Do all state and local workers receive lifetime annuities?

The conventional wisdom is that all state and local government workers receive a lifetime annuity from their employer pension plan. Is that true?

My colleagues JP Aubry and Kevin Wandrei recently collected data on payout options under state and local retirement plans to answer the question more definitively. They were particularly concerned about the roughly 6.5 million employees who do not participate in Social Security (known as “noncovered” workers).

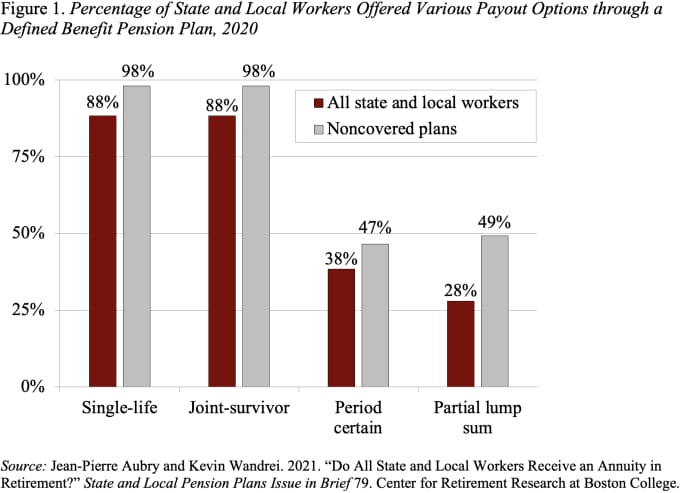

They first focused on defined benefit (DB) plans, in which 88% of all state and local workers and 98% of noncovered workers participate. Within this “annuity-first “framework, the four most common payout options are:

- Single-life annuity: The retiree receives benefits for life.

- Joint-survivor life annuity: The retiree receives benefits for life. When the retiree dies, the designated survivor — usually a spouse — receives an annuity for life.

- Joint-survivor period certain annuity: This option guarantees survivor benefits for a specific period — often 10 years. If the retiree dies after the guarantee period, the survivor receives no benefits.

- Partial lump sum: The retiree receives a portion of the promised annuity as a one-time payment, which is often deposited into a retirement account such as an IRA.

Figure 1 shows that virtually all state and local workers are offered a single- and joint-life annuity. About 40% are offered a period certain annuity, and about a quarter are offered a lump-sum option.

The lump sum option sounds more threatening than it is. Most of the plans limit the lump-sum amount to 36 months (roughly 20%) of the retiree’s promised annuity payments. Moreover, given the small fraction of workers in plans that offer a lump sum and the relatively low take-up rate (roughly 20%), only 6% of all state and local workers — and 8% of noncovered workers — choose this option.

In addition to the small share of state and local workers that “un-annuitize” part of their DB benefit, 12% of all state and local workers (and 2% of noncovered workers) currently participate in something other than a traditional DB as their primary retirement plan. These alternatives include:

- a cash balance plan (a DB plan that defines benefits based on a defined contribution (DC)-like account).

- a stand-alone DC plan; or

- a hybrid plan (a DC plan combined with a reduced DB plan);

Similar to traditional DB plans, the default payout option for public sector cash balance plans — which currently cover just 3% of state and local workers — is an annuity. However, among the public sector DC plans — which currently cover 9% of state and local workers — annuitization is never the default. In fact, 3% of state and local workers participate in DC plans that do not offer an annuity option at all.

In short, while most state and local workers will receive a lifetime pension annuity in retirement, a small share of all state and local workers — about 6% — convert a portion of their pension annuity into a lump sum and another 8% will potentially enter retirement with un-annuitized DC assets.

Among state and local workers who do not participate in Social Security, about 8% take a partial lump sum while 1% will potentially enter retirement with un-annuitized DC assets.

So, the conventional wisdom is basically right. But some exceptions exist, and these are likely to increase as enrollment in primary DC plans grows.