Hong Kong Stocks Sink as Evergrande Woes Spread, Ping An Tumbles

(Bloomberg) — Concerns about the health of China’s real estate sector spilled into Hong Kong markets on Monday, sparking the biggest selloff in property stocks in more than a year and dragging down everything from banks to Ping An Insurance Group Co. and high-yield dollar bonds.

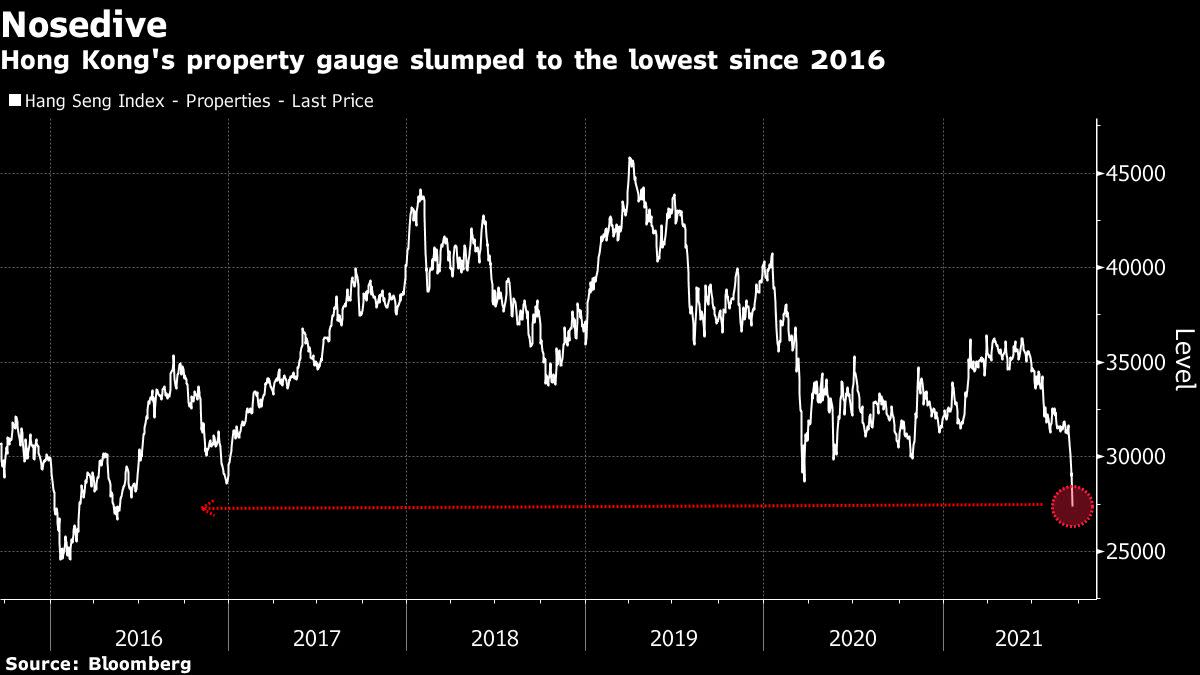

The Hang Seng Property Index tumbled by as much as 5.9%, the most since May 2020, while Ping An Insurance, China’s largest insurer by market value, plunged 7.3% in Hong Kong. The city’s benchmark Hang Seng Index fell 3.3%, its biggest one-day slump in two months. Junk-rated Chinese dollar bonds slid by as much as 2 cents, according to credit traders.

Investor angst that has centered for weeks on China Evergrande Group is rapidly spreading as senior Chinese policy makers stay silent on whether the government will step in to prevent a messy collapse in the world’s most indebted developer. Evergrande, whose shares plunged 13% on Monday, faces interest payment deadlines on bank loans and bonds this week that few expect the property giant will be able to meet.

“Investors may be concerned about highly-geared names and don’t care about valuation nowadays,” said Philip Tse, head of Hong Kong & China Property Research at Bocom International Holdings Co Ltd. “There will be further downside” unless the government gives a clear signal on Evergrande or eases up on its clampdown on the real estate sector, Tse said.

(Updates markets throughout.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.