Bank of America turns bearish on European stocks, sees ‘anti-goldilocks’ shift ahead

European stock investors should brace for as much as a 10% correction by year end, warned Bank of America analysts who see fading economic growth momentum ahead for the region.

“We think the macro backdrop for equities is moving from goldilocks (stronger growth, lower discount rate) to anti-goldilocks,” said a team of strategists led by Sebastian Raedler, in a note to clients on Friday. They see the Stoxx 600 SXXP,

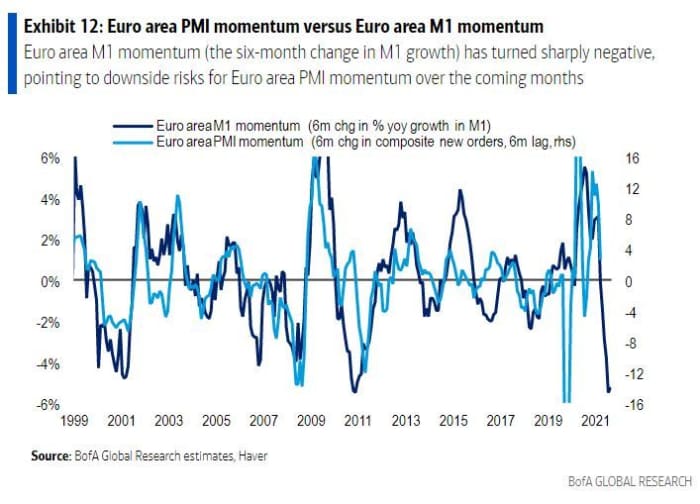

The analysts pointed to a key driver of European stocks, the euro-area purchasing managers index (PMI), that is “now dropping sharply as a reopening boosts fades, with further downside likely as growth normalizes over the coming months.”

Data out Friday showed the eurozone manufacturing PMI falling to 58.6 in September from 61.4 in August, posting the largest drop since April 2020, according to IHS Markit.

“Supply issues continue to wreak havoc across large swaths of European manufacturing, with delays and shortages being reported at rates not witnessed in almost a quarter of a century and showing no signs of any imminent improvement,” Chris Williamson, chief business economist at IHS Markit, said in a news release.

Raedler said downside risks to their growth forecasts are building “given energy shortages in China and Europe, the debt crisis in China’s property sector and ongoing supply-chain disruption.”

Another piece to the bearish puzzle is scope for rising bond yields as central banks turn more hawkish, which the bank sees continuing. A secondary driver of the recovery for Europe stocks since March 2020 has been a near-200 basis point drop in real bond yields, the strategist said.

The bank lowered European capital goods, autos and diversified financials from marketweight to underweight, owing to the downside implied by a weaker macro cycle, and lifted mining from underweight to marketweight, citing projections that point to no further downside until early next year.

European stocks were softer on Friday, following the worst monthly performance in a year.

For September, the Stoxx Europe 600 dropped 3.4%, the biggest percentage decline since October 2020 that broke with a seven month winning streak. Among the major regional indexes, the German DAX DAX,

The eurozone and the U.K. have been grappling with higher energy prices, as natural gas futures continuing to mark fresh records. NovemberTitle Transfer Facility (TTF) natural gas futures in the Netherlands— the European benchmark — continues to hit new records, though down 3.3% to 94.455 euros per megawatt hour (MWh) on Friday.

A surge that began in the summer amid natural gas shortages in the U.K. and on the continent, has taken that price from around 45 euros in late August. On Thursday, crude prices climbed on a report that China’s Vice Premier Han Zheng has reportedly ordered top state-owned energy companies to secure winter supplies at all costs, as the country has been struggling with power outages.

Eurozone finance ministers meeting in Luxembourg on Monday are expected to discuss the energy crisis facing the region and soaring bills for consumers prices. Utilities was one of the few sectors moving higher, with power giant Électricité de France EDF,

Pharmaceuticals, banks and industrial names were leading the downside on Friday. AstraZeneca shares AZN,