Nobody wants to run out of money in retirement.

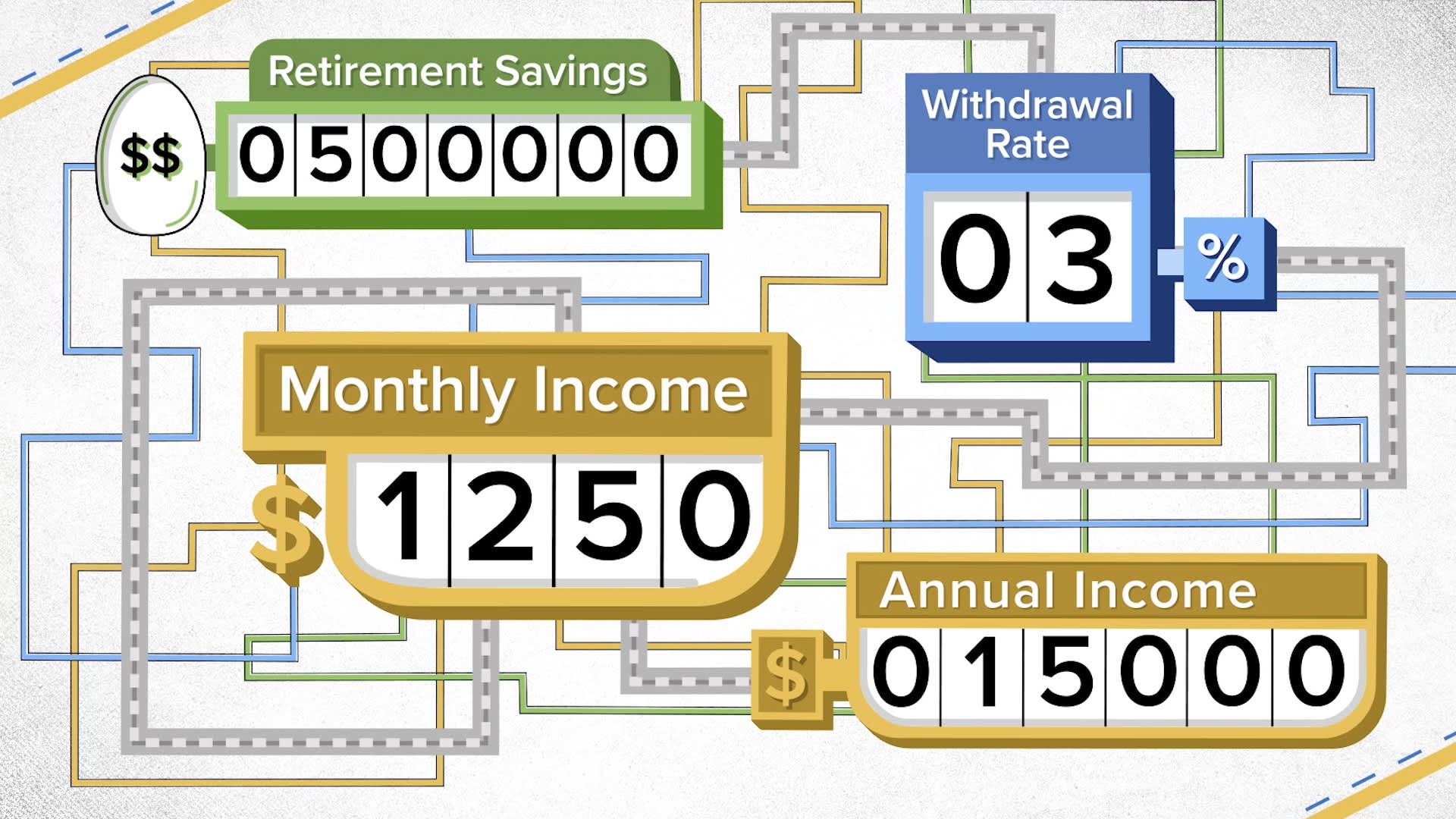

Experts recommend taking up to 4% of your total nest egg annually in retirement as a way to make your funds last.

That percentage can drop a few points based on factors like not owning your home or having high health-care costs. So talk to a professional before making any plans.

Check out this video to see a few different case studies of how much spending money you’ll have if you retire on $500,000.

More from Invest in You:

‘Predictably Irrational’ author says this is what investors should do during pandemic

Coronavirus forced this couple into a 27-day quarantine on their honeymoon cruise

How to prepare for a family member with COVID-19

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.