FedEx stock suffers biggest selloff in 18 months as analysts slash targets after another disappointing earnings report

Shares of FedEx Corp. took a dive Wednesday toward a one-year low, as a host of Wall Street analysts slashed their price targets after continued supply chain and labor market troubles led to another disappointing earnings report.

For the second-straight quarter, the package delivery giant reported a profit that missed expectations while revenue beat. Late Tuesday, the company said a “constrained labor market” boosted fiscal first-quarter costs by about $450 million from a year ago, and prompted a cut in the full-year earnings outlook.

Don’t miss: FedEx lower outlook for the year amid tight labor market, rising expenses.

Also read: FedEx stock sinks into bear-market territory ahead of earnings.

FedEx stock FDX,

Analyst Patrick Brown at Raymond James downgraded FedEx to market perform, after being bullish with an outperform rating for at least the past three years. He no longer has a price target on the stock, after removing his previous target of $330.

Brown said he’s comforted that delivery demand and pricing remain “constructive,” and that FedEx’s less-than-truckload (LTL) business continues to “hit on all cylinders.” But what he’s worried about is that the lowered earnings guidance assumes continued growth in industrial production and trade, that labor market troubles will fade and there will be less one-off negative events, such as weather, and that puts the earnings outlook at risk.

“Based on triangulation, it appears [management] is back-end loading the guidance as the [second half] will likely need to comprise ~60% of the [fiscal year] (our math) to hit the midpoint — a mix not typical,” Brown wrote in a research note to clients.

Brown was one of just 14 analysts, of the 32 analysts surveyed by FactSet, who have cut their price target on FedEx’s stock. The average target has been lowered to $319.50 from $349.48 at the end of August. Meanwhile, including Brown’s downgrade, 75% of the analysts still had bullish ratings on FedEx, and the rest were neutral; there were no bears.

Cowen’s Helane Becker kept her rating at outperform, but dropped her price target to $297 from $335, saying the quarterly results could be “as good as it gets” for the company.

Becker expressed concern that rising labor market costs won’t abate anytime soon, and the company’s plan to raise prices by 5.9% likely won’t be enough, and doesn’t even start until January. Read more about FedEx’s price increases.

“We do not see how these costs moderate, and the 5.9% rate increase slated for early January won’t cover the entire costs increase,” Becker wrote. “We expected additional peak surcharges, which were in place last year as well as fuel surcharges.”

Morgan Stanley’s Ravi Shanker cut his price target to $250 from $275, on the belief the guidance cut wasn’t enough. He’s concerned that FedEx’s woes aren’t company specific, and could take the shine off the broader parcel industry.

Shanker pointed out that FedEx’s disappointing results and outlook is one of several “negative” catalysts in the parcel space in the past few months, which will “likely further pressure the structural parcel bull case.”

And Shanker also continues to see evidence of the “structural bear case,” including the negative flywheel effect, in which margins continued to be pressured as price increases don’t keep up with costs, and an increase in overall capacity and competition.

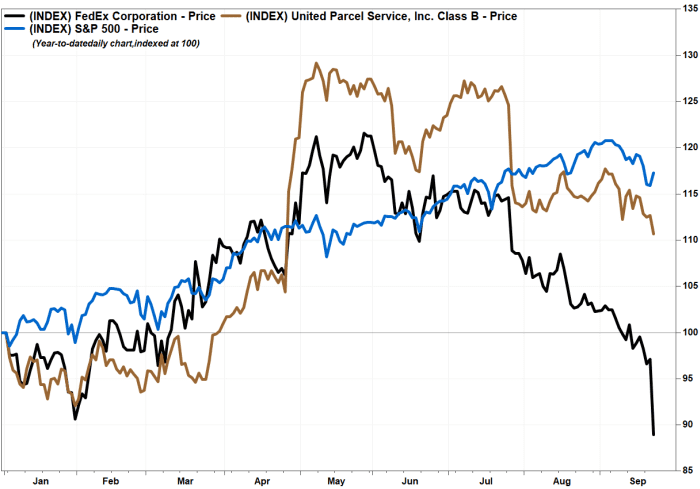

FedEx’s stock has tumbled 22.5% over the past three months, and has slid 11.2% year to date. In comparison, shares of FedEx rival United Parcel Service Inc. have gained 10.6% this year, the Dow Jones Transportation Average DJT,