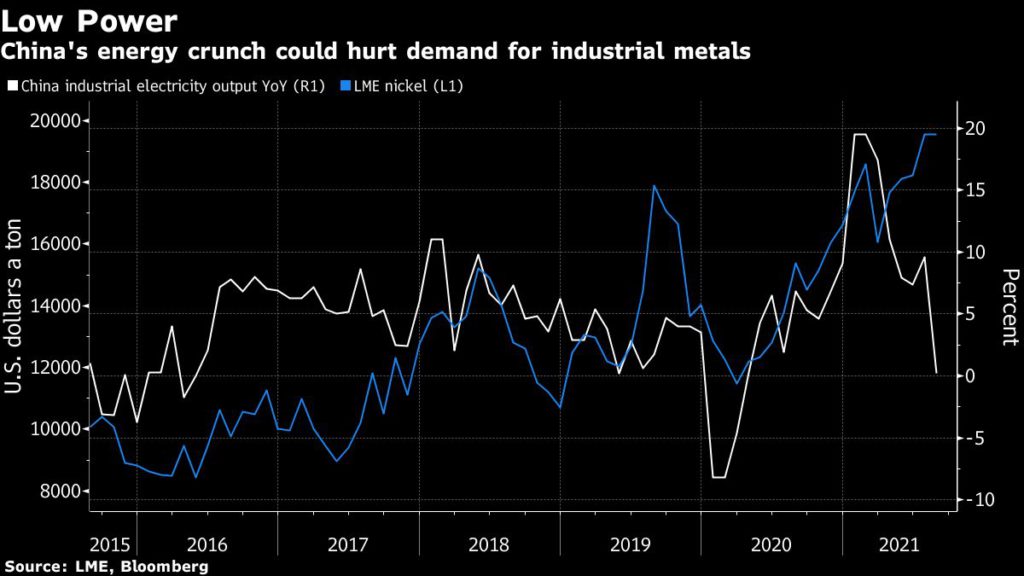

Nickel price tumbles on China’s power crunch

Nickel fell as much as 2.9% to $18,830 a tonne on the London Metal Exchange Monday morning. Zinc declined 0.9%, while copper rose 0.3%. Tin dropped 4.3% to $34,970 a tonne, tumbling from a record high struck last week.

[Click here for an interactive chart of nickel prices]

Restrictions on power use in homes have only just taken effect. However, China’s massive industrial base has been wrestling with sporadic jumps in power prices and usage curbs since at least March, when provincial authorities in Inner Mongolia ordered some heavy industry including an aluminum smelter to curb use so that the province could meet its energy use target for the first quarter.

EXPLAINER-What is behind China’s power crunch?

Economists at Nomura Holdings and China International Capital have downgraded their growth forecasts as electricity shortages force businesses to cut back on production.

The power crunch in the top metals-consuming country has already caused supply losses at metal smelters, fabricators and steel mills in the past few months. Prices of aluminum surged to the highest level since 2008 earlier this month as the energy-intensive sector was a major target of the country’s move to curb power usage.

For nickel, prices are under pressure as the energy crisis is curbing output mostly at stainless steel mills and power restrictions may tighten further into the fourth quarter, stockbroker CICC said in a note on Monday.

(With files from Reuters and Bloomberg)