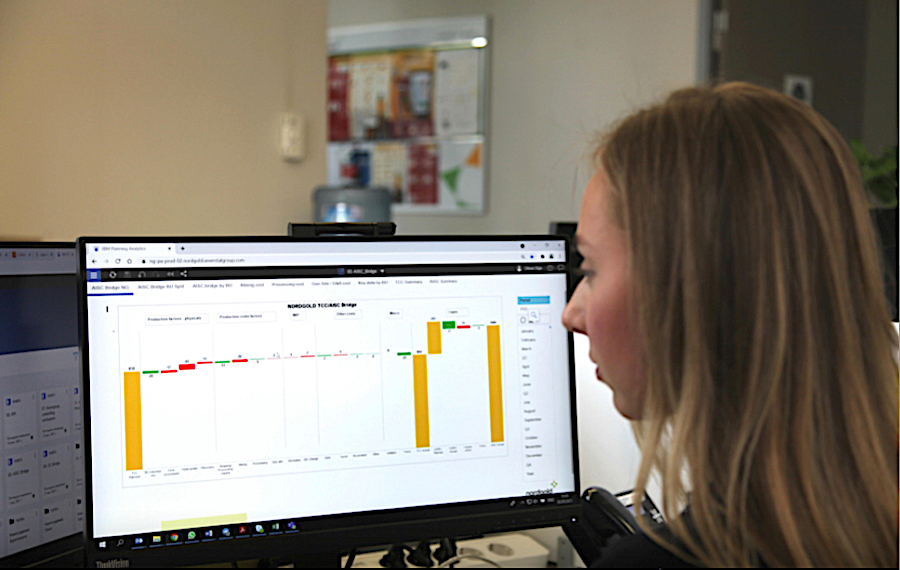

The tool, available on the IBM Global Solutions Directory, automatically generates a full reporting pack immediately after the period end and compares company performance with industry best practices and peers.

“What sets CN Planning Analytics apart is its unique focus on gold mining company performance and the fact it is adaptable to all mining and processing technologies,” Dmitry Markeev, director of transformation and business system development of Nordgold said in the statement. “We continue to invest in our IT capabilities which helps us drive performance, in particular as we move forward on our ambitious growth plans in the Gross region in Russia, where we have built a market leading position.”

The software package includes preconfigured budgeting and management reporting models based on industry-specific Key Performance Indicators (KPIs). It is designed to work with different types of mining methods including open pit, underground and mixed as well as gold processing technologies (CIL, CIP, heap leaching and BIOX).

“Partnering with Nordgold to develop CN Planning Analytics was a unique collaboration that allowed us to combine the practical business experience of a mining company with the industry and product expertise of a consultancy.

Back to London

Nordgold is currently seeking admission in the London Stock Exchange, one of the world’s oldest markets.

The Russian gold miner, majority-owned by billionaire Alexei Mordashov and his sons Kirill and Nikita, was previously a member of the London platform but left in 2017.

The company has said it aims to pay higher dividends than its peers in North America this year. With four mines in Russia, one in Kazakhstan, three in Burkina Faso, one in Guinea and two more mines under development, Nordgold expects to boost production by 20% over the next five years.

In contrast, production at the world’s largest gold miner, Newmont (NYSE: NEM) (TSX: NGT), is set to remain about the same until 2025.

The gold producer would pay a minimum dividend of $400 million this year, in two installments. After that it would pay out 50% of its free cash flow, subject to its net debt remaining less than 1.5 times its earnings before interest, tax, depreciation and amortization.