More than a quarter of Nasdaq-100 stocks are in bear markets — Wall Street sees a buying opportunity

The Nasdaq-100 Index has performed very well against the broader S&P 500 index in recent years and it is down only 6% from its record intraday high set on Sept. 7. Even so, more than a quarter of stocks in the Nasdaq-100 are in bear markets — down at least 20% from their 52-week highs.

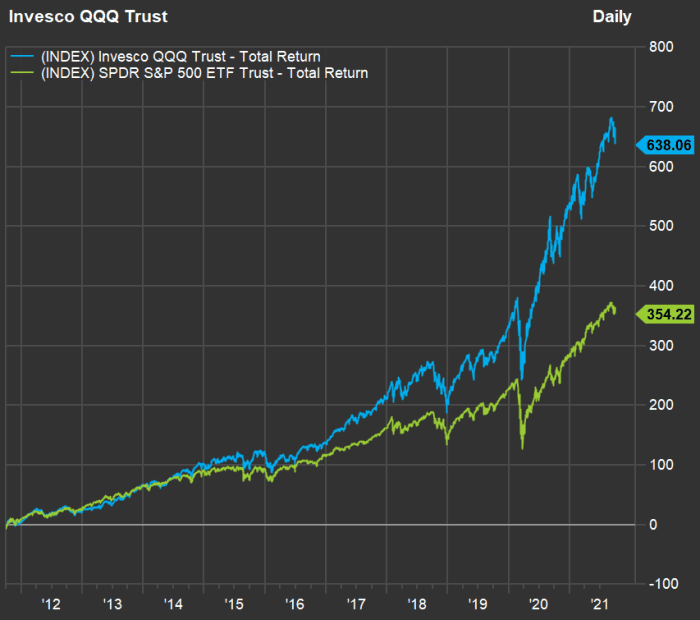

Before looking at those stocks, let’s take a quick look at the Nasdaq-100 Index NDX. It is made up of the largest 100 non-financial stocks in the full Nasdaq Composite Index COMP and is weighted by market capitalization. The Nasdaq-100 has greatly outperformed the S&P 500 index SPX (which is also weighted by market cap) in recent years.

Using exchange-traded funds that track both — the Invesco QQQ Trust QQQ for the Nasdaq-100 and the SPDR S&P 500 ETF Trust SPY, here is a 10-year chart showing total returns, with dividends reinvested:

One reason for QQQ’s outperformance over the past 10 years has been its heavy concentration in giant tech companies. As of the close on Sept. 27, the top five companies held by QQQ (Apple Inc. AAPL, Microsoft Corp. MSFT, Amazon.com Inc. AMZN, Tesla Inc. TSLA and two common-share classes of Alphabet Inc. GOOG GOOGL ) made up 41.3% of the portfolio. Meanwhile the top five positions of SPY (the same, except replace Tesla with Facebook Inc. FB ) made up 22.6% of its portfolio.

Another important difference between the indexes is the Nasdaq-100 includes American depositary receipts of some non-U.S. companies, while the S&P 500 excludes ADRs. Some of the ADRs held by QQQ are included in the list below.

Here’s a comparison of average annual returns for the two ETFs over many periods:

| ETF | 3 Years | 5 Years | 10 years | 15 Years | 20 Years |

| Invesco QQQ Trust QQQ | 25.6% | 25.8% | 22.0% | 16.6% | 14.2% |

| SPDR S&P 500 ETF Trust SPY | 16.3% | 17.0% | 16.4% | 10.3% | 9.5% |

| Source: FactSet | |||||

One thing to keep an eye on is the relative cost of the indexes/ETFs. QQQ looks a bit expensive relative to where it usually trades against SPY. Here’s a comparison of current forward price-to-earnings ratios with averages:

| ETF | Forward P/E | 10-year average forward P/E | 15-year average forward P/E |

| Invesco QQQ Trust QQQ | 26.95 | 19.32 | 18.73 |

| SPDR S&P 500 ETF Trust | 20.82 | 16.37 | 15.26 |

| Source: FactSet | |||

So QQQ now trades for 129% of SPY’s forward P/E valuation. It has traded for 118% of SPY’s forward P/E on average over 10 years and 123% based on the 15-year averages.

The Nasdaq-100 bear list

There are actually 102 stocks in the Nasdaq-100 because Alphabet and Fox Corp. have two common-share classes apiece. Here are the 22 stocks among them that were down at least 20% from their 52-week highs as of the close on Sept. 28:

| Company | Decline from 52-week high | 52-week high | Date of 52-week high | Closing Price – Sept. 28 |

| Pinduoduo Inc. ADR Class A PDD | -58.1% | $212.60 | 02/16/2021 | $89.00 |

| Baidu Inc. ADR Class A BIDU | -56.6% | $354.82 | 02/22/2021 | $154.02 |

| Zoom Video Communications Inc. Class A ZM | -55.5% | $588.84 | 10/19/2020 | $261.89 |

| Peloton Interactive Inc. Class A PTON | -48.7% | $171.09 | 01/14/2021 | $87.80 |

| Biogen Inc. BIIB | -39.2% | $468.55 | 06/07/2021 | $284.71 |

| Splunk Inc. SPLK | -37.3% | $222.19 | 10/21/2020 | $139.42 |

| NetEase Inc. ADR NTES | -37.0% | $134.33 | 02/11/2021 | $84.69 |

| Vertex Pharmaceuticals Inc. VRTX | -35.4% | $280.99 | 10/13/2020 | $181.60 |

| Trip.com Group Ltd. ADR TCOM | -33.6% | $45.19 | 03/17/2021 | $30.01 |

| Incyte Corp. INCY | -32.3% | $101.47 | 01/25/2021 | $68.68 |

| JD.com Inc. ADR Class A JD | -30.4% | $108.29 | 02/17/2021 | $75.42 |

| Dollar Tree Inc. DLTR | -28.3% | $120.37 | 04/06/2021 | $86.28 |

| Activision Blizzard Inc. ATVI | -27.0% | $104.53 | 02/16/2021 | $76.33 |

| Illumina Inc. ILMN | -26.2% | $555.77 | 02/12/2021 | $410.20 |

| Sirius XM Holdings Inc. SIRI | -25.1% | $8.14 | 01/27/2021 | $6.10 |

| Micron Technology Inc. MU | -24.6% | $96.96 | 04/12/2021 | $73.10 |

| Seagen Inc. SGEN | -24.6% | $213.94 | 10/13/2020 | $161.40 |

| Amgen Inc. AMGN | -23.3% | $276.69 | 01/28/2021 | $212.27 |

| Moderna Inc. MRNA | -22.8% | $497.49 | 08/10/2021 | $384.21 |

| Qualcomm Inc. QCOM | -22.7% | $167.94 | 01/20/2021 | $129.90 |

| Paccar Inc. PCAR | -21.7% | $103.19 | 01/21/2021 | $80.82 |

| Intel Corp. INTC | -21.2% | $68.49 | 04/12/2021 | $54.00 |

| Source: FactSet | ||||

You can click the tickers for more about each company. Click here for Tomi Kilgore’s guide to the wealth of information available for free on the quote page.

Pinduoduo Inc. and Baidu Inc. top the list, with sharp declines from their 52-week highs, as investors continue to wonder how the Chinese government’s crackdowns on various industries might affect them. China’s Cyberspace Administration set out new guidelines for algorithms used by companies providing internet services on Wednesday. Investor are also concerned about the health of China’s credit markets.

Here’s a summary of opinion for the group among analysts polled by FactSet:

| Company | Share “buy” ratings | Share neutral ratings | Share “sell” ratings | Closing Price – Sept. 28 | Cons. price target | Implied 12-month upside potential |

| Pinduoduo Inc. ADR Class A PDD | 79% | 21% | 0% | $89.00 | $136.54 | 35% |

| Baidu Inc. ADR Class A BIDU | 86% | 9% | 5% | $154.02 | $256.77 | 40% |

| Zoom Video Communications Inc. Class A ZM | 52% | 44% | 4% | $261.89 | $363.11 | 28% |

| Peloton Interactive Inc. Class A PTON | 74% | 19% | 7% | $87.80 | $129.67 | 32% |

| Biogen Inc. BIIB | 52% | 48% | 0% | $284.71 | $418.24 | 32% |

| Splunk Inc. SPLK | 62% | 38% | 0% | $139.42 | $179.90 | 22% |

| NetEase Inc. ADR NTES | 94% | 6% | 0% | $84.69 | $124.99 | 32% |

| Vertex Pharmaceuticals Inc. VRTX | 74% | 19% | 7% | $181.60 | $260.67 | 30% |

| Trip.com Group Ltd. ADR TCOM | 71% | 29% | 0% | $30.01 | $37.25 | 19% |

| Incyte Corp. INCY | 60% | 40% | 0% | $68.68 | $101.27 | 32% |

| JD.com Inc. ADR Class A JD | 94% | 6% | 0% | $75.42 | $93.02 | 19% |

| Dollar Tree Inc. DLTR | 36% | 60% | 4% | $86.28 | $105.52 | 18% |

| Activision Blizzard Inc. ATVI | 94% | 6% | 0% | $76.33 | $115.34 | 34% |

| Illumina Inc. ILMN | 15% | 65% | 20% | $410.20 | $455.19 | 10% |

| Sirius XM Holdings Inc. SIRI | 65% | 29% | 6% | $6.10 | $7.60 | 20% |

| Micron Technology Inc. MU | 87% | 13% | 0% | $73.10 | $104.60 | 30% |

| Seagen Inc. SGEN | 57% | 38% | 5% | $161.40 | $187.35 | 14% |

| Amgen Inc. AMGN | 31% | 61% | 8% | $212.27 | $246.10 | 14% |

| Moderna Inc. MRNA | 31% | 44% | 25% | $384.21 | $351.40 | -9% |

| Qualcomm Inc. QCOM | 64% | 36% | 0% | $129.90 | $184.15 | 29% |

| Paccar Inc. PCAR | 53% | 42% | 5% | $80.82 | $99.56 | 19% |

| Intel Corp. INTC | 37% | 39% | 24% | $54.00 | $61.98 | 13% |

| Source: FactSet | ||||||

Don’t miss: Bank stocks are cheap — here are the 20 best players in the industry