Real-Rate Reckoning Is Coming for Big Tech, Wells Fargo Warns

(Bloomberg) — Big Tech stocks may be defying the biggest outbreak of bond volatility since April 2020, but a cohort of Wall Street strategists warn that a spike in real interest rates could finally knock them from all-time highs.

Most Read from Bloomberg

With the Federal Reserve likely to announce the paring of pandemic stimulus this week, Wells Fargo Securities is the latest to warn that a “sharp” rise in inflation-adjusted yields is becoming ever-more probable. And that threatens to inflict pain on pricey tech stocks in particular given their tight link with Treasury-market machinations.

“Our trading call on Tech may be at risk, especially across ‘high-octane’ names,” a team led by Christopher Harvey wrote in a Tuesday note.

Hand-wringing on Wall Street over the bond-market threat to tech equities is nothing new. The difference this time is that Treasury gyrations are hitting extremes. Market-derived inflation expectations have risen in recent weeks while nominal yields have yet to move as fast — causing real rates to drop near record lows. That’s juicing tech valuations for now, but a reversal could spark disorderly moves.

“The Fed’s anticipated taper announcement this week may potentially catalyze a significant directional change in real rates,” the Wells Fargo note said. “We believe the eventual real/break-even reversion will be sharp.”

For now, tech stocks are rallying along with seemingly every other equity. The Nasdaq 100, S&P 500, Dow Jones Industrial Average and Russell 2000 all closed at record highs on Tuesday.

When real yields fall to rock bottom, future profits are discounted at lower rates — pushing up valuations of stocks deemed able to grow their earnings for years to come. That’s why low rates have buoyed what quants call growth stocks, epitomized by tech names riding structural trends like Tesla Inc. or Netflix Inc.

All that has helped the Nasdaq 100 to outperform this quarter and Wells Fargo’s own basket of “growth at any price” shares jump 13% toward another record.

While tech has dominated in the low-inflation world of the past decade, its recent rally has taken place against the backdrop of growing anxiety over consumer-price growth. As breakeven rates rose, a Societe Generale SA basket of stocks that gain with the cost of living just posted its best month since February.

Wells Fargo is hardly alone in sounding the alarm on the outlook for Big Tech. The last time the Fed started to withdraw stimulus, real rates began rising sharply just before its balance sheet expanded again. Given how negative those yields are now, “a revaluation may be ahead for long-duration assets like the megacap growth stocks that dominate the major indexes,” Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management warned last week.

Over at UBS Asset Management, strategist Luke Kawa suggests real yields are low despite bets on imminent monetary tightening because traders expect the Fed to reverse course eventually or the economy to tank as a result. At the same time though, he says real rates could also gain to reflect faster growth and inflation. The latter scenario would be good for the pro-cyclical stock exposures but bad for the market’s overall valuations.

“If the world is moving into a world of a sustained higher inflation rate and nominal yields suddenly reflect that, then global equity valuations will be reset to a lower level causing a substantial drawdown in equities,” Peter Garnry, head of equity strategy at Saxo Bank, wrote in a Tuesday note.

To many on Wall Street, tech investing is therefore at the mercy of a macro call. Is the world heading for a period of resilient growth, faster inflation and tighter Fed policy — or will the business cycle buckle under the pressure of supply-chain bottlenecks and reduced stimulus?

That conundrum is everywhere in the bond market. While the shorter-end of the yield curve steepened in anticipation of the Fed move, the longer-end has flattened just as aggressively amid growth fears.

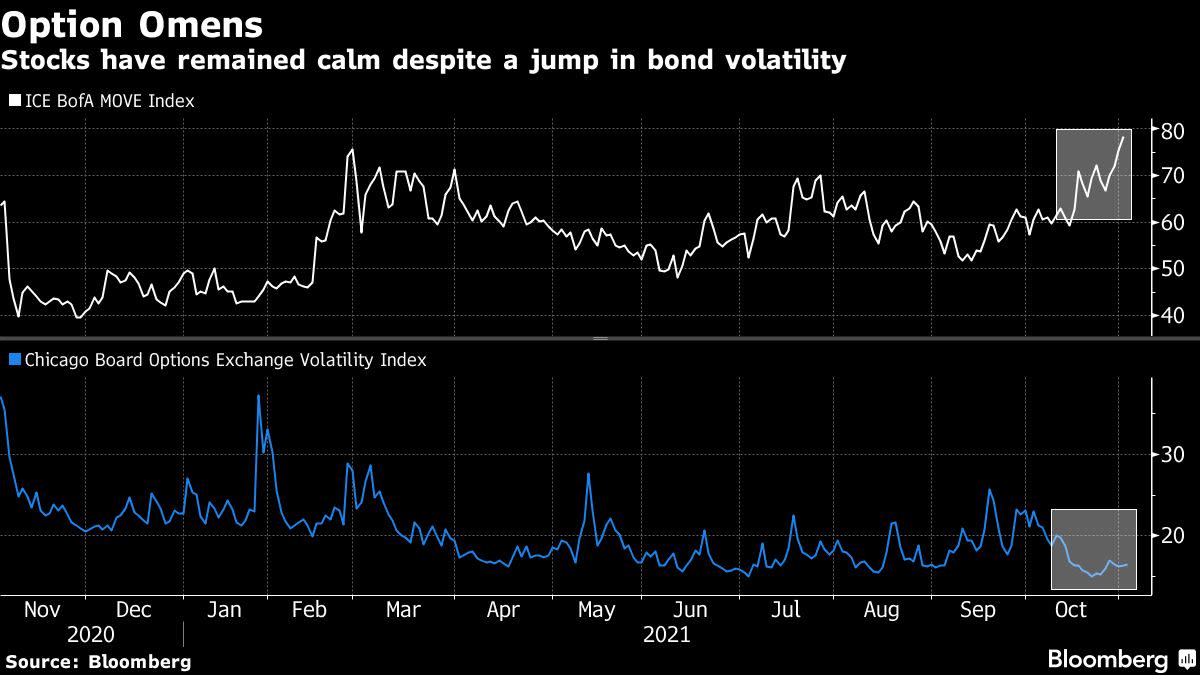

Meanwhile, an option-derived gauge of Treasury volatility recently surged to the highest since April 2020, while the S&P 500’s equivalent hovers close to the lowest since before the crash last year. It’s a sign the fixed-income market may be telegraphing worrying omens for stocks.

“From here we enter the midcycle adjustment, where gains moderate as expectations get recalibrated and policy normalizes,” Shalett at Morgan Stanley Wealth wrote. “Odds of a 10%-15% correction are increasing.”

(Updates with Tuesday trading latest.)

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.