Doubting that we could be in a stock-market bubble? Here’s the chart you need to see.

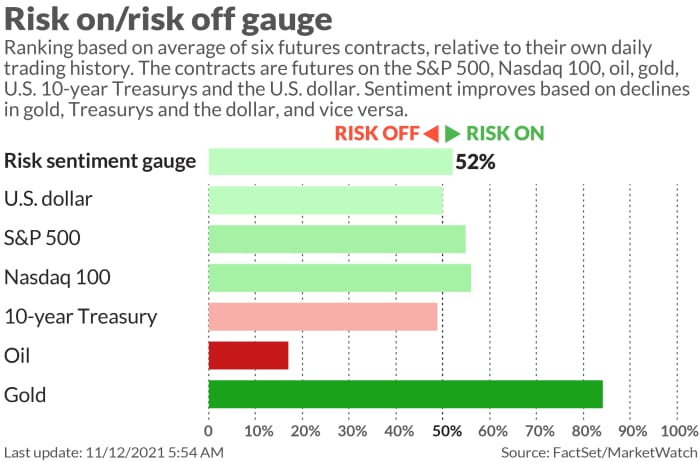

A shocking week on the inflation front has left a dent in stocks, with major indexes set to deliver 1%-plus losses across the board. That’s even as some Wall Street strategists see little blocking further stock gains or that frequent year-end melt-up.

Yet the worry festers, such as for Nicolai Tangen, the manager of Norways’ $1.4 trillion sovereign-wealth fund, the biggest money pot in the world.

“We’re looking at the degree of euphoria. With markets really panicky last year, we have entered a very euphoric phase, and we just need to consistently gauge the levels of euphoria,” Tangen said in a recent interview with Devin Banerjee, editor at large, business and finance for LinkedIn.

“And then, of course, the real threat is inflation. If inflation really takes off, that’s going to be bad news both for our bond portfolio and for the equity portfolio. So, that’s where we have the laser focus,” added Tangen.

It’s a reminder that what some see as heady times for stocks aren’t going unnoticed.

That brings us to our call of the day from Michael O’Rourke, chief market strategist at JonesTrading, who falls into that camp with his latest note entitled “In case there are bubble doubts.”

He writes: “Since the U.S. financial markets have achieved new levels of insanity, we want to make sure we document this moment in time for posterity’s sake. Apparently, we have not learned anything from the Equity, Housing and Credit bubbles that occurred between 1999 and 2008.

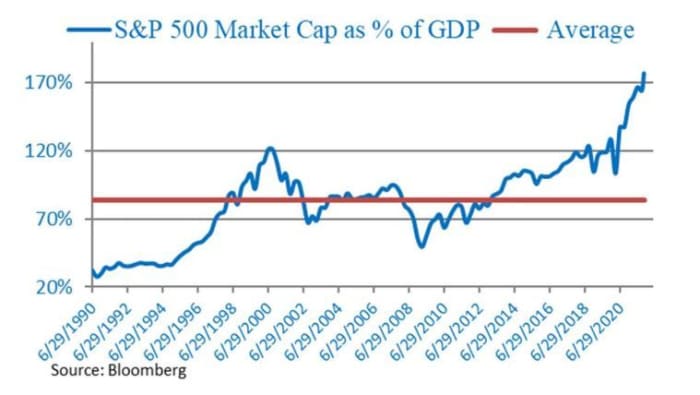

“It can’t be any clearer than the fact that the S&P 500’s market capitalization is 177% of U.S. GDP,” adds O’Rourke, who provides this chart:

During the 2000 tech bubble, the S&P 500’s market capitalization peaked at 121% of nominal gross domestic product, he says.

“That should paint a stark picture as to how expensive today’s market is relative to the last generational equity bubble,” says O’Rourke, who adds that the current level is also double the average reading of the past three decades and triple the valuation where the S&P 500 bottomed during the 2008-09 financial crisis.

“Even with the greater inflationary bump to Nominal GDP, it would need to grow at 8% for a decade to return to the historic market cap to GDP average,” he says.

“The $3 trillion in crypto (whose only purpose appears to be speculation) is a

clear illustration of an environment that knows no fear. Nonetheless, we are

among the few who fear a 50% S&P 500 valuation drop that would bring the

index’s market capitalization back in line with its average historic relationship

to GDP,” he says.

O’Rourke reminds of us a “painful” 80% decline for the Nasdaq Composite between March 2000 and October 2002. “Just think, the broad tape is 50% more expensive today than March 2000,” he says.

Back then, Amazon AMZN,

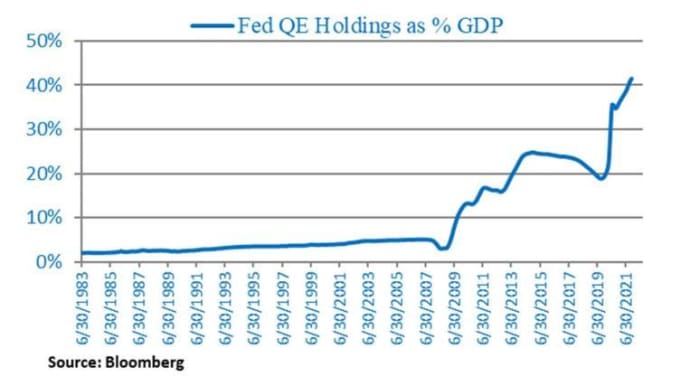

The strategist goes on to point the finger at the Federal Reserve and other central banks for propping up markets. “Today, the world is no better than the one two decades ago, and it is arguably worse. It is simply that these extra trillions of dollars having entered the economy in a short period of time provide the pretense of a special time meriting unsustainable valuations,” he says.

Also read: ‘Risks of a market bubble are growing,’ warns Morgan Stanley

The buzz

Johnson & Johnson JNJ,

Lordstown Motors RIDE,

Rivian Automotive RIVN,

AMC Entertainment’s CEO Adam Aron tweeted that as promised, the movie-theater chain is now accepting bitcoin and other cryptocurrencies, and Dogecoin DOGEUSD,

The September Jobs Openings and Labor Turnover Survey (known as Jolts) is due after the market open, alongside the November University of Michigan consumer sentiment index.

Austria’s worst COVID-19-affected region will put millions of unvaccinated people under lockdown starting next week, as much of Europe battles another wave of infections.

President Joe Biden and Chinese President Xi Jinping will reportedly hold a virtual summit on Monday.

The markets

Stock futures ES00,

The Russian ruble USDRUB,

The chart

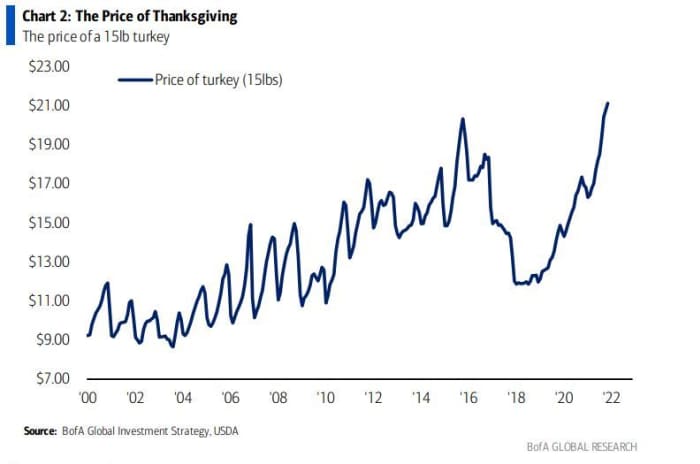

Ouch. Our chart of the day from Bank of America’s weekly Flow Show report puts inflation in perspective with the estimated cost of a turkey (gulp) this Thanksgiving.

Random reads

3,000 miles later, a rare penguin ends up in New Zealand.

The real Venom? A deadly spider with fangs long enough to bite through a human fingernail is going to help save lives.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.