Plug Power stock jumps toward a 6th straight gain ahead of much-awaited annual symposium

Shares of Plug Power charged higher Tuesday, putting them on track for a sixth straight gain, ahead of the hydrogen and fuel cell systems company’s much-anticipated annual symposium later this week.

Analyst Christopher Souther at B. Riley said he believes the symposium, to be held virtually on Oct. 14, will be key for gauging the company’s long-term potential.

“In our view, management is likely to increase its 2021 guidance and 2024 targets given the strength in material handling and the additional adjacent market opportunities, which should boast robust growth rates through the decade,” Souther wrote in a note to clients. “In addition to the potential near- and mid-term guidance raises, we expect management to provide insight into its goals for 2025+, which should drive positive investor sentiment given [Plug Power’s] opportunity set.”

He reiterated the buy rating he’s had on the stock since June 2020 and kept his stock price target at $45, which implied about 52% upside from current levels.

The stock PLUG,

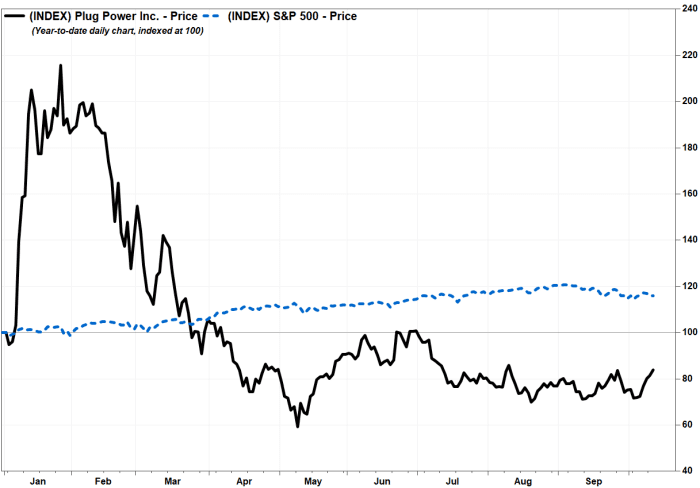

While the stock has now run up 47.1% off its 2021 closing low of $20.07 on May 10, it was still down 59.6% from its 16-year high of $73.18 on Jan. 26.

In August, during Plug’s conference call following the company’s second-quarter earnings report, Plug Chief Executive Andrew Marsh raised the 2021 gross billings guidance to $500 million, up from previous guidance of $475 million provided in February, and 48% above 2020’s $337 million.

B. Riley’s Souther said he believes the company is “ahead of schedule” on its full-year gross billings target, making another guidance raise possible.

“Core material handling should represent 90% of the $500 million target, and accelerating electrolyzer and stationary demand could drive the total higher,” Souther wrote.

He said that Amazon.com Inc. AMZN,

Souther also expects Plug to provide at the symposium a breakdown of annual targets by end market and geography, which should help improve visibility into the company’s long-term outlook.

Regarding green hydrogen, the company is likely to give investors more color on production facilities and policy impacts, Souther said. After Congress proposed last month a production tax credit of up to $3 per kilogram for green hydrogen, he expects Plug to detail how such legislation could impact its goals.

Plug’s stock has dropped 12.9% year to date, while shares of competitors Ballard Power Systems Inc. BLDP,