MicroStrategy buys more than 5,000 bitcoins in 3 weeks while it sells its own stock

Enterprise software company MicroStrategy Inc. keeps swapping out its shares for more bitcoin.

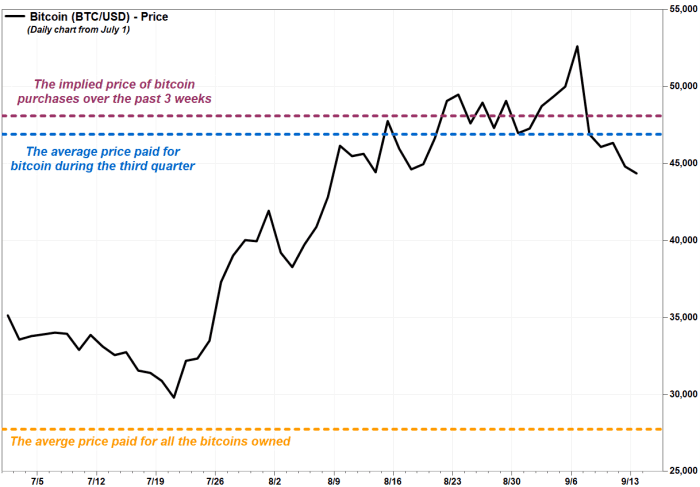

The company, which has previously said it uses bitcoin as a primary Treasury reserve asset, disclosed Monday that it bought 8,957 bitcoins for $419.9 million in cash, including fees and expenses, between July 1 and Sept. 12. The average price paid for the bitcoin was $46,875, the company said.

Last month, the company had disclosed that between July 1 and Aug. 23, it spent $177.0 million to buy 3,907 bitcoins, at an average price of $45,294 per bitcoin.

That indicates that over the past three weeks, the company bought 5,050 bitcoins for $242.9 million. That implies an average per-bitcoin price of $48,099, according to a MarketWatch calculation.

Bitcoin BTCUSD,

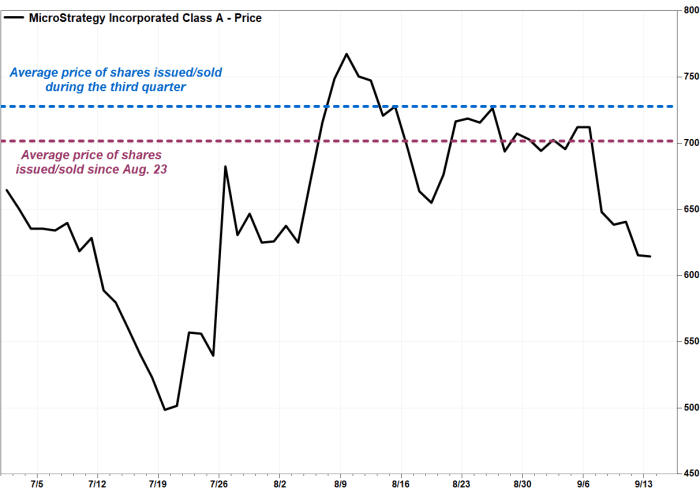

MicroStrategy also disclosed Monday that it had issued and sold a total of 555,179 shares of common stock at an average price of $727.64, to raise about $399.9 million, between July 1 and Sept. 12.

That follows the company’s previous announcement between July 1 and Aug. 23, it had sold 238,053 shares at an average price of $753.21 to raise $177.5 million.

That indicates the company sold 317,126 shares to raise $222.4 million since Aug. 23, implying an average sale price of $701.30 per share.

Not a bad sale over the past three weeks, as the stock was recently trading just below $616.

The share sales are part of an open-market sales agreement with Jefferies LLC announced on June 14 for the sale of up to $1 billion worth of stock.

Overall, the company said it now holds about 114,042 bitcoins that were bought for $3.16 billion, at an average price of $27,713 per bitcoin. That implies a gain of about $1.89 billion on the company’s bitcoin investment at current bitcoin prices.

Separately, the company disclosed late Friday that Morgan Stanley MS,

MicroStrategy’s stock has rallied 19.3% over the past three months, while bitcoin has climbed 18.6%, the SPDR S&P Software and Services exchange-traded fund XSW,