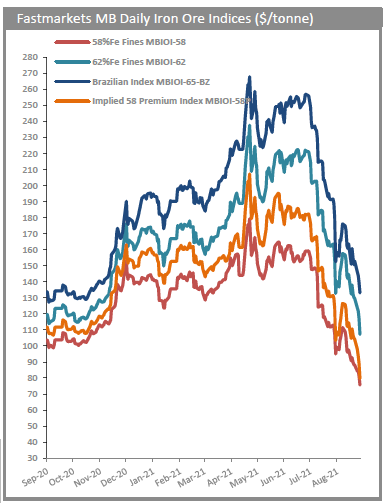

Iron ore price dives 7% on China’s lower steel output data

The high-grade Brazilian index (65% Fe fines) also fell 4.3% to $133.10 a tonne.

Mining stocks also slid, with BHP Group down more than 6% from the previous week, Rio Tinto Group down 5.3%, and Vale down 7%.

China produced 83.24 million tonnes of crude steel in August, a 13.2% drop from the same period a year ago, according to data released by China’s National Bureau of Statistics on Wednesday, as the country curbed its steel industry to cut emissions.

According to analysts at ANZ Research, it was the lowest level since March 2020.

“These constraints are expected to remain through the end of the year as provinces look to hit targets on emission,” according to ANZ Research.

“With China’s plans to limit production to last year’s level, we see output falling by 11% y/y in the second half of 2021,” ANZ Research wrote, adding that it may result in loss of 87 million tonnes of iron ore demand.

“Markets remain highly sensitive to news of new curbs because iron ore prices are still well above the cost of production.” senior economist at Westpac, Justin Smirk, told the Financial Review.

China’s southwest Yunnan province asked local producers on Monday to restrict output on steel, aluminum and other materials. Part of the planned production in September would be postponed to the last two months of the year.

The province, which produces about 2.3% of the nation’s total crude steel, is the latest to be targeted as the country steps up its blue skies campaign aimed at reducing air pollution for the Beijing Winter Olympic Games in February.

(With files from Reuters)