundless claims and a clear lack of industry understanding,” the company said in its statement. “It’s important to note that Scorpion never reached out to us prior to the publication of their report. We believe the sole purpose of the report was to serve the short seller’s interests at the expense of Berkeley Lights shareholders.”

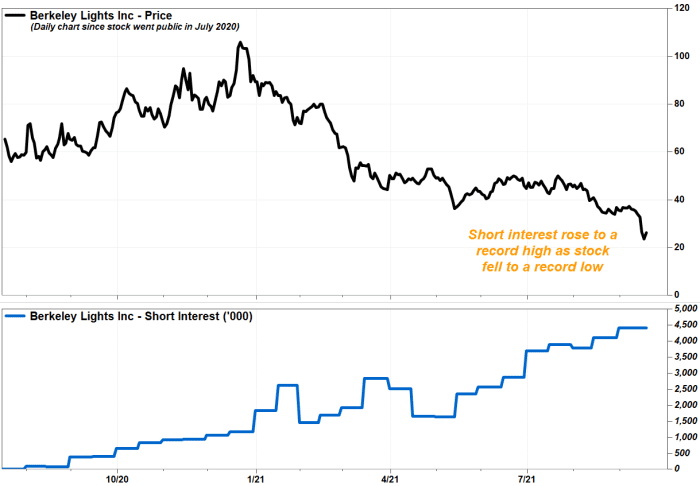

The stock’s drop had come as the latest exchange data showed that short interest, or bets that the stock would fall, had increased to a record 4.42 million shares as of the end of August. That lifted short interest as a percent of the public float, or share available to trade by the public, at 8.99%.

Also read: Short sellers are not evil, but they are misunderstood.

Analyst Julia Qin at J.P. Morgan reiterated her overweight rating on BLI and her stock price target of $100, which implies a near four-fold gain from current levels, saying the “drastic” stock reaction to the short seller’s report is “way overdone,” and creates an attractive buying opportunity.

“Overall, we see little merit in most of the accusations made in the short report, and we believe the underlying value proposition of BLI’s Beacon platform stays intact,” Qin wrote in a note to clients. “In fact, BLI had customers on site yesterday who expressed no concern in reaction to the Scorpion report.”

Stifel Nicolaus’s Daniel Arias also defended the company, saying its portfolio of biology products are “highly transformational.” He affirmed his buy rating, and his price target of $61.

“The biggest criticism that has been leveled against BLI is aimed at performance of the Beacon platform, which was more or less a called a useless device,” Arias wrote. “Our calls with customers yielded the opposite view.”

BLI went public on July 17, 2020 at an IPO price of $22, which valued the company at about $1.3 billion. The stock closed its first day of trading at $65.45, then rose to a closing record of $106.00 on Dec. 22, 2020. At that time, short interest was 1.17 million shares.

The stock has plummeted 69.7% year to date, while the iShares Biotechnology exchange-traded fund IBB,