These 8 money-losing stocks could bring you big gains come January

Tax-loss selling will disrupt stock markets between now and the end of the year — and shrewd buyers can profit from the chaos.

The cause of this turmoil is year-end tax-loss selling. This occurs when an investor sells a stock at loss in order to offset capital gains realized earlier in the year and on which capital gains tax would otherwise be due. Such selling needs to be completed before Dec. 31 in order to reduce 2021 taxes.

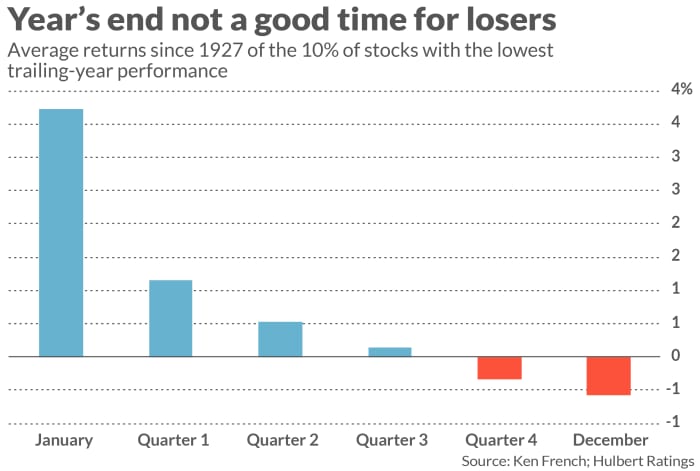

To appreciate the big role that tax-loss selling plays as the new year approaches, consider the performance of a hypothetical portfolio containing the 10% of U.S. stocks with the lowest trailing-12 month returns, rebalanced monthly. The stocks in this portfolio should be the ones most susceptible to tax-loss selling.

Since 1927, according to data from Dartmouth professor Ken French, this “losers” portfolio does progressively worse as the end of the year approaches, as the chart below indicates.

The investment implication of this pattern depends on your time horizon. If you’re not a short-term trader, then the takeaway is that you should prepare for extra market volatility over the next two months. Resist the inclination to dump a stock because of artificial selling pressure having nothing to do with its fundamentals.

For traders and short-term investors, there’s a separate investment implication — profit from others’ tax-loss selling. As the chart also shows, the stocks most punished by this selling tend to bounce back sharply in January. That makes sense, because tax-loss selling ends on Dec. 31; in January a huge weight is lifted off these already-beleaguered stocks, and many perform strongly.

With that in mind, I constructed a list of stocks with attractive longer-term prospects that are also losers for the year through Oct. 22. There’s a good chance that tax-loss selling will significantly depress their returns between now and the end of the year, enabling traders to pick up a few of them at bargain prices.

You might consider placing buy limits well-below the current market on a basket of them, in hopes that a couple of them get filled. If history is any guide, these stocks stand a good chance of rebounding significantly in January.

To construct the table below, I started with a list of stocks in the S&P 1500 index that were losers through the close of trading on Oct. 22. I narrowed the list further to include only those that are currently recommended by two or more of the top-performing investment newsletters that my auditing firm monitors.

| Stock | YTD % | # Newsletters recommending |

| Bristol-Myers Squibb Company BMY, |

-5.0% | 2 |

| Cardinal Health, Inc. CAH, |

-5.0% | 4 |

| Walt Disney Company DIS, |

-6.5% | 3 |

| Amgen Inc. AMGN, |

-7.0% | 2 |

| FedEx Corporation FDX, |

-9.6% | 4 |

| PetMed Express, Inc. PETS, |

-13.2% | 2 |

| Activision Blizzard, Inc. ATVI, |

-14.2% | 2 |

| Viatris, Inc. VTRS, |

-24.5% | 2 |

YTD return as of 10/22/21

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: These are the 2 main reasons you should consider adding semiconductor stocks to your portfolio now