Investor who almost doubled the return of her index says these three midcap stocks are ripe for the economic recovery

At this stage of the bull market, there’s been a crowding of money in large-cap stocks, especially growth stocks.

Diversifying into smaller companies might cut risks and put you in a part of the market filled with ripe opportunities at the right time. You can do this with midcap stocks.

Below are three midcap stocks selected by Amy Zhang, who manages the $903 million Alger Mid-Cap Focus Fund AFOIX,

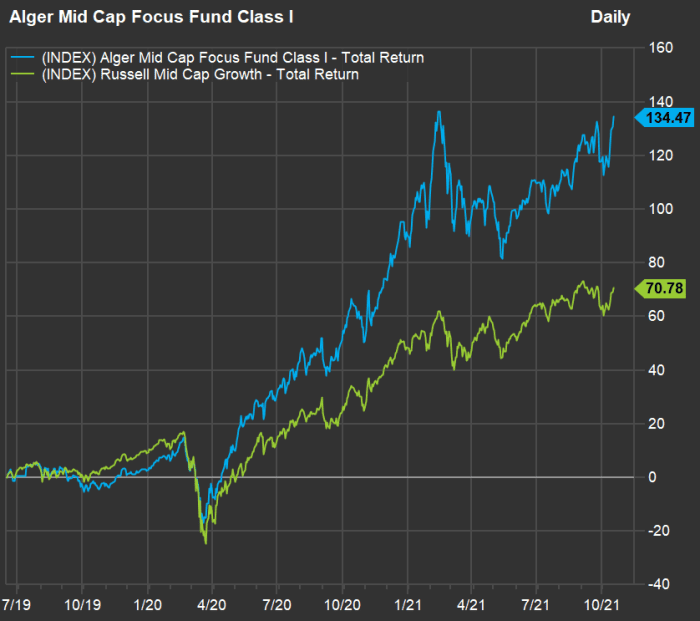

Here’s a comparison of total returns for the Alger Mid-Cap Focus Fund’s Class I shares and the Russell Mid-Cap Growth Index RMCCG,

The Alger Mid-Cap Focus Fund generally holds about 50 stocks. Zhang also manages the Alger Mid-Cap 40 ETF FRTY,

Read: Why U.S. midcap stocks may shine in the year ahead, according to Citi

During an interview, Zhang called midcaps “the best of both worlds,” because there are good values to be found off the beaten path, and because there are also growth plays.

In the small-cap focus fund, Zhang’s selections tend to be healthcare or technical companies because those sectors feature so much innovation. But small caps also require heavy research — many companies are expected to be unprofitable for years. Risks are high if a company is only offering one product or service.

When selecting midcap stocks, Zhang follows the same strategy of investing in “positive dynamic change” as she does for small caps. But, she said, for the midcaps “we have the growth case and others participating in the [economic] recovery.”

Midcaps tend to have higher financial quality and more diversified revenue streams than small caps. Therefore, Zhang might pick a stock in any industry, she explained. She also said the Alger Mid-Cap Focus Fund isn’t locked into any sector allocation, as the firm’s strategy “is really about stock selection.”

At the end of September, the fund was “overweight in financials and industrials,” compared to its benchmark index, she said.

“In times like this year, when the market is so macro-driven, while we are still focused on high-quality growth companies in midcap, we [have had] more exposure to cyclicals,” she said, adding that the economic environment has led to better performance for midcaps in 2021 than it has for small caps.

Three midcap stocks

Zhang highlighted three of the Alger Mid-Cap Focus Fund’s largest holdings. Here they are, with consensus revenue estimates for calendar years through 2023, along with expected two-year compound annual growth rates (CAGR) for revenue (in millions of dollars) and forward price-to-earnings (P/E) ratios:

| Company | Estimated revenue – 2021 | Estimated revenue – 2022 | Estimated revenue – 2023 | Estimated revenue CAGR | Forward P/E |

| Upstart Holdings Inc. UPST, |

$756 | $1,079 | $1,376 | 34.9% | 320.7 |

| Signature Bank SBNY, |

$1,969 | $2,349 | $2,804 | 19.3% | 19.3 |

| Herc Holdings Inc. HRI, |

$2,087 | $2,447 | $2,831 | 16.5% | 21.1 |

| Source: FactSet | |||||

These are high expected CAGR for revenue. In comparison, the aggregate two-year CAGR for sales are expected to be only 2.5% for the S&P S&P Small-Cap 600 SML,

Upstart Holdings

Upstart Holdings Inc. UPST,

“Over time, we really think they will be the one-stop shop, potentially entering cards, mortgages, point-of-sale loans,” and home equity loans, Zhang said. She likes the setup — a company with a small market share in the giant U.S. credit market.

The company went public in December 2020. This is an early-stage play, with small-cap-like characteristics, including that very high forward P/E. But the high P/E isn’t meaningful at such an early stage, when a rapidly growing company focuses on growth in lieu of showing a profit.

Wall Street analysts expect the company’s rapid growth to continue, as you can see on the table, above, and Zhang expects profit margins to improve “as they scale.”

Signature Bank

Signature Bank SBNY,

Zhang believes “there is room for multiple expansion,” because the stock’s forward P/E ratio is in line with slow-growing midcap banks.

She is especially impressed with Signature Bank’s Signet digital-payments platform, which allows real-time payments between commercial customers at all times. Signet makes use of blockchain technology. The real-time aspect of the service is more significant than you might think — bank transaction processing has traditionally been an overnight business, as mainframe computers process billions of transactions in batches outside business hours.

Zhang said Signet illustrates the bank’s “optionality in crypto” as bitcoin and other digital currencies are more widely adopted.

Herc Holdings

Herc Holdings Inc. HRI,

Herc has two larger U.S. competitors: United Rentals Inc URI,

She expects Herc’s margins to improve and cause a “re-rating” of the company by investors, which mean an expansion of the P/E multiple.

The prospects of an infrastructure bill passed by Congress and signed by President Biden would provide a tailwind to the company, Zhang said. Aside from the political developments, “we all know the supply-chain issue that has held up projections this year. Herc is a solution for that,” she added.

A discounted group of stocks

Large-cap stocks get most of the coverage in the financial media — rightly so, considering how rapidly and consistently the leaders of the technology world have grown. Broad index funds are excellent low-cost investments, but if you are in one, it might surprise you how much of your money is concentrated in a small number of stocks.

For the best example, the SPDR S&P 500 ETF Trust SPY,

The S&P 500 Index SPX,

In addition to Zhang’s arguments about the “best of both worlds” in the midcap space, it might surprise you that price-to-earnings valuations haven’t increased anywhere near as much for midcaps (or small caps) as they have for large-cap stocks.

And the same can be said about small caps.

Timothy Skiendzielewski, who manages the Aberdeen U.S. Small Cap Equity Fund GSCIX,

Using data compiled by FactSet, here’s a comparison of current weighted forward price-to-earnings ratios for the three broad S&P indexes, showing that the midcaps and small caps aren’t trading at much higher valuations than usual, and that their current discounts to the valuation of the S&P 500 are much larger than usual, based on long-term averages:

| Forward P/E ratios | ||||||

| Index | Current | 3-year average | 5-year average | 10-year average | 15-year average | 20-year average |

| S&P Small Cap 600 | 15.50 | 16.43 | 17.14 | 16.84 | 16.42 | 16.78 |

| S&P 400 Mid Cap | 18.97 | 18.78 | 19.07 | 18.07 | 16.99 | 17.04 |

| S&P 500 | 24.96 | 22.43 | 21.64 | 18.90 | 17.41 | 17.80 |

| Percent of S&P 500’s forward P/E valuation | ||||||

| Current | 3-year average | 5-year average | 10-year average | 15-year average | 20-year average | |

| S&P Small Cap 600 | 62% | 73% | 79% | 89% | 94% | 94% |

| S&P 400 Mid Cap | 76% | 84% | 88% | 96% | 98% | 96% |

Don’t miss: 5 quality energy stocks with high dividend yields propelled by soaring oil prices