Iron ore price retreats on steel output curbs

On China’s Dalian Commodity Exchange, the most-traded January contract ended daytime trading 0.2% lower at 769.50 yuan ($119.26) a tonne. It rose as much as 4.3% earlier in the session.

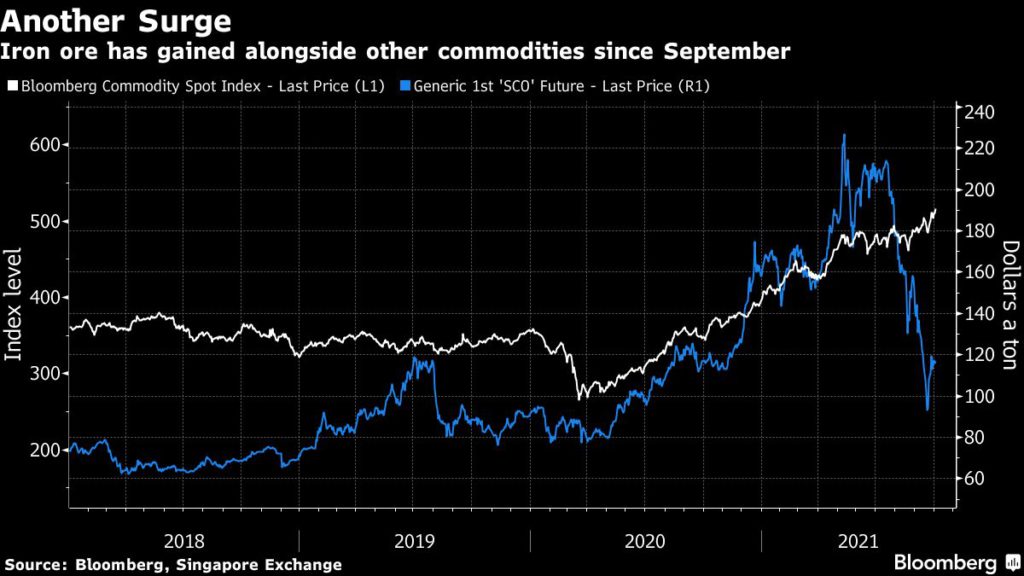

Futures have climbed 50% in just three weeks, joining gains in aluminum to energy as rising demand, stalled supply lines and climate policy send an index of raw materials to the highest ever.

“China’s plans to have a flat steel production growth this year look possible, as output curbs have been accelerated by power shortfalls,” said ANZ senior commodity strategist Daniel Hynes.

Steel output in China, the world’s biggest producer of the construction and manufacturing material, will have to contract 10% in annual terms between September and December, to stay in line with its decarbonisation goals, Hynes said.

China’s crude steel output from January-August grew 5.3% from a year earlier, despite production controls intensifying, beginning July.

“Steel output is reportedly set to increase in October in some parts of China, like Tangshan, Jiangsu, Zhejiang and Anhui, after these regions exceeded steel production cuts in September,” Vivek Dhar, commodities analyst at Commonwealth Bank of Australia, wrote in a note.

“The impacted mills may see November output either match or exceed October levels.”

Tighter steel output curbs could be expected in early 2022, with China likely to keep air quality as clean as possible for the Winter Olympics in February, analysts said.

Related read: Iron ore price rout hacks $160 billion off top mining stocks

(With files from Reuters and Bloomberg)