Investment advisers ‘extremely skeptical’ about first U.S. bitcoin ETF: ‘It’s a hard thing for RIAs to recommend an inferior’ crypto product

Happy Sunday! Welcome to the penultimate installment of Need to Know Crypto Edition, ahead of the launch of a new weekly crypto newsletter “Distributed Ledger,” which will kick off next month.

I’m Mark DeCambre, managing editor of markets and I’ll walk you through the latest and greatest in digital assets this week so far. There is a lot of ground to cover, especially as ProShares bitcoin futures exchange-traded fund could debut as early as next week, marking a milestone in digital assets.

Sign up for that newsletter here.

Crypto in a snap

It has been nearly eight years in the making and scores of applications have been rebuffed along the way, but there is finally going to be an ETF loosely pegged to bitcoin that offers average investors access without having to worry about custody of digital assets.

ProShares submitted an amended filing with the Securities and Exchange Commission on Friday for a bitcoin futures ETF, which carried all the hallmarks of a regulatory filing that might lead to a launch soon, said Todd Rosenbluth, head of ETF and mutual fund research at CFRA, in a phone interview.

The ETF isn’t the hoped-for U.S. fund that is directly backed by bitcoin such as those from our neighbors to the north but it is something that crypto bulls can hang their hats on, with many taking it as a watershed moment for an asset that didn’t exist until 2009.

We’ve talked about the benefits and the drawbacks of ETF futures here and here.

In any case, the fervor around the ETF helped jolt bitcoins’s price BTCUSD,

Ether ETHUSD,

Will they come?

In the wake of the news on the ProShares futures ETF, and what is likely to be a steady flow of similar fund products, we talked to Ben Cruikshank, head of Flourish, an investing platform, owned by insurance giant MassMutual, that works with hundreds of registered investment advisers, or RIAs, that oversee $1 trillion in assets.

Flourish said that there is white-hot interest in crypto but advisers are reluctant from a fiduciary perspective to recommend a bitcoin futures product for clients when there are better options to owning crypto such as Coinbase Global or other digital-asset exchanges.

“The feedback that I’m getting is a derivative is a less efficient form of ownership,” Cruikshank told MarketWatch in a phone interview.

RIAs are asking as “a fiduciary are we going to recommend a complicated futures product that is a more complicated than…opening a Coinbase account in 5 minutes?”

“It’s a hard thing to justify an inferior futures product,” he said. “That is less my feedback and more what firms are telling me.”

Cruikshank estimated that some 50 million Americans already have invested in crypto and said that the sense among RIAs is that “investors always prefer direct access if it is available.”

“People value convenience and I’m not saying that there won’t be some adoption…but the firms we are speaking to are extremely skeptical” of a futures ETF, Cruikshank said.

The movers

| Biggest gainers | Price | %Weekly return |

| Stacks | $2.03 | 40.63 |

| Perpetual Protocol | $18.20 | 30.70 |

| Telecoin | $0.02272 | 28.58 |

| Polkdadot | $41.91 | 23.43 |

| Bitcoin BEP2 | $$61,731.03 | 13.18% |

| Source: CoinMarketCap.com. Biggest gainers within the top 100 by market value |

| Biggest losers | Price | %Weekly Return |

| Arweave | $52.64 | -18.15 |

| Terra | $37.44 | -15.62 |

| Fantom | $1.96 | -15.38 |

| Internet Computer | $43.32 | -14.57 |

| Shiba Inu | $0.00002498 | -13.20 |

| Source: CoinMarketCap.com. Biggest losers within the top 100 by market value |

Bitcoin $100,000 in 2023?

We chatted briefly with Jurrien Timmer, director of global macro at Fidelity Investments in Boston, about the outlook for bitcoin and his recent tweets suggesting that, based on his fundamental analysis, bitcoin was heading for $100,000 by 2023.

Timmer said a combination of network effects, the theory that value is based on the increased usage of a good or service, and stock-to-flow models, which represent a way to value an asset based on supply/demand metrics, are converging in the next two years or so.

“You get a lot of hyperbolic price targets…which aren’t price targets,” Timmer said. “The only number that I am comfortable with has some basis in research,” he told MarketWatch.

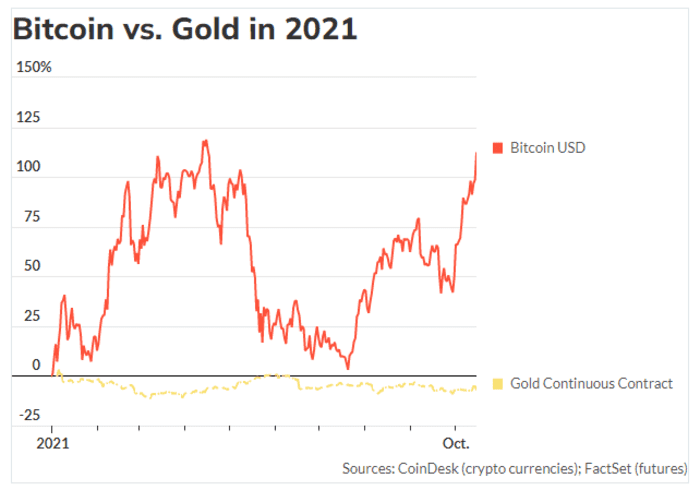

He said that bitcoin offers a unique value proposition and that some investors viewed it as digital gold. In fact, Timmer said that bitcoin may be taking some market share from gold and that allocations to bitcoin are likely some fraction of what is allocated to the precious metal.

Timmer says that bitcoin might fit on the 40% side of the traditional 60:40 “model” portfolios, with 60% representing an allocation to equities and 40%, representing your typical allocation to bonds.

‘Crypto’ banks

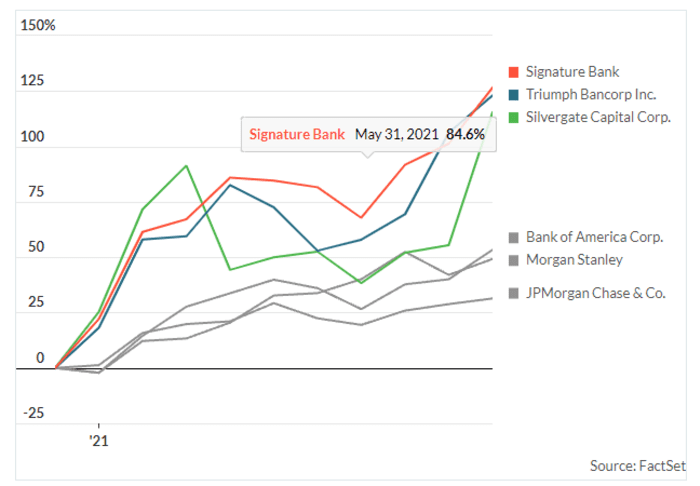

Morgan Stanley analyst, led by Ken Zerbe, published a list of what it described as “crypto banks,” otherwise traditional bricks-and-mortar institutions that “offer crypto-related products or services.

The Morgan Stanley MS,

However, Morgan Stanley says its list reflects institutions that have been “the most proactive in the cryptocurrency ecosystem.”

Morgan Stanley acknowledges that the list may be subjective, noting that it plans on altering the composition of the list over time.

As it stands, it includes Signature Bank SBNY,

Morgan Stanley writes that crypto banks have significantly outperformed some bigger peers.

Many of the midcap crypto names are enjoying triple-digit, year-to-date returns, which handily outperform Bank of America, up 53% YTD, Morgan Stanley, up 49%, and JPMorgan Chase, up over 31% (see attached chart showing some comparative returns thus far in 2021).

Tether, Bitfinex fines

The Commodity Futures Trading Commission settled charges with Tether Holdings Ltd. for misleading customers about the quality of the reserves that back its stablecoin, Tether USDTUSD,

The CFTC said in a press release that Tether misrepresented the stablecoin when it claimed that the token was “100% backed by” fiat currency assets.

“Instead of holding all USDT token reserves in U.S. dollars as represented, Tether relied upon unregulated entities and certain third parties to hold funds comprising the reserves; commingled reserve funds with Bitfinex’s operational and customer funds; and held reserves in non-fiat financial products,” the CFTC said.

Tether’s stablecoin, which carries the same name, is a popular asset in crypto because its price is intended to be “stable” and pegged to a fiat asset like the U.S. dollar. Tether is seen as a way for investors to stay in crypto without the volatility associated with bitcoin and Ether.

Tether’s CFTC settlement comes about eight months after the New York attorney general’s office completed a two-year probe into Tether and Bitfinex. That office also concluded that the companies made several public misrepresentations, regarding the dollar reserves backing for Tether in 2017 and a situation in 2018 when Bitfinex lost access to about $850 million of its customers’ funds that it had placed with an outside company.

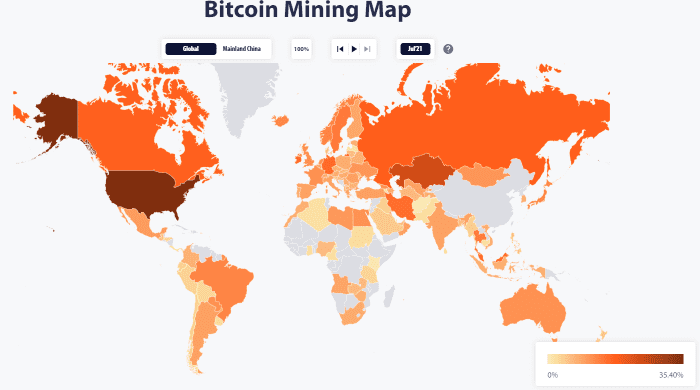

Mining U.S.A.

Earlier this week, the Washington Post reported that the U.S. overtook China to lead the world with the largest share in global bitcoin mining networks, citing data from the University of Cambridge.

The move comes after China in the summer cracked down on mining and trading in crypto, sparking a mass exodus out of Beijing.

A crypto sheriff?

Coinbase Global Inc. COIN,

“There should be one federal regulator designated for digital asset markets,” Faryar Shirzad, chief policy officer at Coinbase told reporters on Thursday.

Crypto companies, funds

In crypto-related company news, shares of Coinbase rallied 7.93% on Friday to $280.61, and climbed 13.1% for the week.

Michael Saylor’s MicroStrategy Inc. MSTR,

Overstock.com Inc. OSTK,

PayPal Holdings Inc. PYPL,

In the fund space, the Bitwise Crypto Industry Innovators ETF BITQ,

New funds, the Invesco Alerian Galaxy Crypto Economy ETF SATO,