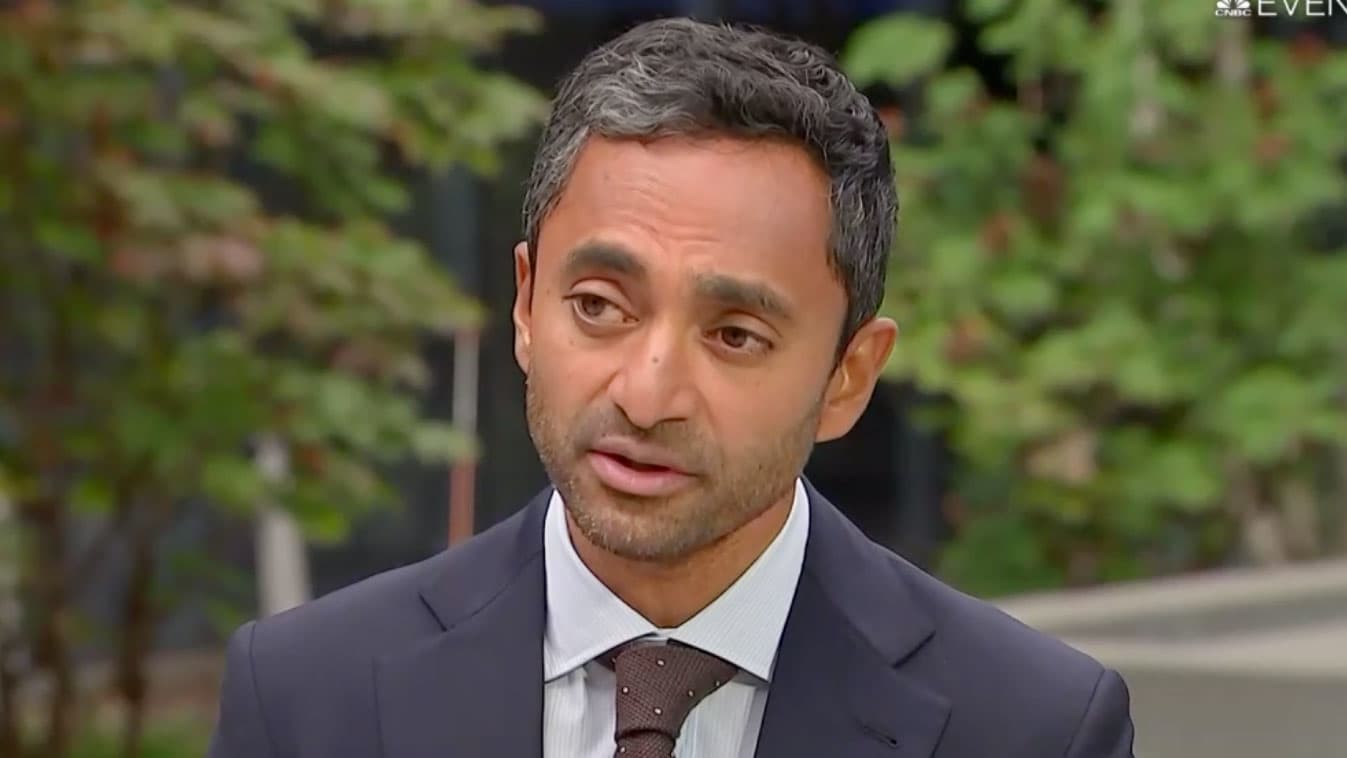

Investor Chamath Palihapitiya is concerned about inflation and hedging with three types of assets in the mean time.

The Social Capital Founder and CEO likes hypergrowth companies, cash-generating businesses and a handful of assets, like bitcoin, that don’t correlate to the former two.

“I’m very concerned about medium term inflation,” Palihapitiya told CNBC’s Scott Wapner at the Delivering Alpha conference on Wednesday. “In an inflationary environment, in my very simplistic view of the world, I want to own three things: hypergrowth, because hypergrowth can always out-run inflation…cash-generative assets…and then I want to own non-correlated assets.”

Palihapitiya defines hypergrowth companies and businesses that are growing 50% or more each year. The technology investor mentioned Sofi, Opendoor Technologies and Clover Health, all of which he helped take public through special purpose acquisition companies.

In terms of stocks that are generating cash, Palihapitiya said mining stocks are a good option.

“When we are back to normal, if we go through an inflationary period, you’ll want the thing that was growing a lot, not the thing that was growing a little bit,” he added. “And you’ll want the thing that was generating a ton of cash because in a rising rate environment that has very positive attributes that work in your favor.”

Regarding the third type of investment to hedge inflation, Palihapitiya recommends a non-correlated asset like bitcoin or Solana. Solana is a one and a half-year-old blockchain network that has surged to become the sixth largest cryptocurrency by market cap, according to CoinGecko.

He said these are a “great counterintuitive hedge” against the other two investments. Palihapitiya said bitcoin has effectively replaced gold and it will continue to do so.

“I do worry that we’ve pumped an enormous amount of money in the ecosystem and it has to show itself. When we start to balkanize these supply chains and regionalize, because of China, prices are going to go up,” he added.

Palihapitiya told CNBC earlier this year that bitcoin could reach $200,000 one day. The digital currency currently sits around $41,000.

However, the former Facebook executive did put a forecast on crypto on Wednesday.

“I don’t know where it goes,” said Palihapitiya. “I’m a huge intellectual bull. It could get very big. We all need to pay attention to it.”

Regarding potential regulation from the Securities and Exchange Commission, Palihapitiya said cryptocurrency it is just an iteration of the internet and will be difficult to legislate.

“I think it’s very hard to kill,” said Palihapitiya. “It’s completely headless. Its entirely peer to peer. I think that’s both scary and exhilarating.”