Big Short’s Michael Burry Closes Bets Against Ark, Tesla and Treasuries

(Bloomberg) — Michael Burry may have ditched some of his biggest shorts — at least for now.

Most Read from Bloomberg

Scion Asset Management, which Burry founded and runs as chief executive officer, had cut back to only a handful of positions as of the end of September, according to a regulatory filing made on Monday.

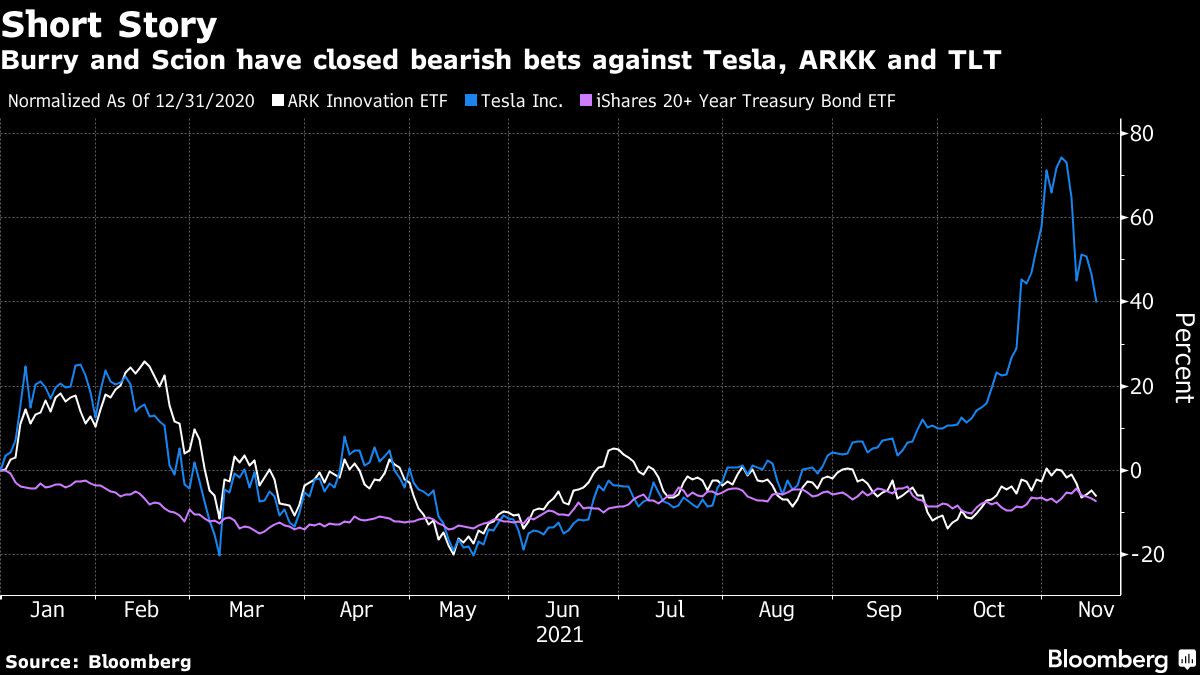

Among trades that the firm closed in the third quarter were bets against Cathie Wood’s flagship ARK Innovation ETF, Elon Musk’s Tesla Inc. and the biggest Treasuries exchange-traded fund, the iShares 20+ Year Treasury Bond ETF.

Burry could still be betting against them using OTC options, which don’t show up in such filings.

It’s unclear how successful the wagers were, because full details of the bearish put options used by the firm were never released. Burry told CNBC last month that he had closed his Tesla wager and that the position was just a trade.

An email to Scion seeking comment wasn’t immediately answered on Monday.

Bubble Warning

Burry rose to fame when his successful bets against mortgage securities during the financial crisis were featured in “The Big Short,” the movie version of Michael Lewis’s best-selling book. Christian Bale portrayed Burry.

At the end of June, Scion had bearish bets on about 235,000 shares of Wood’s main ETF (ticker ARKK), around 1.9 million shares of the Treasury ETF (TLT), and more than 1 million Tesla shares, a September filing showed.

ARKK dropped more than 15% in the third quarter, while TLT was little changed and Tesla rallied 14%.

After his wagers against Ark came to light, Wood responded by saying she didn’t think he understood the fundamentals behind her investments.

The infamously bearish Burry has been even more vocal than usual on Twitter lately, weighing in on Tesla CEO Musk’s share sales and warning of what he sees as an ongoing bubble in financial markets.

Among the positions Scion did report, a 200,000-share holding of CVS Health Corp. was its biggest. The firm also declared a reduced stake in CoreCivic Inc., shares in Geo Group Inc. and new positions in Lockheed Martin Corp., Now Inc. and Scynexis Inc.

Monday’s filing is a quarterly requirement of hedge funds with more than $100 million in U.S. equities.

(Updates with context and details on Ark short, bubble fears.)

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.