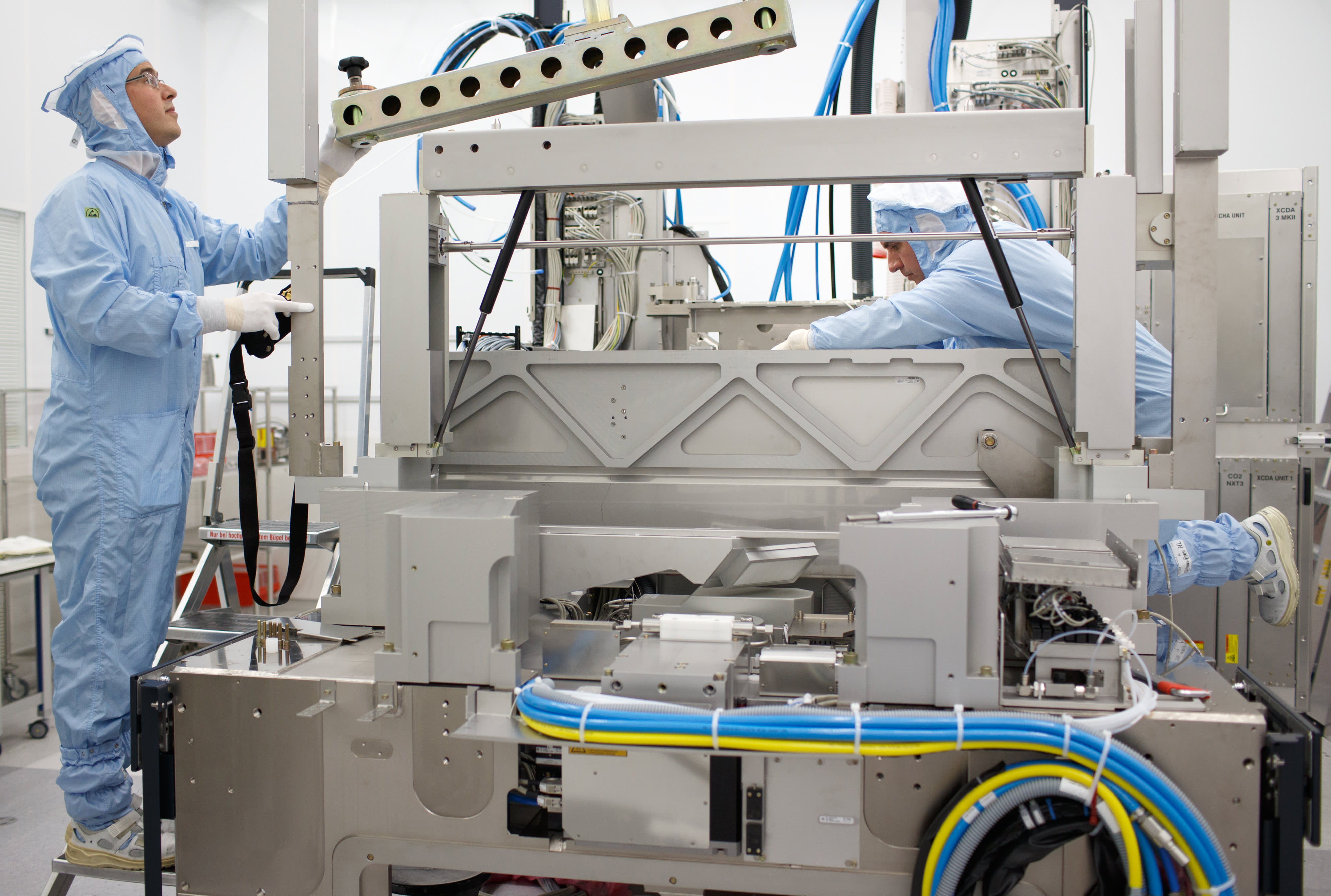

Employees assemble a ASML NXT1970Ci photolithography machine at the ASML Holding NV factory in Veldhoven, Netherlands.

Jasper Juinen | Bloomberg | Getty Images

With a market value of around $350 billion, Dutch-headquartered ASML is a little-known tech juggernaut that’s set to keep on growing in line with the insatiable demand for semiconductors.

The 37-year-old company, which has over 28,000 staff, is the only firm in the world capable of making the highly-complex machines that are needed to manufacture the most advanced chips.

These machines, which cost approximately $140 million each, shine exceptionally narrow beams of light onto silicon wafers that have been treated with “photoresist” chemicals. Intricate patterns are created on the wafer where the light comes into contact with the chemicals, which are carefully laid out beforehand.

This process, which leads to the formation of the all-important transistors, is known as lithography. The machines themselves are called extreme ultraviolet lithography machines, or EUV machines.

ASML sells the relatively rare EUV machines to a handful chipmaking giants including TSMC, Samsung and Intel. Each machine reportedly has over 100,000 components and it takes 40 freight containers or four jumbo jets to ship. Last year, ASML sold just 31 of these enormous pieces of equipment, according to its financials.

The Trump administration even pressured the Dutch government to stop the sale of the machine to Chinese customers, Reuters reported last year. As a result, Chinese chipmakers have been unable to make the most advanced chips. The Biden administration has shown no signs of reversing Trump’s stance.

Chris Miller, an assistant professor at the Fletcher School of Law and Diplomacy at Tufts University, told CNBC that chipmakers want to use the narrowest wavelength of light possible in lithography so that they can fit more transistors onto each piece of silicon.

Transistors are one of the basic building blocks of modern electronics and they enable an electric current to flow around a circuit. Generally speaking, the more transistors you can fit onto a chip, the more powerful and efficient that chip will be.

“The EUV light that ASML’s most advanced tools use has a wavelength of 13.5 nanometers, which lets you carve extraordinarily small shapes on silicon,” said Miller, who is in the process of writing a book about the history of the semiconductor industry.

The TSMC chips in the latest Apple iPhones, which were created with ASML’s EUV machines, have around 10 billion transistors on them, Miller added.

Beyond lithography, there are several other manufacturing processes that must be completed before a chip is ready for shipping. “Ultimately what you’re trying to do is build structures on the silicon using a mix of carving things out and depositing new chemicals onto it,” Miller said.

Mirrors and lasers

Given no one else can make EUV machines that are suitable for mass manufacturing, ASML has a monopoly on the segment and there’s no sign of anyone catching up.

“ASML is absolutely critical to the entire semiconductor ecosystem,” Peter Hanbury, a semiconductor analyst at Bain & Co, told CNBC. “In some ways it’s just as important as TSMC.”

He added: “Every bleeding edge chip, starting at five nanometers, and going forward for likely a very long time, is going to be heavily reliant on ASML equipment.”

Semiconductor analysts believe it would take around a decade and billions of dollars for another company to get to a stage where it could start to compete with ASML.

“ASML has around 4,000 suppliers that they’re aware of and their suppliers have suppliers as well,” said Miller.

Some of the key components in ASML’s EUV machines are particularly difficult to make.

The mirrors, for example, are made by German firm Zeiss in partnership with ASML and they’re the flattest structures humans have ever made.

“These structures themselves are sort of marvels of engineering,” Miller said. Compared to normal mirrors, they’re relatively reflective, which is important because chipmakers don’t want photons to be lost before the beams of light come into contact with their wafers.

The hardest part of the EUV machine to make, however, is the light source, which has come a long way over the years. “Historically, they [chipmakers] just used a light bulb in the 60s and 70s,” Miller said. “Light bulbs don’t emit extreme ultraviolet light and it’s hard to get enough power [or] enough photons emitted.”

The light source in ASML’s EUV machine emits tiny balls of tin, about 30 microns wide, that are blasted twice by the world’s most powerful carbon dioxide lasers. The first blast “gets it ready” and the second, stronger pulse turns it into a plasma which is 400,000 degrees Fahrenheit in temperature, Miller said.

“This plasma of exploded tin, if you will, emits photons of extreme ultraviolet light,” Miller said. “Making this process work took 30 years.”

ASML’s EUV machines are primarily made at a facility in the Netherlands, but there’s also a site in Connecticut where some equipment is made.

“It’s an insane process to ship them,” said Miller. “Then there’s a big learning process to get them up and running because the machines are so complicated. They’re not like an off the shelf, plug it in, turn it on and go. You need to be able to train the staff that are operating them.”

ASML staff are based inside the chip foundries where the machines get deployed, Miller said, adding that they monitor and tweak the EUV machines whenever necessary. “There’s only a couple dozen of these machines in operation worldwide. They’re still learning how they actually work.”

Upcoming sales boom?

Demand for ASML’s EUV machines is soaring as chipmakers attempt to overcome a global crunch.

In September, ASML said it expects a sales boom over the next decade. It believes annual revenue will hit 24-30 billion euros by 2025, with gross margins up to between 54% and 56%. The prediction is significantly higher than the 15-24 billion euro range it had previously forecast.

“We see significant growth opportunities beyond 2025,” the company said, adding that it expects to achieve an annual revenue growth rate of around 11% between 2020 and 2030.

ASML said “global megatrends in the electronic industry” coupled with “a highly profitable and fiercely innovative ecosystem” are expected to continue to fuel growth across the semiconductor market, which is battling the global chip shortage.

It added that growth in semiconductor markets and “increasing lithography intensity” are driving demand for its products and services.

Over the last 12 months, ASML’s share price on Amsterdam’s stock exchange has gone from around 350 euros to 772 euros on Nov. 19. Shares were trading at an all time high on Friday last week.

In October, two tech investors, Ian Hogarth and Nathan Benaich, predicted that ASML will become a $500 billion company by the end of 2022.

“As people look for alpha when investing in this trend of semiconductors being more and more critical to global supply chains, this [ASML] feels like it’s an obvious candidate,” angel investor Ian Hogarth told CNBC.

Miller said there’s plenty of reasons to expect ASML’s sales to grow.

“We’re just in the early stages right now with EUV,” he said, adding that EUV machines have only been used in high-volume manufacturing for a couple of years.

In that time they’ve been used to help create hundreds of millions of chips, but most of ASML’s key customers are really just beginning to roll out EUV in a serious way, according to Miller.

ASML isn’t resting on its laurels either. The company is planning to release a next generation machine called High-NA, which stands for high numerical aperture, around 2025.

“It will allow even more specific etchings on silicon chips,” Miller said, adding that Intel has signed an exclusive (and probably very expensive) deal to get the first High-NA machines.

“Unless you think that our demand for computing power is going to stagnate or decline, which doesn’t seem like a safe bet from my perspective, I think the expectation’s got to be that ASML’s revenue keeps growing,” Miller said.