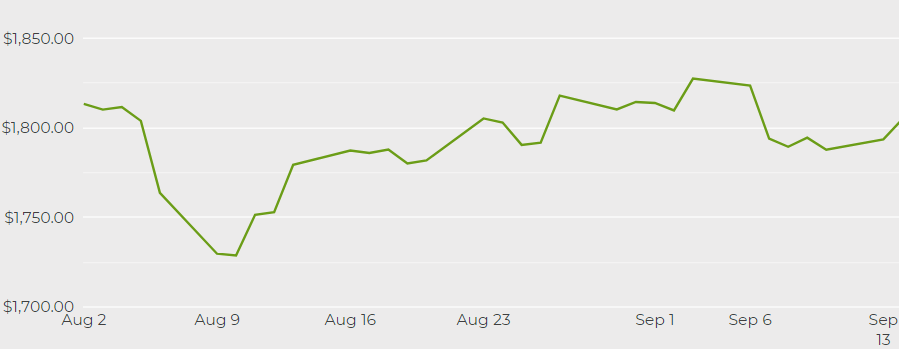

Gold price drops to lowest in a month after US retail data surprise

[Click here for an interactive chart of gold prices]

Meanwhile, the US dollar index jumped after data showed an unexpected increase in US retail sales for the month of August, hammering gold’s appeal to holders of other currencies.

“It’s just a bad day for gold … it couldn’t get back over $1,800 yesterday, setting up the large downward (move),” Phillip Streible, chief market strategist at Blue Line Futures in Chicago, said in a Reuters report.

The better-than-expected numbers show “consumer sentiment is starting to come back, a good indicator for the Fed to bring in those expectations on the next rate hike,” he added.

Bullion also found little respite from overall labour market sluggishness — considered a key economic barometer by the Fed, with initial jobless claims coming in slightly higher than expected last week. The focus now turns to the next Federal Open Market Committee (FOMC) meeting, to be held September 21-22.

“There are a lot of members in the FOMC in favour of commencing tapering this year and therefore the outlook for gold is not positive,” said Quantitative Commodity Research analyst Peter Fertig.

(With files from Reuters)