My ridiculously simple ‘inflation hedge’

Well, I just went out and spent a ton of money on nonperishable food items. Not because I’m especially hungry, but because right now it’s a better investment than keeping money in the bank.

Financial planners tell you to keep “3 to 6 months” worth of expenses in cash in an emergency fund. I have other questions about that, but let’s start with the assumption they’re right.

The interest rate I’m going to earn on money I keep in the bank, either in a savings account or a certificate of deposit? About 0%.

Food price inflation: 3%.

In other words I am, of course, going backward.

Bankrate tells me the highest rate I can get on a CD is 0.75%. And remember that interest is taxed, so realistically you’re getting less — maybe a lot less.

Meanwhile if your marginal income-tax rate is, say, 25%, prebuying food and saving yourself that 3% inflation is the equivalent of making about 4% on your savings before tax.

If any bank anywhere was offering 4% on its CDs the front door would be crushed by the stampede. It would be like a 1930s bank run, only in reverse. They’d have to pull down the steel shutters to keep people out.

OK, so there is only so much food I can buy and store. And not that much food keeps indefinitely, either. How much rice, barley, oats, split peas and lentils am I going to eat?

But of course I’m not just prebuying food, but all sorts of other personal and household necessities as well.

Sure, we’re not talking vast sums of money. But this is at least one of the few low risk ways available to anyone to keep up with inflation. The government’s own Treasury inflation-protected securities, or TIPS, don’t even keep up with inflation—which makes you wonder how they can still be called “inflation protected securities.” The 5-year TIPS bond actually guarantees that my money will buy 7% less when the bond comes due than it does today. Yet people are so desperate for inflation protection they will still buy them.

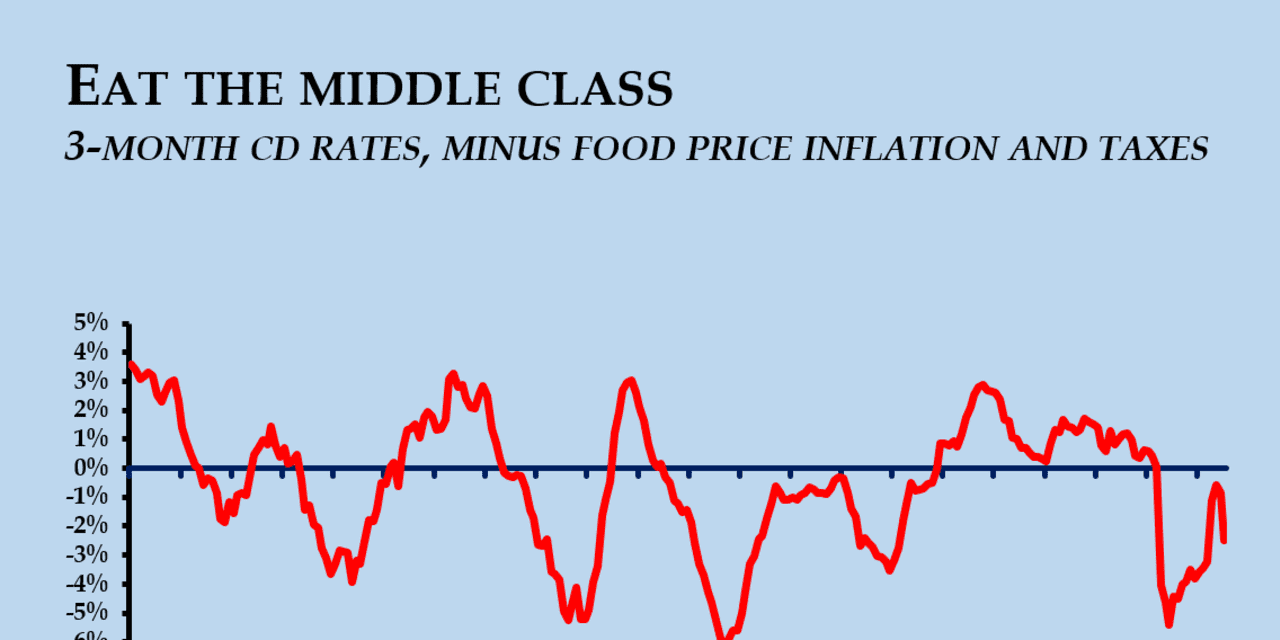

As our chart above shows, the current situation is nothing new. So far this millennium, anyone keeping their money in the average 3-month CD, and paying around 20% marginal tax, has been falling behind food price inflation most of the time. Over the past 10 years the average loss of purchasing power has been about 1% a year.

I have a broader problem with these emergency savings theories. I understand the psychological appeal of having 3-6 months’ worth of expenses in checking or deposit accounts. But the actual cost is horrendous.

Money in such accounts has been losing value, net of taxes and inflation, consistently for about two decades. And it’s been a poor investment almost forever. The same financial planning industry that tells us to have up to half a year’s expenses in cash also tells us that cash is a terrible long-term place to hold your money.

The “real,” inflation adjusted return on the S&P 500 SPY,

If someone knows the answer to these questions, I am—in the words of the late, great Ross Perot—“all ears.”

Meanwhile, one thing I do know is that when I prebuy necessities like food I am at least guaranteed to keep up with inflation, after tax.

Oh, and food has one great advantage over that other “inflation hedge,” gold. GC00,