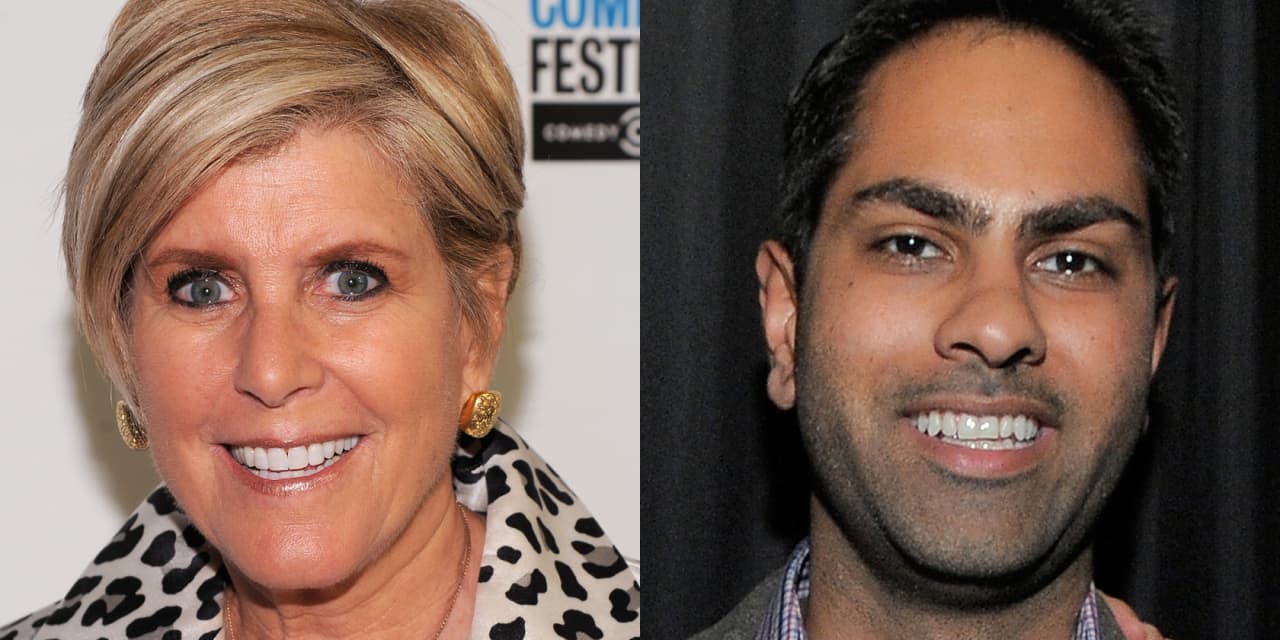

This is what both Suze Orman and Ramit Sethi say you should do if you’re worried about inflation

MarketWatch has highlighted these products and services because we think readers will find them useful. We may earn a commission if you buy products through our links, but our recommendations are independent of any compensation that we may receive.

If you’re worried about inflation right now, you’re not alone. “The rate of inflation in the U.S. rose again in July and drove the increase over the past year to a 30-year high,” MarketWatch’s Jeffrey Bartash reported in August. For investors, that news was, no doubt, worrisome, so we looked at what two financial bigwigs, Suze Orman and Ramit Sethi, as well as other pros, have told investors in the past about dealing with inflation (psst: both say you need to keep investing in stocks.) Here (and below) are Bankrate’s list of featured investing products for September.

Suze Orman: “Plan on many costs being double what they are today, and keep investing in stocks.”

On July 8, 2021, Orman wrote, “A 3% annual inflation rate might not sound so bad, but if you compound that 3% every year for 25 years, it means that what costs you $100 today will cost you more than $200 in 25 years.” So Orman, a financial advisor and host of The Suze Orman Show, recommends people keep investing in stocks because over the long-term, stocks have produced the best gains after factoring in inflation. “Bonds and cash struggle to keep pace with inflation; only stocks have a track record of earning more than inflation,” Orman says.

Ramit Sethi: “Investing is the single most effective way to get rich. Inflation can be bad for individuals when you just keep your money sitting in a bank account and do nothing else with it.”

Sethi, a self-made millionaire and author of I Will Teach You To Be Rich, says you need to “take a long-term view of your personal finances and that means choosing different investment options that allow you to make money despite events like recessions.” As an example, Sethi says, “Big banks pay about 0.01% interest on savings in 2018. This means if you put $1,000 in a savings account, you’d earn a whopping $0.10 per year. If your money is sitting in one of these big banks, you’d be losing money every day because inflation is 3%,” he wrote in 2018. (Though his example is from 2018, savings accounts today are also paying low interest rates too, so it’s still relevant.) Here are Bankrate’s list of the best investing products of September 2021.

What other pros say

It’s not just the famous faces who say to keep investing: Tiffany Lam-Balfour, investing and retirement specialist at NerdWallet, says: “If you’re invested for the longer-term in a well-diversified portfolio, you’ve likely already got inflation protection built in. Staying invested and not holding onto too much cash are two sound ways to fight against inflation.” Not sure if you’re properly invested? “If you’re worried your portfolio isn’t allocated appropriately, consult with a trusted advisor before making any hasty investment decisions,” says Lam-Balfour.