Wall Street sees as much as 56% upside for its 20 favorite stocks

As the stock market reopens following Labor Day weekend, there is no shortage of warnings that a correction is due — which would be a pullback of at least 10% for the benchmark S&P 500 following a gain of 21% so far this year.

But there still may be catalysts for stock prices as the economy rebounds and interest rates remain low. A list of favorite S&P 500 SPX,

In Monday’s Need to Know column, Barbara Kollmeyer cites Matt Maley, chief market strategist at Miller Tabak + Co., who sees parallels between current market conditions and those of 2007, 1999 and 1929 that preceded three crashes.

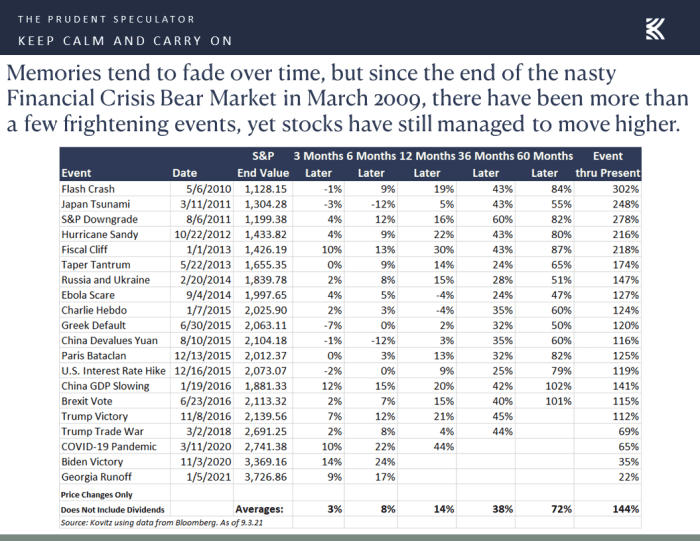

Then again, John Buckingham, editor of the Prudent Speculator newsletter, shared this chart, which shows how the market recovered after declines brought about by 20 “frightening events” going back to 2010:

An investor with a crystal ball might time the market perfectly, selling everything at a market top and buying at the bottom. But the human tendency, even for an investor who “gets out in time,” is to buy back in too late and miss the rebound. For the vast majority of long-term investors, waiting out a bear market (one with a decline of at least 20%) tends to work out well if one can stay in for three years. If your investment horizon is shorter than that, stocks might not be for you.

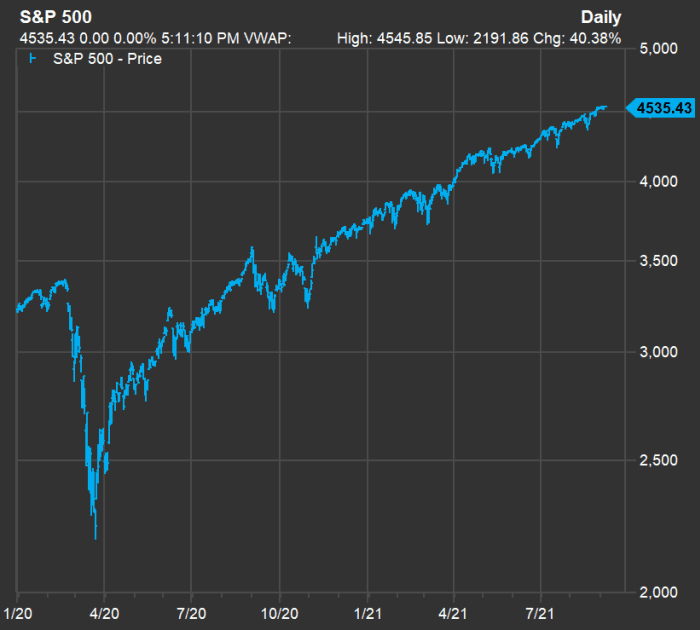

Buckingham’s chart, above, shows how well the S&P 500 has performed since the COVID-19 crisis began. But here’s another way of illustrating how quickly the market can recover, especially when supported by government stimulus and Federal Reserve policy — the S&P 500’s price movement since the end of 2019:

From an intraday peak Feb. 10, 2020, through the pandemic trough March 23, 2020, the S&P 500 dropped 35%. It has gained 107% since that bottom. But if you look more closely, you can see significant pullbacks (based on intraday prices) of 11% between Sept. 2, 2020, and Sept. 24, 2020, and 9% between Oct. 10, 2020, and Oct. 30, 2020. Those weren’t fun periods for investors, but in hindsight they were blips. Investors fare best when they held on.

Valuations and relative bargains

Federal stimulus and central-bank easy-money policies have made interest rates so low that some investors who would traditionally lean toward bonds and preferred stocks for income turned toward common stocks. So the forward price-to-earnings (P/E) ratio for the S&P 500 is now 21.4, based on consensus estimates among analysts polled by FactSet, compared to a 10-year average valuation of 16.5.

The 11 sectors of the S&P 500 tend to trade higher or lower than the full index on a P/E basis. Here are the sectors’ relative valuations to the full index and how those compare to average valuations:

| S&P 500 sector | Forward P/E | Average forward P/E – 10 years | P/E to full index P/E | Average P/E to average full index P/E | Relative premium or discount |

| Energy | 13.2 | 15.3 | 62% | 93% | -31% |

| Materials | 17.2 | 15.8 | 80% | 95% | -15% |

| Industrials | 22.5 | 16.7 | 105% | 101% | 4% |

| Consumer Discretionary | 31.5 | 22.1 | 148% | 134% | 14% |

| Consumer Staples | 20.8 | 18.5 | 97% | 112% | -15% |

| Health Care | 17.7 | 15.5 | 83% | 94% | -11% |

| Financials | 14.4 | 12.2 | 67% | 74% | -7% |

| Real Estate | 23.3 | 18.6 | 109% | 112% | -3% |

| Information Technology | 26.6 | 16.8 | 125% | 102% | 23% |

| Communication Services | 22.7 | 18.6 | 106% | 113% | -6% |

| Utilities | 20.0 | 16.7 | 94% | 101% | -7% |

| S&P 500 | 21.4 | 16.5 | |||

| Source: FactSet | |||||

It probably isn’t a surprise to see that the information technology sector, dominated by rapidly growing tech giants (in an index weighted by market capitalization) trades much higher relative to the full index than it did five years ago, or that the energy sector trades much lower.

But it is worth noting that several sectors still trade lower than usual, relative to the full index, even in a market that has lifted 88% of the S&P 500 this year. These include health care, which is up 20% in 2021, and the financial sector, up 29%.

Wall Street’s favorites among the S&P 500

Analysts who work for brokerage firms tend to shy away from negative ratings. Among the S&P 500, there are no companies with majority “sell” or equivalent ratings. But the analysts still have clear preferences for some stocks over others. Here are 20 stocks in the benchmark index with at least 75% “buy” or equivalent ratings, with the most upside implied for the next year, based on consensus price targets:

| Company | Share “buy” ratings | Closing price – Sept. 3 | Consensus price target | Implied 12-month upside potential |

| Micron Technology Inc. MU, |

88% | $73.81 | $114.96 | 56% |

| Diamondback Energy Inc. FANG, |

91% | $75.56 | $113.52 | 50% |

| General Motors Co. GM, |

92% | $48.82 | $72.16 | 48% |

| News Corp. Class A NWSA, |

80% | $22.56 | $32.74 | 45% |

| Global Payments Inc. GPN, |

81% | $158.01 | $228.69 | 45% |

| Activision Blizzard Inc. ATVI, |

91% | $81.18 | $116.04 | 43% |

| Alaska Air Group Inc. ALK, |

93% | $57.11 | $80.00 | 40% |

| Pioneer Natural Resources Co. PXD, |

81% | $149.88 | $207.09 | 38% |

| Southwest Airlines Co. LUV, |

82% | $48.86 | $66.24 | 36% |

| Lamb Weston Holdings Inc. LW, |

78% | $63.58 | $85.43 | 34% |

| ConocoPhillips COP, |

97% | $56.24 | $75.52 | 34% |

| Centene Corp. CNC, |

85% | $64.37 | $85.47 | 33% |

| Vertex Pharmaceuticals Inc. VRTX, |

78% | $198.05 | $262.14 | 32% |

| FedEx Corp. FDX, |

78% | $266.04 | $349.48 | 31% |

| Devon Energy Corp. DVN, |

85% | $29.17 | $38.19 | 31% |

| Valero Energy Corp. VLO, |

85% | $64.70 | $84.06 | 30% |

| Mastercard Inc. Class A MA, |

84% | $340.23 | $439.16 | 29% |

| Zimmer Biomet Holdings Inc. ZBH, |

79% | $146.74 | $187.58 | 28% |

| Schlumberger Ltd. SLB, |

79% | $28.09 | $35.56 | 27% |

| T-Mobile US Inc. TMUS, |

87% | $136.00 | $172.00 | 26% |

| Source: FactSet | ||||

Click on the tickers for more about each company.

If you see any stocks of interest, you should do your own research and form your own opinion about how likely a company is to remain competitive over the next decade. Tomi Kilgore has just written a detailed guide to the information available on MarketWatch’s quote page. That’s a great way to begin digging into any stock.

Don’t miss: 14 dividend stocks from a winning value manager as the broader market hits record highs