Bitcoin, gold or dollar for a rainy day? Here’s what the bosses at Bridgewater, BlackRock and Goldman choose

A blockbuster week in tech has already been delivering records some investors didn’t see coming. Tesla TSLA,

For Tuesday, we’ll shift over to a boatload of earnings, with Alphabet parent Google GOOGL,

For sure, tech may have been taking a bit of focus off bitcoin BTCUSD,

Our call of the day circles back to that crypto as we eavesdropped in on the fifth Future Investment Initiative running from Tuesday to Thursday in Saudi Arabia. Also known as “Davos at the Desert,” a simple question on the opening panel may have revealed insight into big money managers’ feelings about cryptocurrency.

In attendance were Blackstone BX,

The group was posed a question at the end of the panel, that if they could be paid a dividend by an imaginary board, would they choose dollars, euros, some gold or bitcoin to “put under your bed for a rainy day?”

The first to answer was Dalio. “I can’t put a mix together, I guess. I would take the gold…I would like to sprinkle a little bit of bitcoin into that mix too,” he responded.

“The biggest asset is human productivity and if you can tap that…so I’m looking at the new technologies and all of those [things] are very, very exciting,” Dalio said. “Gold is a dead asset, but the amount of printing of money and the devaluation of debt is a big force too. So I want that technology, a little bit of bitcoin, and I want to bet on those other industries.”

Next up was Blackstone’s co-founder Schwarzman, who said he just wanted to “own earning assets…as long as you can make things better and own wonderful things, you can come out and you can own dollars or you can own whatever you want to convert that currency into, but you’ll have more and more and more and you won’t be a professional victim.”

Santander’s Botín said she would take “50 cents in euros and 50 cents in dollars. Punto.”

Also less bitcoin-keen was the response of BlackRock’s Fink, who responded: “In using Ray’s statement about technology and innovation and what Steve said, I’d put 100% in dollars.”

As for Goldman’s Solomon, he said given the topics the panel had discussed, which included battling climate change and corporate diversity and energy prices, he “thinks the glass is half full as a broad global community and in that construct I choose dollars.”

African Rainbow Capital’s Motsepe said as he’s got 50,000 mine workers on the company’s mines, his choice would be gold.

“I’ll take bitcoin hedged in gold,” joked Mubadala Investment’s Al Mubarak.

One more highlight from that panel—Fink also said there’s a high likelihood that oil will hit $100 a barrel. And Dalio weighed in on the billionaire tax.

Read: Why the S&P 500 could continue climbing into year’s end, eclipsing its 21% rally so far in 2021

The buzz

Late Monday and amid a wave of negative newsflow, Facebook FB,

Among the big names reporting ahead of the market’s open, Archer-Daniels-Midland ADM,

Apple AAPL,

More trouble for Chinese real estate after Modern Land China, which specializes in green technologies, didn’t make a payment for the principal or interest on a $250 million bond due Monday, Bloomberg reports.

Data en route include the S&P Case-Shiller home price index, consumer confidence and new home sales, all due after the market open.

The markets

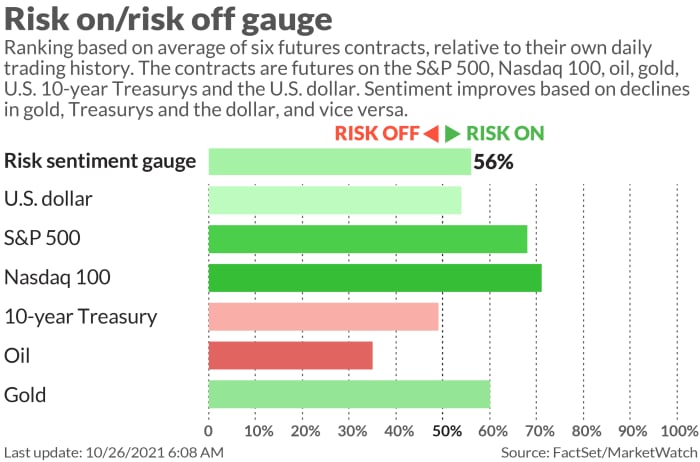

Stocks DJIA,

Random reads

Lego joins the fight to save Singapore’s coral reefs.

“Squid Games” creator says he lost six teeth in the process of making the hit show. And it hasn’t made him rich.

Hippos whose parents were owned by Colombian drug kingpin Pablo Escobar win U.S. personhood rights.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.