Stocks Set to Dip as Traders Mull Evergrande, Fed: Markets Wrap

(Bloomberg) — Stocks looked set to fall Monday amid challenges from the debt crisis at China Evergrande Group and a Federal Reserve meeting this week that’s expected to hint at moving toward scaling back stimulus.

Futures for Australia and Hong Kong slipped, while markets in Japan, China and South Korea are closed for holidays. U.S. contracts declined after the S&P 500 slid the most in a month, testing the dip-buying psychology in the U.S. as the gauge jabs at its 50-day moving average. The Nasdaq 100 also retreated.

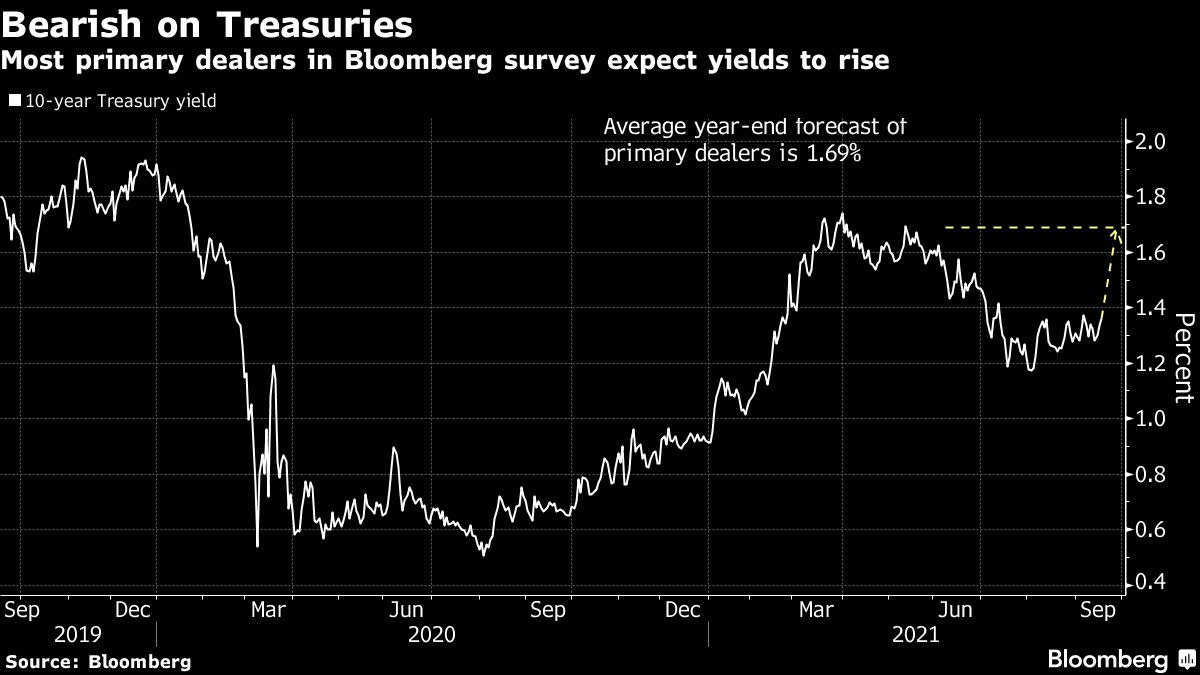

Ten-year Treasury yields rose ahead of the Fed meeting this week where policy makers are expected to start laying the groundwork for paring stimulus. Cash Treasuries won’t trade Monday in Asia because of the Japan holiday. The dollar was mixed and Australia’s currency fell, hurt by a plunge in iron-ore prices.

The offshore yuan will come under scrutiny as investors wait to see if indebted developer Evergrande will continue meeting obligations to bondholders. Investors are pricing in a high likelihood of default, with one of the notes trading at less than 30% of face value.

Aside from Evergrande and the prospect of reduced Fed stimulus, financial markets also face risks from uncertainty over the outlook for President Joe Biden’s $4 trillion economic agenda as well as the need to raise or suspend the U.S. debt ceiling. Investors were already fretting over a slowing global recovery from the pandemic and inflation stoked by commodity prices.

“Shares remain vulnerable to a short-term correction with possible triggers being coronavirus, the inflation scare and U.S. taper talk, likely U.S. tax hikes and a debt ceiling standoff and the slowing Chinese economy,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, said in a note.

Treasury Secretary Janet Yellen said the U.S. government will run out of money to pay its bills sometime in October without action on the debt ceiling, warning of “economic catastrophe” unless lawmakers take the necessary steps.

Here are key events to watch this week:

Canada federal election, MondayBank of Japan rate decision, WednesdayFederal Reserve rate decision, WednesdayBank of England rate decision, ThursdayFed Chair Jerome Powell, Fed Governor Michelle Bowman and Vice Chairman Richard Clarida discuss pandemic recovery, Friday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 7:34 a.m. in Tokyo. The S&P 500 fell 0.9%Nasdaq 100 futures dropped 0.2%. The Nasdaq 100 fell 1.2%Australia’s S&P/ASX 200 Index futures fell 0.9%Hong Kong’s Hang Seng Index futures fell 0.4%

Currencies

The Japanese yen was at 110 per dollarThe offshore yuan traded at 6.4726 per dollarThe Bloomberg Dollar Spot Index rose 0.1%The euro was at $1.1725

Bonds

The yield on 10-year Treasuries advanced two basis points to 1.36% on Friday

Commodities

West Texas Intermediate crude was at $71.52 a barrel, down 0.6%Gold was at $1,752.79 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.