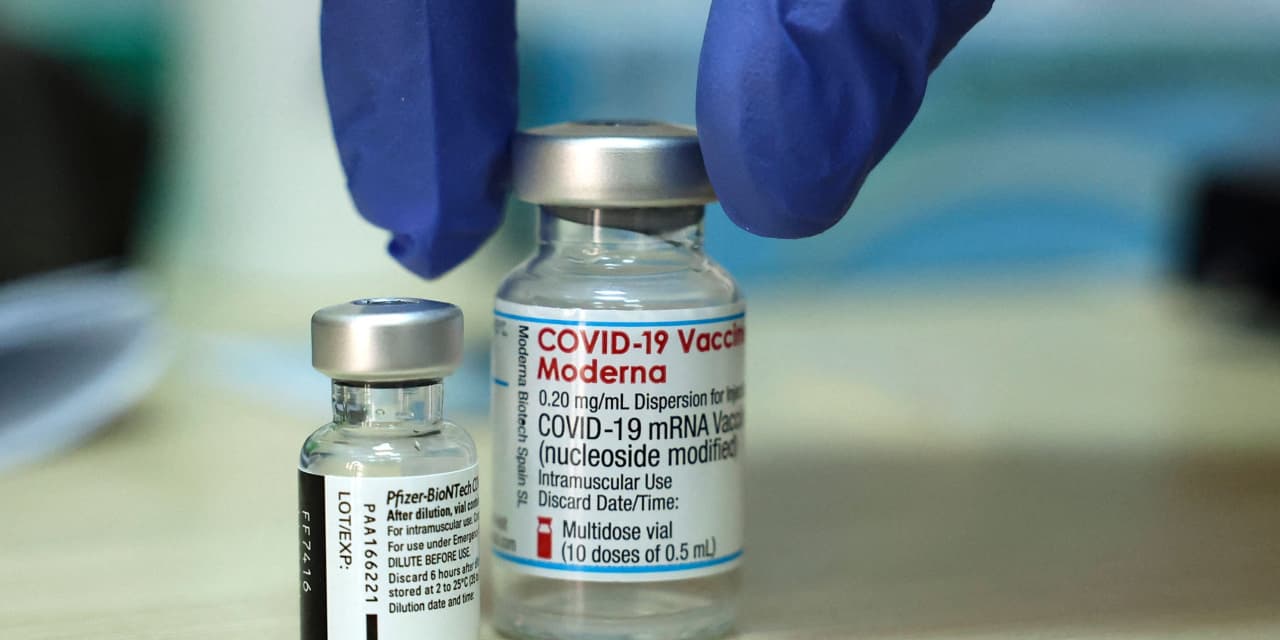

How much is Big Pharma making from COVID-19 vaccines? We’re about to find out

U.S. pharmaceutical companies are expected to collect more revenue from COVID-19 vaccines in the third quarter than they did in the entire first half of the year, and that money should continue to grow.

In the first half of the year, Pfizer Inc. PFE,

Pfizer collected revenue of $11.3 billion in the first half of the year from its COVID-19 vaccine, now known as Comirnaty, and analysts project third-quarter sales of $11.86 billion. Those numbers could be a bit high, however, as some sales could get pushed into the fourth quarter, when booster shots and the newly authorized vaccine for younger children begin landing in arms.

See also: Big Tech is still headed for its biggest year ever, but Apple and Amazon could cut into profit

Mizuho analysts wrote earlier this month that Pfizer might struggle to put up more than $10 billion in third-quarter COVID-19 vaccine sales, though the missing revenue would likely just be pushed into the fourth quarter instead.

“Comirnaty sales have driven remarkable upside to Pfizer numbers in 1Q21 and 2Q21, but for 3Q21 we believe consensus estimates are currently too high based on orders Pfizer has publicly announced and government websites that track actual COVID vaccine shipments,” wrote the analysts, who have a neutral rating and $43 price target on Pfizer stock. “Our FY21 Comirnaty sales estimates are unchanged, however, as we shift revenues from 3Q21 to 4Q21, while awaiting further clarity on order trends and uptake on the conference call.”

Moderna on average is expected to report vaccine sales of $6.17 billion in the third quarter, after collecting $5.93 billion in the first half. The vaccine is more important financially to Moderna, because it is the first approved product for the younger pharmaceutical company, but the company faces a potential delay in its own product aimed at children after a setback over the weekend.

Pandemic coverage: Follow MarketWatch’s coverage of COVID-19 here

Any forecasts or color from executives on fourth-quarter and 2022 expectations will also be important, as analysts are predicting more than $21 billion in fourth-quarter revenue from Moderna and Pfizer alone. Production capacities will be an interesting topic as well, with the companies rolling out boosters and doses for younger patients while still attempting to protect people worldwide from the pandemic.

Moderna and Pfizer are two of 167 S&P 500 SPX,

The numbers to watch

- Holiday forecasts. Guidance for the fourth quarter continues to come to light, with FactSet reporting that 25 of 40 S&P 500 companies that provided guidance came in lower than estimates so far, an ominous sign. Issues with the supply chain, staffing and inflation have proved hard to overcome for executives attempting to predict their companies’ holiday performance, leading to Wall Street repercussions for the likes of Snap Inc. SNAP,

-3.33% and Amazon.com Inc. AMZN,-2.15% . Third-quarter results continue to come in higher than forecasts so far, but investors’ eyes are more trained toward the holidays than the past results. Most interesting should be consumer-products companies that do most of their manufacturing overseas, such as Peloton Interactive Inc. PTON,+1.25% and GoPro Inc. GPRO,-1.37% , which both report Thursday afternoon. - Videogame sales. Videogames were already in contention to be the most lucrative form of entertainment in the world before the COVID-19 pandemic, but a boom in online sales during shelter-in-place rules made its case even stronger. However, game publishers like Activision Blizzard Inc. ATVI,

-0.87% , Electronic Arts Inc. EA,+0.01% and Take-Two Interactive Software Inc. TTWO,-0.06% suggested the boom would fizzle out in the third quarter, leading to a big downturn in videogame stocks. All three of those major publishers are scheduled to report this week and have a chance to change that trajectory by reporting stronger results than executives projected and delivering good holiday forecasts, as MarketWatch’s Wallace Witkowski explains.

The conference calls to put on your calendar

- Uber and Lyft. As Uber Technologies Inc. UBER,

-1.79% and Lyft Inc. LYFT,-2.24% attempt to revive ride-hailing businesses that took a hit during the pandemic, analysts believe that Uber may be winning the race, as MarketWatch’s Levi Sumagaysay recently reported. The competition used to be about luring riders to the competing platforms, but now it is more of a battle for drivers as ride-hailing companies struggling with staffing shortages. Keep an ear to these calls for hints about which company is finding success despite the shortage, and how it is playing out. - The gambling companies. As legal sports gambling continues to spread to new states, casinos have reopened to gamblers as well, leading to an interesting split between those who continue to gamble online and those who are heading back to the casino counter. The size of that spread should be of interest this week to investors, who have quite a parlay card of gambling stocks to check out with traditional players Caesars Entertainment Inc. CZR,

-1.29% and MGM Resorts Intl. MGM,+0.40% reporting Tuesday and Wednesday, respectively, and Penn National Gaming Inc. PENN,-1.92% and DraftKings Inc. DKNG,-1.25% following on Thursday and Friday, respectively. Truist Securities analysts recently wrote that gambling was “one of the few sectors to truly emerge from COVID stronger than ever,” with an eye on continued in-person recovery: “Ultimately, we expect continued resilience to COVID and the operating environment still favoring regional operators with a continuing tilt towards destination recovery.” The Truist analysts’ price targets imply more upside for Penn and Caesars than MGM and DraftKings, but are highest on Bally’s Corp. BALY,-3.23% , which also reports Thursday.

This week in earnings

While 167 S&P 500 companies are expected to report, according to FactSet Senior Earnings Analyst John Butters, it will be a much slower week for the blue-chip Dow Jones Industrial Average DJIA,

The action is hotter for companies not in the major indexes, such as vacation-rental company Airbnb Inc. ABNB,