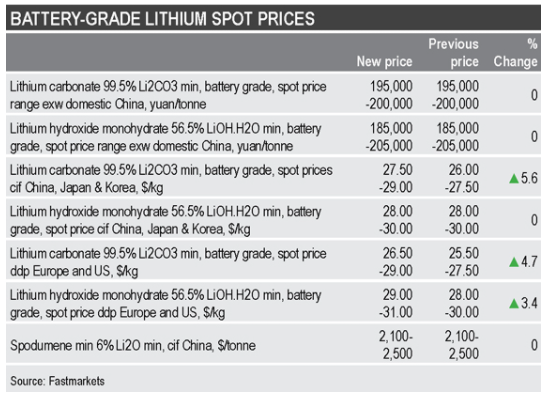

Lithium prices continue to rise on the strength of the Chinese market

“Chinese prices still hold a large premium over regional prices, and it’s more profitable to sell units to the Chinese market. Plus, freight rates are also very high, so prices across the two markets should be at the same level,” a producer source in China told Fastmarkets.

Demand for the materials used in electric cars and renewable-energy storage has soared and, while miners are seeking to boost supply, there’s not enough to meet consumption.

Related Article: Passenger EV sales to jump more than 80% in 2021 — report

“The financing for lithium projects is still too little, too late,” said Cameron Perks, a Melbourne-based analyst at BMI.

“The market deficit is already occurring.”

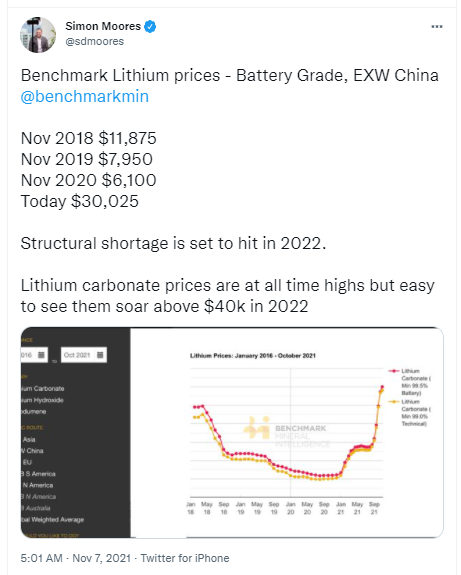

“Structural shortage is set to hit in 2022,” Benchmark Mineral Intelligence CEO Simon Moores tweeted recently.