After a 71% profit, this investor just got out of oil and is putting everything into this commodity instead

Wednesday brought some (more) grim news on the energy front, with a warning for U.S. households to expect higher heating bills this winter, as supply-and-demand struggles in Europe and Asia come home to roost.

And just as the world is trying to get greener, shortages have led to the revenge of the fossil fuels, helping push crude CL00,

Our call of the day from the co-founder of TankerTrackers.com, Samir “Sam” Madani, sees a lot of red flags on that oil optimism. He cashed out of his oil exposure two weeks ago, after gaining 71% on the asset from exposure that began in March 2020, when oil crashed below $20 a barrel amid early COVID-19 pandemic panic.

“I feel like it’s becoming a crowded thing. The narrative is way too bullish,” said Madani in a recent telephone interview with MarketWatch, adding oil’s downfall will be the consumer. “The cost of living is now outpacing income. Food prices are up due to labor shortages, high fertilizer demand and very high diesel prices (used by tractors and trucks alike), so I think $100 is too soon.”

“If we have this discussion a year from now when the economy is on a better economic foundation, then definitely $100 is justifiable,” he said. And it isn’t just that the Organization of the Petroleum Exporting Countries and its allies should be keeping prices at around $68 to $78 to save off an economic meltdown, but the fact that outside of North America consumers are being squeezed by high fuel taxes, he said.

So Madani — who has been socking money away for his own retirement and an apartment or anything any of his four children might need — switched out of oil investments that were via a mutual fund offered through Sweden’s public pension plan. And he switched into water.

He began investing in water earlier this year, replacing exposure to China stocks that he had held since 2016. That investment has gone up 20%. The oil exposure that he got out of two weeks ago went to the Pictet-Water P mutual fund. He also has some small-cap stock investments and is looking at gold mining stocks.

“I think it’s the mother of all commodities, whereas all the other commodities have been boom-and-bust cycles, there has been a continual demand for water as population growth continues at a rate of 100 million net a year,” he said, noting projections for a global population of 10 billion by 2052.

“Whether there’s a flood or a drought this fund should do well because it also includes infrastructure like pipes, procession, filtration, you name it,” Madani said. Water’s importance popped up for the U.S. infrastructure bill, where it was one of the few priorities political parties agreed on, he said.

Read: Stocks and sectors that could benefit from the infrastructure bill

Growing up in the Middle East, where spare gasoline was used to wash cars, taught him water’s importance, and that “water is something you’re supposed to drink, not something you’re supposed to squander.”

While many early investors and Wall Street are catching on to water, it’s only a physical market with no futures. Companies include Danaher Corp. DHR,

Exchange-traded funds include First Trust Water FIW,

Some argue that water is a tougher environmental, social, and governance investment, because the ecosystem involved needs considerable time to understand. “Years from now it could be my kids that are tracking water,” said Madani.

Read: Every whale is worth $2 million? Why it’s time to add the value of nature to GDP.

The buzz

A bevvy of banks have reported ahead of the bell with beats from Bank of America BAC,

Taiwan Semiconductor TSM,

Meanwhile, U.S. efforts to unclog supply-chain problems by opening up the Port of Los Angeles 24/7 may not be enough to save Christmas, industry experts warn.

Headed into Thursday’s first day of trading, all-remote software group GitLab priced its initial public offering late Wednesday at $77 a share, well above an already elevated range.

Weekly jobless claims totaled 293,000, which was fewer than expected, while September producer prices met forecasts, with a gain of 0.5%, and up 0.2% stripping food and energy costs. And China’s factory-gate prices jumped 10.7% in September, the fastest pace in more than two decades, driven by surging raw materials prices.

Catch the latest Best New Ideas in Money podcast.

The markets

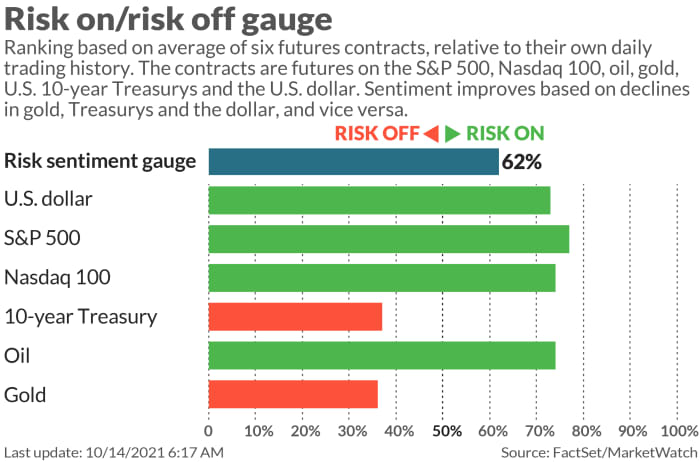

Stock futures ES00,

Random reads

Bali has finally reopened to international tourists, but good luck finding a flight.

A beloved donut cookie, befelled by illegal sprinkles.

4-foot, nearly 40 pound prehistoric ‘river monster’ caught in Kansas.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.