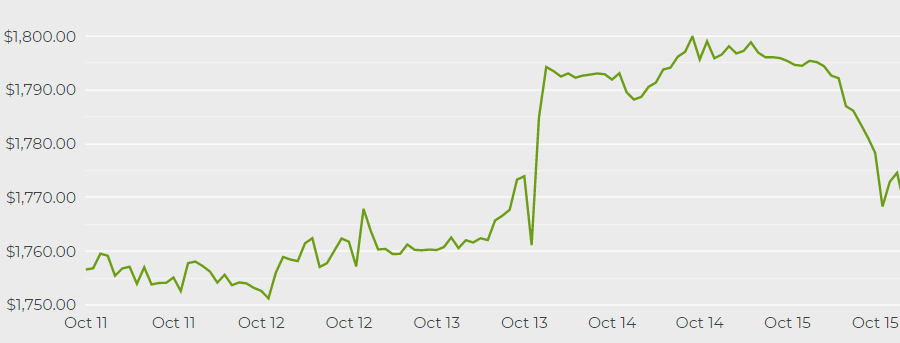

Gold price pares weekly gain as US bond yields rebound

[Click here for an interactive chart of gold prices]

Meanwhile, both European stocks and US futures advanced after robust corporate earnings. US bond yields rose after three straight days of declines, causing non-interest bearing gold to sink through its 50-day moving average.

Still, bullion is approaching its best weekly performance since August after receiving a boost from the latest US inflation report.

The consumer price index showed high inflation persisting in the world’s largest economy, causing 10-year Treasury yields to sink earlier in the week as traders weighed how the Federal Reserve would react.

“The market, as a snapshot of that, priced in increased stagflation fear,” said Marcus Garvey, head of metals strategy at Macquarie Group Ltd., in a Bloomberg interview.

“That inflation now will bring forward tightening, but the economy won’t handle it, and, therefore, it will be a very limited tightening cycle.”

Bank of America chief executive Brian Moynihan joined fellow finance industry leaders, including Morgan Stanley CEO James Gorman and Goldman Sachs Group’s chief operating officer John Waldron, in predicting that inflation will stick around. Some Federal Reserve officials also are now less certain price pressures will prove transitory.

This sentiment has caused traders in the US short-term rates market to bet on the Fed raising rates faster and more aggressively starting at the end of next year. Whether the central bank takes action to curb inflation at the expense of employment will be crucial to gold’s performance over the next year, the Bloomberg report stated.

Investors so far remain cautious. Exchange-traded funds are set to cut their gold holdings for a fourth week running, according to an initial tally by Bloomberg.

“The gold investment market is still suffering from a hangover from last year,” said Adrian Ash, director of research at brokerage BullionVault. “It was always going to be a hard act to follow.”

(With files from Bloomberg)