Expensify prices IPO at $27 a share, valuing software company at $2.18 billion

The valuation has been corrected to reflect a fully diluted share count.

Cloud-software maker Expensify Inc. priced its initial public offering at $27 a share Tuesday night, at the top of its range, valuing the company at about $2.6 billion on a fully diluted basis.

On Monday, Expensify raised its expected price range to between $25 and $27 a share, up from its original $23-to-$25 range. The company is offering 2.6 million shares, raising $70.2 million.

Expensify generated $65 million in revenue during the first half of 2021, up from $40.6 million in the first six months of 2020. The company also generated $14.7 million in net income during the first six months of the year, up from $3.5 million in the first six months of 2020.

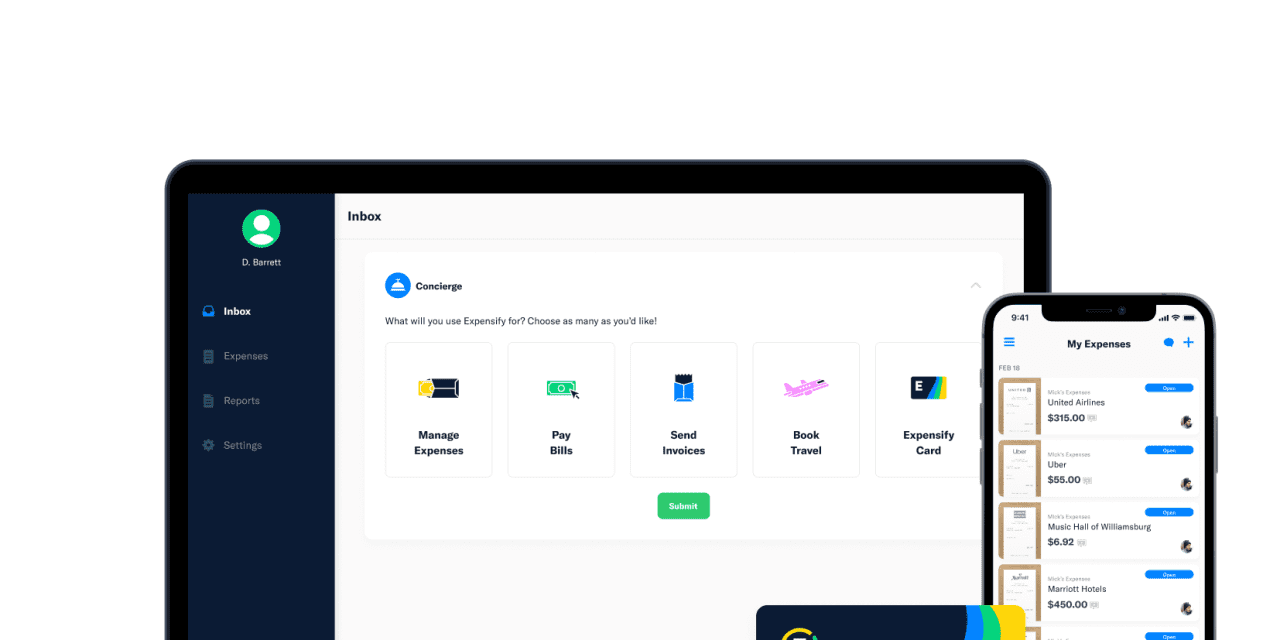

The company, which makes a cloud-based expense-management software, is expected to start trading Wednesday on the Nasdaq under the ticker symbol “EXFY.”

JPMorgan, Citigroup and BofA Securities are lead underwriters for the offering.

Emily Bary contributed to this report.