Analyst Who Exposed Libor as Broken Warns of Rising Rate ‘Tsunami’

(Bloomberg) — Scott Peng knows trouble when he sees it — and right now he detects it all over markets thanks to an oncoming interest-rate “tsunami.”

Most Read from Bloomberg

The Advocate Capital Management executive — who helped uncover the biggest scandal in modern banking with a damning 2008 report on Libor manipulation — has a plan. He’s launching the Rising Rate Hedge exchange-traded fund as soon as next week to ride a breakout in bond yields, as market-based measures of inflation jump to the highest in decades.

“There are so many forces that are primed to force rates higher: the Fed’s QE taper, fiscal stimulus, the fiscal deficit and non-transitory inflation,” Peng, who serves as Advocate’s chief investment officer, said in an interview. “The Fed’s reaction function is pretty slow — you’re talking 10 months before they can start hiking rates, and if they are wrong about the transitory nature of inflation it will drive the long-end bananas.”

The actively managed fund, ticker RRH, will trade Treasuries and a host of derivatives across bonds, equity indexes, currencies and commodities to generate returns when long-term U.S. interest rates rise, according to a filing.

The more than two-decade Wall Street veteran has form spotting trouble in the plumbing of financial markets. He rose to prominence co-authoring a game-changing report dubbed “Is Libor Broken?” as head of U.S. rate strategy at Citigroup Inc. It helped spark investigations that led to banks paying billions of dollars of fines. Today policy makers are locked in a battle to phase out the trillion-dollar benchmark.

These days Peng — who has previously also warned about risks in shadow banking — is focused squarely on market disruptions spurred by interest-rate liftoff. The intensifying supply-chain and commodity crisis this week has sent a measure of inflation expectations to the highest in more than 15 years. Traders are pricing half a percentage point of Federal Reserve hikes by the end of 2022.

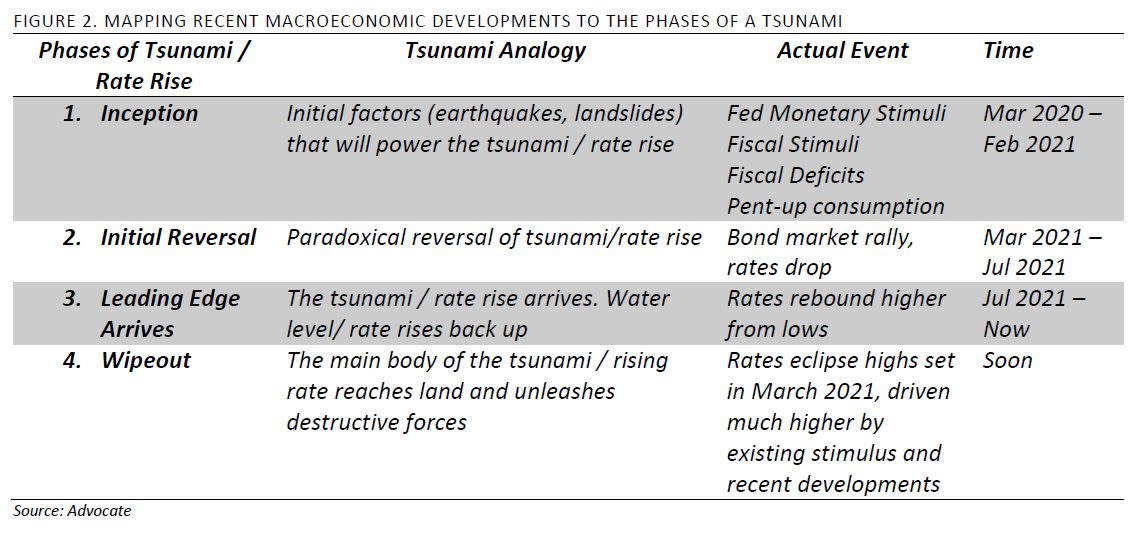

“The leading edge of the rising rate tsunami has arrived,” Peng, a former managing director at Credit Suisse Group AG, wrote in a paper this month. “Investors who choose to do nothing as interest rates continue to rise may soon be faced with a much more difficult environment.”

The report labels the next part of the hiking cycle the “wipeout” phase, in a warning to unhedged investors in everything from government debt and high-yield credit to bond-sensitive tech stocks.

Peng argues popular hedging trades tend to impose a heavy holding cost, or negative carry, which undercuts performance over time. RRH is pitched as a long-term investment and a core part of a portfolio.

Still, Advocate Capital is far from alone in targeting fears over inflation and nominal bond risks.

Among other recent filings, Pacer ETFs has applied to create the Pacer Pacific Asset Floating Rate High Income ETF. The FolioBeyond Rising Rates ETF (RISR) launched at the start of the month. The Simplify Interest Rate Hedge ETF (PFIX) debuted in May and has garnered almost $120 million in assets.

One of the most popular investing styles is the $35 billion iShares Treasury Inflation-Protected Securities ETF (TIP), which has added almost $9 billion this year while returning 4.2%.

Among the more specialized hedging products are the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) with $3.6 billion and the $1 billion ProShares Investment Grade-Interest Rate Hedged ETF (IGHG).

With no signs of inflation easing for now, Peng sees ever-growing demand for protective strategies.

“We plan on issuing other risk-mitigation ETFs,” he said.

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.