Following the minerals

As the Taliban re-take government in the country known to have harbored al-Qaeda, the terrorist group that planned and carried out the 2001 attacks in the United States, Afghanistan’s neighbors are poised to take advantage.

Related read: How Afghanistan’s $1 trillion mining wealth sold the war

Hemmed in by China to the east, Iran to the west and Russia to the north, the landlocked nation is known as “the graveyard of empires.” Three Anglo-Afghan Wars in the 19th and early 20th centuries, saw Britain fail to extend its control over Afghanistan from its base in neighboring India, and oppose Russian influence there. Six decades later, the former Soviet Union invaded and occupied the country for 10 years, before withdrawing in a humiliating defeat in 1989.

“Russia is clearly interested in [a] consolidated Afghanistan under a stable rule,” NBC News quotes Fyodor Lukyanov, a top Russian foreign policy expert who leads the Moscow-based Council on Foreign and Defense Policy. “It doesn’t matter so much for Moscow who is in charge in Kabul.”

Iran nearly went to war with the Taliban in 1998 after they killed 10 Iranian diplomats, but has since improved ties with the group; it is also one of Afghanistan’s biggest trading partners.

China sees an opportunity to exploit potentially lucrative oil and gas and mining projects which have been scrubbed or delayed by security concerns, a lack of infrastructure and technical issues. The country reportedly has $1 trillion worth of minerals in reserves, including copper, iron, lithium and rare earths (more on that below).

Beijing recently said it would provide the Taliban with $31 million in emergency aid including food and 3 million covid-19 vaccine doses.

All three countries are worried that the withdrawal of US forces will create chaos in the region, ensnaring them in Afghanistan’s internal affairs. Moreover, they are concerned about terrorism once again breeding under Taliban protection.

The country is the deadliest for terrorism on Earth, with both Islamic State and Al Qaeda maintaining presences there.

Hemmed in by China to the east, Iran to the west and Russia to the north, the landlocked nation is known as “the graveyard of empires”

“[Terrorists] consider Afghan territory as a base to transfer their activity to the states of Central Asia, to Chinese Xinjiang, to the north of Iran, in the direction of India,” Nikolai Patrushev, secretary of the Russian Security Council, said in an interview with the Russian newspaper Izvestia in August.

China is worried about extremism seeping into the western region of Xinjiang, where the government has detained hundreds of thousands of Uyghurs and other mostly Muslim ethnic minorities. Beijing has called on the Taliban to cut ties with terrorist groups.

China eyeing $1 trillion in minerals

China not only wants regional stability (in 2009, 140 people were killed and hundreds were injured in clashes between Muslim Ughurs and Han Chinese in Xinjiang. Beijing uses this incident as justification for repressing the Muslim minority) it is also coveting Afghanistan’s mineral endowment, which despite recent headlines, may not be as rich as advertised.

(A Bloomberg article, one of several like it, states that in 2010, US officials estimated Afghanistan had $1 trillion in unexplored mineral deposits. The deposits may include the world’s largest reserve of lithium, along with vast amounts of rare earths and copper — minerals critical to the global green-energy transition. But as Bloomberg states, flimsy infrastructure in the landlocked country, along with poor security, have hampered efforts to mine and profit off the reserves.)

“With the U.S. withdrawal, Beijing can offer what Kabul needs most: political impartiality and economic investment,” the article quoted a senior colonel in the People’s Liberation Army from 2003 to 2020, who wrote an op-ed in the New York Times. “Afghanistan in turn has what China most prizes: opportunities in infrastructure and industry building — areas in which China’s capabilities are arguably unmatched — and access to $1 trillion in untapped mineral deposits.”

Remember China is actively promoting its Belt and Road Initiative (BRI), a $900 billion program to open channels between China and its neighbors, mostly through infrastructure investments.

The “Belt” part of the Belt and Road Initiative, introduced by President Xi Jinping in 2013, refers to a network of overland road and rail routes and oil/ natural gas pipelines planned to run along the major Eurasian land bridges: China-Mongolia-Russia, China-Central and West Asia, China-Indochina peninsula, China-Pakistan, Bangladesh-China-India-Myanmar. They’ll stretch from Xi’an in Central China through Central Asia, reaching as far as Moscow, Rotterdam and Venice.

China is actively promoting its Belt and Road Initiative (BRI), a $900 billion program to open channels between China and its neighbors, mostly through infrastructure investments

The “Road” is a network of ports and other coastal infrastructure projects from South and Southeast Asia to East Africa and the northern Mediterranean Sea.

An Asia geopolitical expert says that, while the BRI satisfies a number of economic goals for China, including expanding its supply chains, accessing overseas labor, and preventing layoffs when companies run out of domestic infrastructure to build, the over-riding goal is regional influence.

Richard Javad Heydarian, author of ‘Asia’s New Battlefield: The USA, China, and the Struggle for the Western Pacific’, writes:

“Above all, however, it allows China to lock in precious mineral resources and transform nations across the Eurasian land mass and Indian Ocean into long-term debtors. A leading credit rating agency warned [in 2017] warned that the [One Belt One Road] OBOR is “driven primarily by China’s efforts to extend its global influence”, where “genuine infrastructure needs and commercial logic might be secondary to political motivations”.

The result is what one observer aptly described as “debt-trap diplomacy”, since some nations end up piling up unsustainable debts to China.

China’s idea is for Chinese state-owned firms to build the infrastructure, paid for by participating countries. Those who can’t afford it, and that is most of them, are offered inexpensive loans and credit. It’s no different from banks offering rock-bottom interest rates to homeowners whose incomes are below that needed to support a mortgage.

In 2017, when Sri Lanka couldn’t pay off its Chinese creditors, Beijing took control of Colombo, a strategic port, through a 99-year lease. By the end of 2018, nearly a quarter of Sri Lanka’s foreign debt was owed to China — the money accepted for around $8 billion worth of ports and highways planned through BRI.

In the context of China’s Belt and Road Initiative, then, Afghanistan holds tremendous economic and strategic value. Whereas Western institutional investors would rightly shy away from the country especially now that the Taliban is back in power, Chinese leaders in Beijing see an opportunity to invest in the country’s mineral sector, which can then be transported back on Chinese-financed infrastructure that includes about $60 billion of projects in neighboring Pakistan, according to the above-mentioned Bloomberg piece.

In 2017, when Sri Lanka couldn’t pay off its Chinese creditors, Beijing took control of Colombo, a strategic port, through a 99-year lease

It should be noted that China has already dipped its minerals-seeking toe into Afghanistan’s turbulent waters. In 2007, state-owned Metallurgical Corp of China won a nearly $3 billion bid to develop the country’s largest copper mine, Mes Agnak near Kabul, with estimated reserves of six million tonnes.

However the project has yet to see production, nor is there any rail access or power plant, due to delays ranging from security concerns to the discovery of historical artifacts. (the Hajigak iron ore project, the only other deposit that currently has any prospect of becoming a mine, has also gone nowhere)

All the right moves

Despite these difficulties, the mining industry’s experience of China locking up the world’s mineral resources testifies to how far the Chinese will go to ensure their ever-growing demand for mined commodities is met.

While iron ore and copper were the hot targets of overseas acquisitions by Chinese firms as they sought to feed an economy that up until 2015 saw double-digit growth, the Chinese have also gone after gold, nickel, tin, coking coal and oilsands. More recently the most desired metals are those that feed into the global shift from fossil fuels to the electrification of vehicles. This has meant a hunt for lithium, cobalt, graphite, copper and rare earths — metals used in electric vehicles, of which China has become the world’s leading manufacturer.

EVs use a lot of copper, four times as much as a regular vehicle, and China hasn’t been shy about boosting its copper reserves to meet expected demand.

Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15%). The Chinese-backed Mirador mine in Ecuador opened in 2019.

Four out of the five major copper projects in the pipeline right now either have offtake agreements in place with non-Western countries (South Korea and China), or the mines are partially owned by Japanese companies that have a say in where some of the mined copper is destined. (ie. Japan)

At Ivanhole Mines’ massive Kamoa-Kaukula copper mine in the DRC, which just came online, 100% of initial production will be split between two Chinese companies, one of which owns 39.6% of the joint venture project.

China long ago put a lock on much of Africa’s vast resources. Within a decade, the number of major mines or mineral processing facilities with China-headquartered companies rose from a handful in 2006 to more than 120 in 2015.

We know from previous articles that China has been extremely active in acquiring ownership or part-ownership of foreign lithium mines and inking offtake agreements.

China of course, has also locked up rare earths and is the main player in a number of critical mineral markets including cobalt, graphite, manganese and vanadium.

For years the United States and Canada didn’t bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it.

China recognized opportunity knocking and answered the door, seizing control of almost all REE processing and magnet manufacturing, in the space of about 10 years.

As part of its US-China trade war strategy, China raised the prospect of restricting exports of these commodities, that are critical to America’s defense, energy electronics and auto sectors.

Currently nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards and low costs.

Over half of the world’s cobalt — a key ingredient of electric vehicle batteries — is mined as a byproduct of copper production in the Democratic Republic of Congo (DRC). In a $9 billion joint venture with the DRC government, China got the rights to the vast copper and cobalt resources of the North Kivu in exchange for providing $6 billion worth of infrastructure including roads, dams, hospitals, schools and railway links.

China controls about 85% of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral, to sell cobalt hydroxide to Chinese chemicals firm GEM. China Molybdenum is the largest shareholder in the major DRC copper-cobalt mine Tenke Fungurume, which supplies cobalt to the Kokkola refinery in Finland. China imports 98% of its cobalt from the DRC and produces around half of the world’s refined cobalt.

Most of the metal produced under these offtake agreements will never come to the market anyplace other than in China. Those metals that do, can have their supply shut down any time the Chinese want.

Often China’s modus operandi is to build mines in exchange for providing infrastructure that supports, and gains the favor of, the local population, such as schools, health clinics, roads and clean water systems.

Over the past few years, overt resource grabs by China in what used to be the US backyard, countries defined by ‘The Monroe Doctrine’, include:

Shandong Gold partnered with Barrick Gold to purchase a 50% stake in the Veladero gold mine on the Chile-Argentina border for $960 million.

Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15.0%).

In 2018 China’s Tianqi Lithium purchased a 23.7% stake in Chilean state lithium miner SQM, despite concerns from regulators that the $4 billion tie-up would give Tianqi a near monopoly over the lithium market and unprecedented pricing power.

The Chinese are also investing in early-stage lithium plays. In 2018 Bacanora Lithium, which has a lithium project in Mexico, announced that NextView Capital, a Chinese institutional fund manager, acquired a 19.89% equity interest, in exchange for a lithium battery offtake agreement.

China’s most recent foray into overseas minerals acquisition involves Indonesian nickel. The country is using Indonesia’s ban on raw nickel exports to monopolize the nickel market.

Tsingshan, the world’s largest stainless steel maker, plans to construct an Indonesian plant to produce nickel-cobalt salts from nickel laterite ores. Using previously uneconomic high pressure acid leaching (HPAL) technology Tsingshan says it will transform class 2 laterite deposits into class 1 metal for the electric vehicle battery market.

In April 2021, Chinese battery maker CNGR announced it will buy nickel matte, used to make EV battery chemicals, from Tsingshan’s $243 million smelting project on the Indonesian island of Sulawesi.

A month later, China’s Lygend Mining and its $1 billion nickel and cobalt smelting operation became the first project in the southeast Asian country to reach full production.

The venture is the latest among several cobalt-nickel HPAL plants in Indonesia that are under the spotlight as a source of supply for the burgeoning electric-vehicle battery sector. The country banned nickel ore exports from the start of 2020 as it sought to establish a fully integrated battery industry at home.

But China doesn’t care about that. Its goal is to establish a nickel processing beach head in the world’s largest nickel producer, using Chinese technology to process class 2 nickel laterite deposits into class 1 battery-grade metal. Then sell its nickel chemicals to battery companies either in China or Belt and Road countries, as it continues on its path to complete global metals domination.

US mining blunders

It’s interesting to speculate on how Afghanistan could have turned out much differently for the United States, had it tried to bolster the country economically, by doing what China is doing, developing its mineral resources. Instead, the US prioritized the military solution, starting by bombing the mountainous Taliban stronghold of Tora Bora looking to flush out Bin Laden, then appointing diplomat Paul Bremer to oversee the US occupation.

A current Frontline documentary describes how Bremer dismissed the entire Afghan army, along with anyone working with the Taliban government installed during the ‘90s. The result was a large contingent of unemployed young men, who became willing recruits to the anti-US insurgency that was to plague the United States for the next two decades.

Years of neglecting its critical metal supplies is catching up with the US, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up

In fact, arguably the biggest mistake the US made in Afghanistan, ie., not having the vision to rebuild civil society through natural resource development — an obvious path to prosperity — is part of a larger trend, of scuppering opportunities to mine abroad and at home.

Years of neglecting its critical metal supplies is catching up with the United States, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up.

During the 2020 election campaign, candidate Joe Biden said he supports domestic production of metals needed to make electric vehicles, solar panels and other green technologies, and backed bipartisan efforts to foster a domestic supply chain for lithium, copper, rare earths, nickel and other strategic materials that the US imports from China and other countries.

Since becoming president, however, Biden and his Democratic Party have been no friend to the mining industry. On his first day in office, Biden shut down the Keystone XL pipeline that, part-way through construction, was being built to send Alberta oilsands crude to US Gulf Coast refineries, thereby relieving the glut of oil in North America that has been depressing the price of Western Canadian Select. Allowing the pipeline to go ahead would have been a major boon to Canadian producers.

In late February, the Biden administration announced it would conduct a government review of US supply chains to seek to end the country’s reliance on China and other adversaries for crucial goods.

A glance at the US Geological Survey’s mine production data, shows how little of these materials the United States mines.

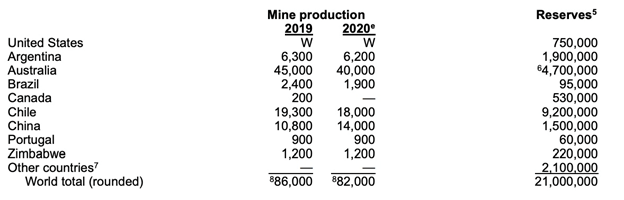

For example, in 2020 (and earlier) the only lithium production in the United States was from Albemarle’s Silver Peak brine operation in Nevada. While the actual amount was withheld by the company, it certainly comes nowhere close to the top three producers, Australia (40,000 tonnes), Chile (18,000t) and China (14,000t). As for current identified lithium resources, the USGS notes these have increased substantially due to continuing exploration, but out of the 86-million-ton total, only 7.9Mt has been found in the US, and 2.9Mt in Canada.

No natural graphite, needed to make spherical graphite used in the EV battery anode, was mined in the US in 2020. The world’s inferred resources of recoverable graphite exceed 800 million tons, but domestic sources are “relatively small,” states USGS.

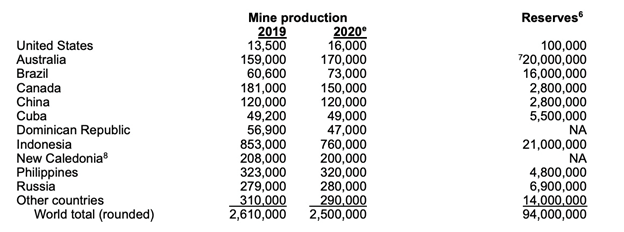

US mines only produced 16,000 tonnes of nickel last year compared to 760,000t in Indonesia, 320,000t in the Philippines, and 280,000t in Russia, the top three Ni miners. Canada managed to output 150,000 tonnes.

The US depends on foreign countries for over 50% of its supply of 46 minerals and metals critical to American supply chains, including 17 where the country is 100% important-reliant.

It’s hard to imagine the US being able to fulfill its new clean energy agenda without either a significant increase in critical metal imports that frankly may not be possible in current market conditions, or executing a home-grown strategy to explore for and mine them in North America.

The Democrats’ anti-mining bent has been exposed through two decisions earlier this month.

A US House of Representative committee voted to block Rio Tinto from building its Resolution copper mine in Arizona. If approved, the bill, part of a wider $3.5 trillion budget package, would reverse a 2014 decision by President Obama and Congress whereby Rio would be allowed to develop federally owned land containing over 50 billion pounds of copper, in exchange for acreage that Rio owns nearby. The land swap agreement was approved by President Trump before leaving office but Biden reversed his decision. The Resolution mine could supply about 25% of US copper demand.

“This move seems contradictory to what the Biden administration is trying to do to address climate change,” said Mila Besic, the mayor of nearby Superior. “I hope the full House does not allow that language to stay in the final bill.”

Another major US mining project, the Pebble mine in Alaska being developed by Northern Dynasty Minerals, is also skating on thin ice thanks to the Biden administration. The Department of Justice is asking a federal court to nullify a 2019 EPA decision that removed from protection Bristol Bay, an important Alaska watershed, and home to a large sockeye salmon fishery.

If the court grants the request, the EPA would resume earlier efforts to protect the Bristol Bay watershed, placing a significant roadblock in front of the Pebble Limited Partnership — four years after parent company Northern Dynasty and the EPA reached a settlement that would have allowed construction of the giant copper-gold mine to move forward.

In development for more than a decade, if permitted Pebble would be North America’s largest new mine, with a resource estimate of 57 billion pounds of copper, 3.4 billion pounds of molybdenum, 71 million ounces of gold and 345Moz of silver.

These two decisions, going against the Resolution copper mine and the Pebble copper-gold mine, are part of a Democratic strategy to ensure that domestic critical minerals feeding into North American supply chains meet sustainability criteria.

According to Metal Tech News, the White House is asking Washington D.C. lawmakers to establish a new mining regulatory framework with strong environmental standards throughout the entire mine life, from development to reclamation.

“We recommend Congress develop legislation to replace outdated mining laws including the General Mining Law (GML) of 1872 governing locatable minerals (including nickel) on federal lands, the Materials Disposal Act of 1947 to dispose of minerals found on federal lands, and the Mineral Land Leasing Act of 1920 among others,” the Biden administration wrote. “These should be updated to have stronger environmental standards, up-to-date fiscal reforms, better enforcement, inspection and bonding requirements, and clear reclamation planning requirements.”

Note: the United States already has very strong environmental protections through the National Environmental Policy Act (NEPA). Infamously, the act can require seven to 10 years to secure a US mine permit, compared to two years in countries with similar regulations like Australia. Thus it is no surprise that mining companies with a choice to mine domestically or abroad, would choose the latter.

The White House sees these allied countries with more efficient mine permitting processes as increasingly important and secure suppliers of minerals and metals into American supply chains, states Metal Tech News.

The Biden administration is also putting up roadblocks to domestic mining indirectly, through liberal-minded policies intended to pressure countries into stopping practices the White House doesn’t like.

In the latest episode of trade tensions between the worlds’ top two economies, the US is now officially blocking imports of solar panels from China over concerns of forced labor.

The implications of such a move could be huge; solar energy is currently the fastest-growing source of new electricity generation in the United States.

According to the Department of Energy, solar accounts for 3% of the electricity generated in America today, and the Biden administration would like to boost that to more than 40% by 2035.

However, the production of solar panel production is dominated by China, and the import ban could pose a new challenge to bringing renewable energy to US households.

According to solar industry analyst Philip Shen, solar panels detained at the US border from a single manufacturer are capable of generating 100 megawatts worth of electricity, enough to power about 29,000 homes a year.

Adding up all the affected manufacturers, we are looking at a severe disruption to a lot of planned solar projects that could completely derail the Biden administration’s plans to develop clean energy such as solar and wind.

One might think that Biden’s $2 trillion climate plan (on which the accumulation of clean-energy minerals such as copper, lithium and nickel is predicated) will have smooth passage, given that the Democrats have majorities (albeit, razor-thin) in both Houses of Congress. But as we know from the past two administrations, passing legislation in the highly divided US Congress is at best difficult and at worst impossible. The Dems and GOP have opposed each other on every significant piece of legislation since Biden was inaugurated in January of this year.

Moreover, Biden can’t even get members of his own party to agree with him. CNN reported earlier this month that Joe Manchin, the Democrat who holds the swing vote in the Senate, is calling for “a pause” on Biden’s $3.5 trillion bill containing much of the president’s agenda.

The legislation could be approved this month by the Senate with a simple majority, via the reconciliation process, however Manchin’s position throws a wrench into Democrats’ plans. The moderate senator says he can’t agree to the $3.5T bill “or anywhere near that level of additional spending” without fully assessing the effects on the economy.

It’s not only the Democrats who have shown their ignorance when it comes to a strategy for sourcing important minerals. While Trump was obviously more in favor of natural resource extraction than Biden, for example encouraging the development of Pebble, offering support to US coal miners, and backing the Keystone XL pipeline, in 2019 there was the highly questionable Energy Resource Governance Initiative.

Led by then-Secretary of State Mike Pompeo, ERGI was created as part of a government-wide action plan to reduce US reliance on imported critical minerals.

That sounds good, but what is disturbing, is the ERGI’s mandate of sharing mining expertise with countries in the group. So, the United States is going to help countries like the DRC, Namibia and Brazil — all of which have been courted by and “married” to China through numerous mineral offtake agreements and loans — to discover and develop mineral deposits of lithium, cobalt and copper, presumably so they can sell more of said minerals to their lead benefactor, China!

In exchange, these developing (ie. poor) countries accept China’s offer to build hundreds of billions worth of infrastructure, thus bringing them closer to Beijing and drawing them further away from the United States.

So far 10 countries have joined the US: Canada, Australia, Botswana, Peru, Argentina, Brazil, Democratic Republic of the Congo, Namibia, the Philippines and Zambia. Really?

Conclusion

Time and again, the United States has made the wrong moves with respect to mining, usually under the banner of increased environmental protection. The latter is obviously an important consideration when regulators, government officials and politicians are asked to decide on the appropriateness of a new mine. However is it not possible to extract and process minerals to the highest standards of solids and liquids containment, and air pollution abatement, using available technology? In other words, do mining and the environment always have to be mutually exclusive? Why can’t they co-exist?

China has lower environmental standards, to put it mildly, and has thus developed a robust mining sector that in several metal markets, leads the world. China is by far the top producer of rare earths, controls about 85% of global cobalt supply, and processes nearly 100% of the world’s graphite. State-owned Chinese companies have scoured the globe for mineral deposits that will help satisfy voracious demand, gaining either full or partial ownership of mines in Africa, South America, Australia, the United States and Canada. Chinese mining companies have set up operations in some of the riskiest, yet potentially lucrative, jurisdictions, including the DRC, which always ranks near the bottom of the Fraser Institute’s mining investment attractiveness index.

Often China’s modus operandi is to build mines in exchange for providing infrastructure that supports, and gains the favor of, the local population, such as schools, health clinics, roads and clean water systems. Through its Belt and Road Initiative, China provides loans for new infrastructure that indebt BRI member countries to Beijing, in exchange for regional influence and the opening up of new markets for raw metals and finished goods.

The fact that the United States failed to develop a single mine in Afghanistan in 20 years, despite a reported $1 trillion worth of estimated mineral reserves, while Beijing now salivates at the thought of being the first to do so, is just the latest example of China “eating our lunch,” to quote President Joe Biden.

The US depends on foreign countries for over 50% of its supply of 46 minerals and metals critical to American supply chains, including 17 where the country is 100% important-reliant.

How to end this dependency for good?

The first step is recognizing that we have these metals, we do not need to purchase them from China, the DRC, Russia or any other foreign producer, we can mine and refine them right here.

Next is upping our exploration game — and nobody is better at it than Canadian junior resource companies — so that we can find and develop the deposits that will become the world’s next mines, to supply the new electrified, decarbonized global economy.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.