Cobalt prices supported in 2021, expected to fall in 2022 – report

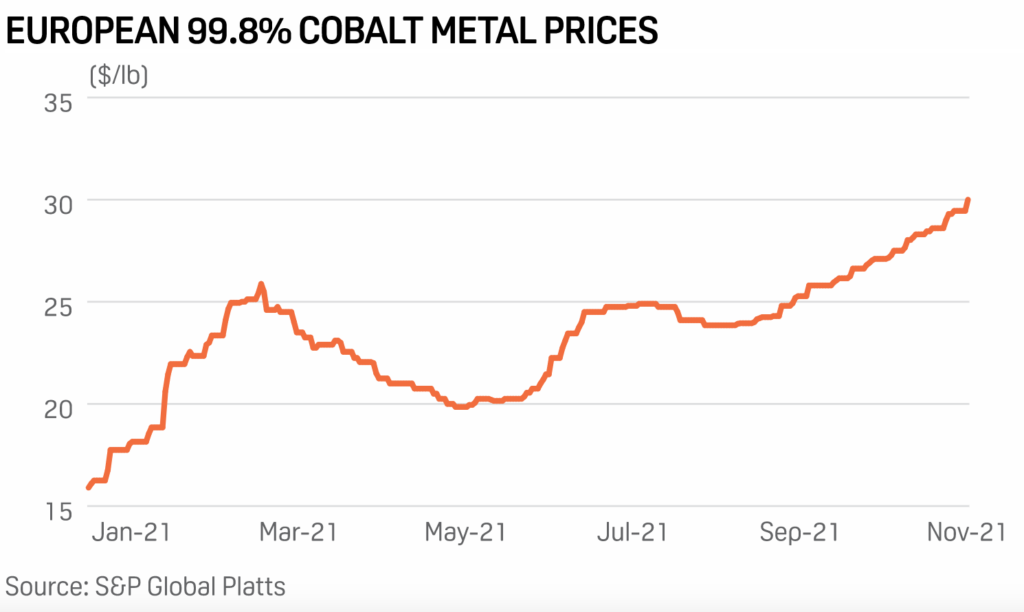

According to S&P Global Platts assessments, European 99.8% cobalt metal prices have risen 88.7% since the start of 2021 to $30/lb IW Europe Nov. 24, the highest level since December 2018.

Yu, however, sees prices falling 8.3% in 2022 on supply growth and the easing of most supply chain bottlenecks.

Total cobalt supply is forecast to total 196,000 mt in 2022, up from 136,000 mt in 2020 and an estimated 164,000 mt in 2021.

On the demand side, S&P MI estimated that cobalt demand would continue growing as higher plug-in electric vehicle sales offset the impact of cobalt thrifting in batteries.

The forecast shows total cobalt demand to rise to 195,000 mt in 2022, up from 132,000 mt in 2020 and an estimated 170,000 mt in 2021.

But since supply will also be climbing, the overall cobalt market balance is expected to return to a surplus of 1,000 mt in 2022, after moving into an estimated deficit of 8,000 mt in 2021 from a surplus of 4,000 mt in 2020.

“A stronger supply ramp-up through to 2024 will sustain a market surplus during the period, pressuring prices,” Yu said.

In her view, the overall cobalt demand was benefiting from a broader-based recovery in 2021 in the metallurgical sector and PEVs, with the aerospace sector seeing increased deliveries — Airbus and Boeing up 51.5% year on year — in the first nine months of 2021, although these were still down 23.8% compared with pre-pandemic levels in the same period of 2019.