Cassava Sciences CEO says ‘enormous profit motive’ behind N.Y. law firm’s fraud allegations

Cassava Sciences Inc.’s Chief Executive Remi Barbier said on Friday that recent allegations of fraud were “false and misleading” and were a result of investor interests to drive down the price of the biotechnology company’s stock.

Cassava’s stock SAVA,

“When I first read the allegation, I felt dazed and confused,” Cassava’s Barbier said Friday.

Although Cassava has disputed Labaton Sucharow’s allegations, the stock has failed to recover. It rallied as much as 8.1% early Friday, but reversed course to be down 5.5% in midday trading. It has now shed 12% this week.

The selloff since the allegations were made has wiped away about $2.7 billion from Cassava’s market capitalization.

It’s no wonder that CEO Barbier released another public statement on Friday.

“Let me be very clear: I think these allegations are false,” Barbier said in a statement. “The allegations claim that our science is improbable, unexpected and unique to Cassava Sciences, and therefore it’s all an elaborate fraud. By these criteria, all drug innovations are fraudulent.”

In an audio file posted to Cassava’s website, Barbier pointed out that Labaton Sucharow disclosed shortly after posting the Citizen Petition that not only did the clients it represented have expertise in neuroscience, drug discovery, biochemistry and finance, but “they also hold short positions in Cassava stock.”

A short position is a bet that a stock will fall in price. Read more about short selling.

“These allegations are not only false, I also think they are misleading,” Barbier said. “There’s an enormous profit motive at work,” he said.

Labaton Sucharow did not respond to a MarketWatch request for comment.

Despite the recent selloff, the stock was still up 653.5% year-to-date, compared with the 15.8% gain in the iShares Biotechnology exchange-traded fund IBB,

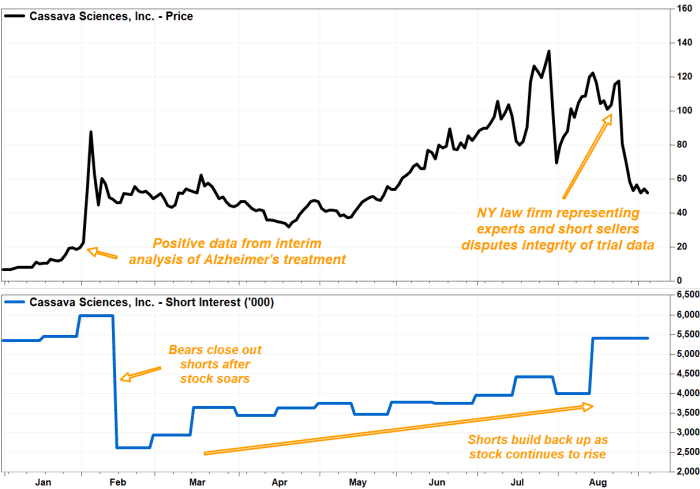

After soaring 190.6% in January, the stock rocketed 141.2% on Feb. 2 after Cassava announced upbeat results of an interim analysis of simufilam.

Short interest, which was at a near-record 5.98 million shares at the end of January, dropped by 56% to 2.62 million shares as of mid-February, according to FactSet data, meaning most of the bearish bets against the stock were closed out after the stock spike higher. As the rally continued — it was up 1,627.7% year to date just prior to last week’s selloff — short interest also increased steadily to 5.40 million shares.

Short interest as a percent of public float, or shares available for trading by the public was 13.9% as of Aug. 31, according to financial data and analytics company S3 Partners, based on latest exchange data. In comparison, short interest as a percent of float for meme stock GameStop Corp. GME,