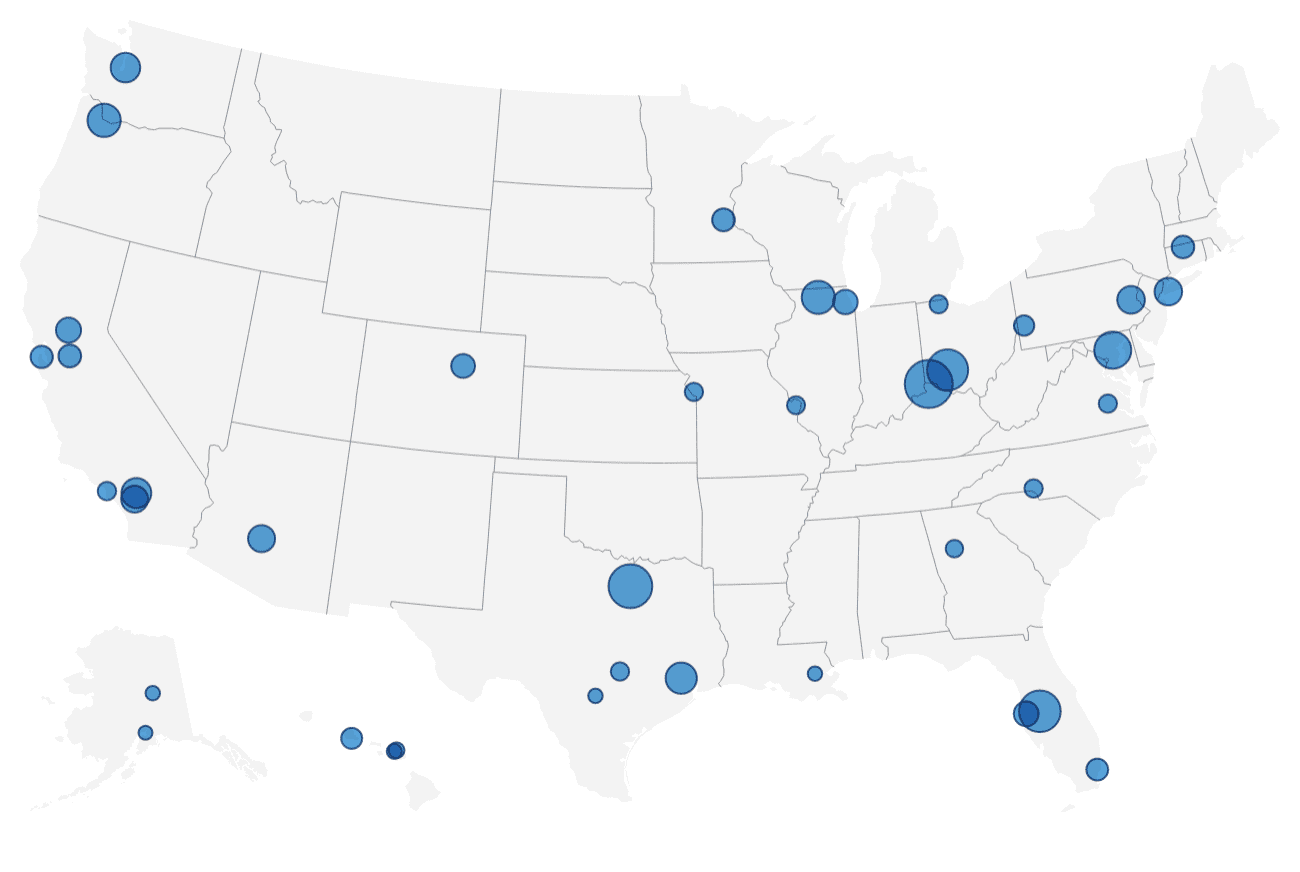

This map shows how Amazon is rapidly growing its air fleet across the U.S.

Source: Chaddick Institute at DePaul University. Shows U.S. airports only and includes partner airlines.

Over the years, Amazon has built up an army of warehouses, shipping hubs, delivery vans and trucks to ensure it can meet its Prime pledge of delivery in two days or less.

Amazon’s air fleet, which now has 75 planes, is another increasingly critical component of the company’s logistics machine. The fleet gives Amazon greater control over its own packages and enables it to offer even faster deliveries.

It’s also bringing Amazon into direct competition with FedEx and UPS. Analysts have long predicted that Amazon is on its way to becoming a “top logistics provider” and anticipate it could one day fly packages for other companies, not just items in its own warehouses.

The company’s latest air cargo expansion suggests Amazon Air is inching toward becoming a more serious competitor to traditional carriers.

Amazon Air now operates out of 42 airports in the U.S., after it added regular flights to seven airports in the last six months, according to a study issued Wednesday by DePaul University’s Chaddick Institute for Metropolitan Development.

That puts 70% of the U.S. population within 100 miles of an Amazon Air airport, up from 54% in May 2020, according to the study.

Amazon Air’s growing footprint enables it to ship packages and inventory to areas that are just a short truck drive or delivery van route away from a significant chunk of the U.S. population, DePaul researchers said.

Amazon Air’s increasing proximity to consumers is key as Amazon continues to move up delivery speeds from two- to one-day shipping. Amazon’s push to get products to customers at a faster and faster clip has brought with it higher shipping costs. Amazon spent more than $61 billion on shipping in 2020, up from nearly $38 billion the year before, based on CNBC calculations using figures from financial filings.

“Amazon Air’s expanded reach bolstered its ability to rapidly move inventory among its multitude of warehouses and sorting services to make next-day delivery possible for an enormous array of products to much of the U.S. population,” according to the report.

Amazon launched its air fleet in 2016. The company still relies on outside carriers Atlas Air Worldwide Holdings and Air Transport Services Group to fly a portion of its packages, but it has started to bring some air cargo operations in house.

In January, the company announced its first aircraft purchases, buying 11 used Boeing 767-300 jets to add to its fleet of leased aircraft. Amazon’s air fleet remains a fraction of the size of FedEx, which has 467 planes, and UPS’ fleet of 284 aircraft, according to data on planespotters.net.

Last month, Amazon opened its $1.5 billion “superhub” at the Cincinnati/Northern Kentucky International Airport, which spans 600 acres and features an 800,000-square-foot robotic sort center, where packages are sorted by zip code and consolidated into trucks before delivery. The hub could handle up to 200 flights a day.

Amazon flight activity has increased 17% over the past six months to an average of 164 flights per day, DePaul researchers said. The researchers predicted Amazon will expand its flight operations by another 12-14%, bringing its daily total to more than 180 by January of next year.

Amazon is likely far off from offering up its air cargo services to third parties, since handling its own order volume is a full-time job, said Joseph Schwieterman, director of the Chaddick Institute, in an interview.

Sarah Rhoads, Amazon Global Air vice president, told CNBC in an interview last month that the company is focused on handling its own package volume.

That could change as the Amazon Air network continues to grow, Schwieterman said.

“If they can provide it to markets where they have coverage and capacity and maybe not try to be all things to all people, it could be a really nice profit center,” Schwieterman said. “The day will likely come that they elbow their way into the massive business-to-consumer logistics segment.”

Amazon declined to comment on the report’s findings.