The world’s largest miner is also predicting that demand for nickel, another highly-needed battery metal, will quadruple by 2050. “And all this will have to be done as sustainably as possible,” Pant added.

Her vision echoes those of most experts, from consultants such as Wood Mackenzie, ING Economics and BloombergNEF, to industry actors including top miners and electric vehicles makers lead by Tesla and Volkswagen.

Copper has long been a common component in most electrical wiring, power generation, transmission, distribution, and circuitry because of its high conductivity and durability.

New energy technologies, however, require even more copper and nickel. Output of both elements would have to rise exponentially in the next three decades to meet demand from renewable power generation, battery storage, electric vehicles, charging stations and related grid infrastructure, BHP estimates.

Boosting portfolio

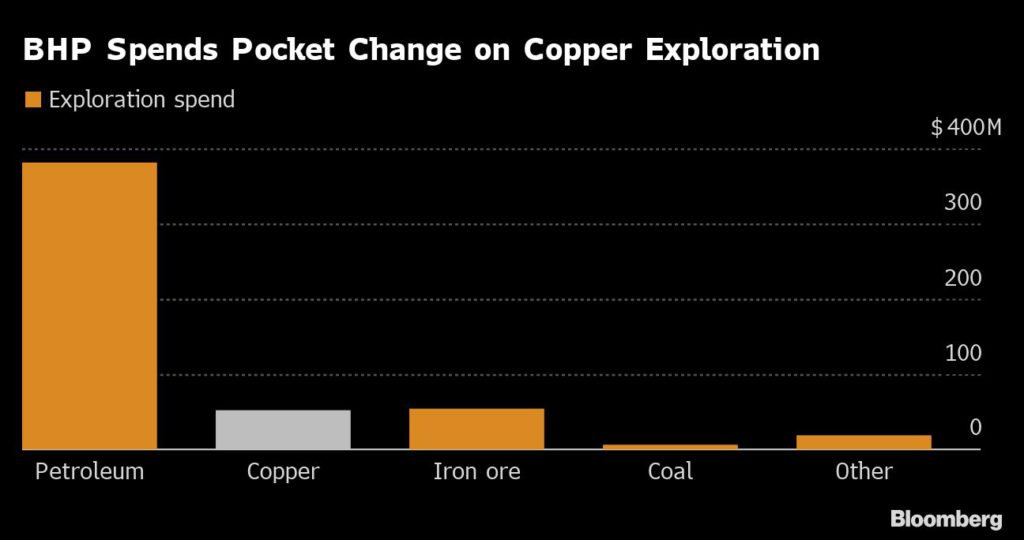

Since Canadian Mike Henry took the top post at the company last year, the group has adopted an aggressive strategy to expand its footprint among what it calls “future-facing” commodities — copper, nickel and copper.

The miner is currently involved in talks with Australian billionaire Andrew Forrest’s Wyloo Metals concerning BHP’s imminent takeover of Noront Resources (TSX-V: NOT).

The two miners were in a bidding war over the Canadian miner, which owns the early-stage Eagle’s Nest nickel and copper deposit in the ‘Ring of Fire’ in northern Ontario.

The asset is believed to be the largest high-grade nickel discovery in Canada since the Voisey’s Bay nickel find in the eastern province of Newfoundland and Labrador.

BHP is also proceeding with the development of the Jansen potash project, in Canada, has merged its oil and gas assets with Australia’s Woodside Petroleum (ASX: WPL), and has sold a big portion of its coal business.

(With files from Reuters)