Watch out: These estate tax moves could be banned within days

If you’ve got an estate worth more than $6 million—or $12 million if you’re married—and you’re working out how to minimize taxes when you die, then you should run, not walk, to a lawyer to put your plan in motion.

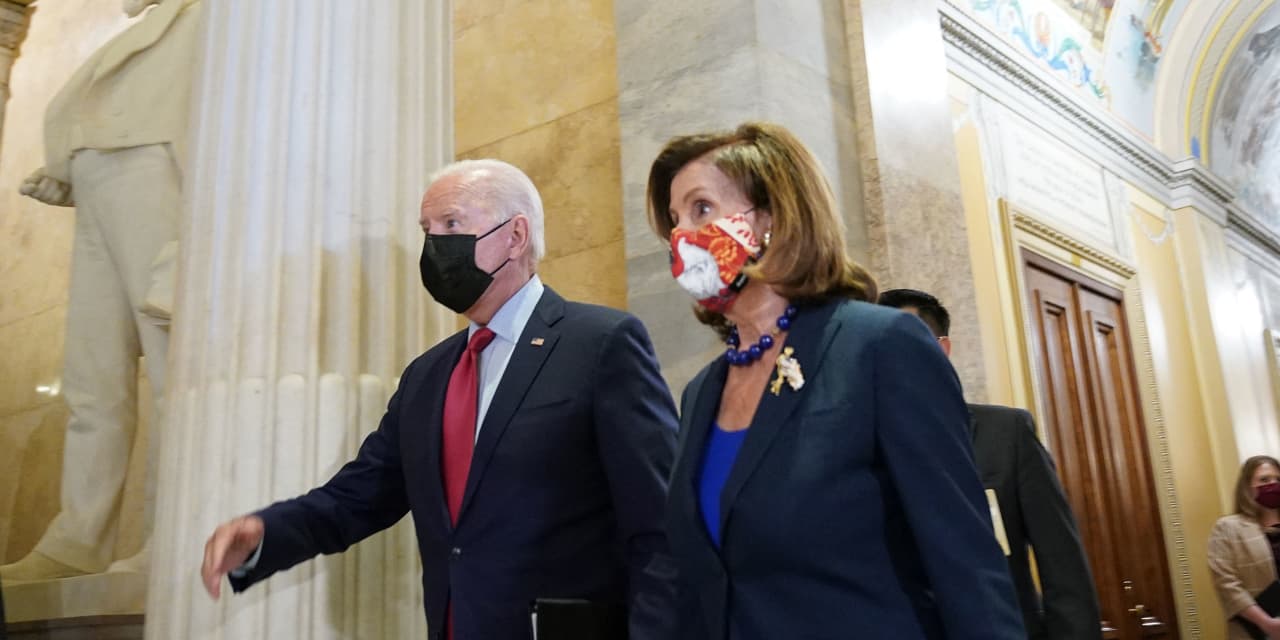

Not only is the tax bill on Capitol Hill planning to close various “loopholes” and limit exemptions, but in some cases those loopholes will close, not at the end of the year, but the moment President Joe Biden signs the bill into law.

In those cases, any tax planning moves must be signed, sealed and delivered before the president signs. If not, your heirs could end up paying millions in extra taxes.

As some of these clever maneuvers can take at least two weeks just to set up, the time to make a move is now.

The proposals on Capitol Hill plan to lower the total estate tax exemption from $11.7 million to $6 million (or from $23.4 million to $12 million if you’re married). They also plan to end, or restrict, various other maneuvers that would help your assets limbo dance under the bar.

Many of these involve trusts, which are used both to simplify estates after death and to avoid taxes. Tax proposals won’t end the use of trusts—far from it—but they do plan to crack down on some of the cleverest wrinkles.

“Anything that involves a trust has probably been hit the hardest” by the proposals, says tax lawyer Jamie Hargrove, CEO of Netlaw.com.

One, for example, is something known as an “intentionally defective grantor trust.”

Robert Morris, a partner at the law firm Pullman & Comley, explains how it works: “Mom and Dad create a trust for the benefit of their children or grandchildren and fund it with $x million, and over the remainder of Mom and Dad’s lifetime, Mom and Dad pay income tax on the earnings,” he says. If the trust was created correctly, those income tax payments are not treated as a taxable gift.

That amounts to an extra benefit for the heirs. (In addition to other benefits from using a trust, such as excluding future asset appreciation from estate tax.)

Other maneuvers that might get rolled back or ended include the clever use of minority stakes to lower the taxable value of your estate. If you have a family business worth $100 million, and you give 49% to your heirs today but hang on to the other 51%, your gift will be valued at far less than $49 million for federal estate and gift tax purposes because it comes without control.

There are ways of combining multiple maneuvers, tax experts add. For example if you want to give a small family business to your heirs, the most efficient way may involve giving a minority 10% stake to a trust, and then sell the other 90% in return for an IOU. The possibilities are extensive. Right now you can even use some of these tricks to reduce the estate value of a stock portfolio, and not just a small business.

Even more confusingly, there are currently ways of getting your business out of your estate while retaining operational control, says Hargrove. “For most of our clients, control is everything,” he says.

As ever with the minefield of the U.S. tax code, trying to get through it on your own is nothing but bad news.

Congressional Democrats and the Biden administration are trying to crack down on tax avoidance tricks by the very rich. Where you define “the very rich,” or even “the rich,” remains as ever the subject of debate.

Time may be quickly running out for estate owners, though.

“We’ve got a little bit of time to make gifts and take advantage of some of the discounting you can on minority interests, at least for some assets,” says Morris. In theory, he says, he could probably do all the paperwork to set up some of the things in a single day, if the client was sitting in his office all day, had all their paperwork to hand and could answer questions as he went. In practice, he says, it takes about two weeks, soup to nuts, to get it done.

How soon will a tax bill get passed by Congress and signed into law? Nobody knows. But there are no penalties for being too early. There could be hefty ones for being too late.