The ‘Dow 36,000’ authors weren’t just 17 years off the mark. Here’s the key mistake they made.

It’s tapering day, not just at the Federal Reserve but also at the Treasury, which is likely to announce auction-size cuts. More on that later.

The book “Dow 36,000” this week attracted headlines 22 years after its publication, when the leading stock market benchmark DJIA,

Eddy Elfenbein, the portfolio manager of the AdvisorShares Focused Equity ETF and the author of the Crossing Wall Street blog, said he read the book in one day and found key errors.

The point he made in his review was not so much that James Glassman and Kevin Hassett, who would later become chairman of the Council of Economic Advisers in the Trump administration, were wrong in their prediction (though, to be clear, they were). As he points out, they were actually arguing the Dow should be at 36,000, in 1999, when it was 9,000, though they conceded it would take three to five years to get there.

He took issue with their way of measuring risk. Glassman and Hassett conclude that stocks are not riskier than Treasury bonds, because the standard deviation of stock returns in the long run is similar to that of bond returns.

“That’s a faulty conclusion. Even if the standard deviations are the same size, it doesn’t say anything about the risk that they’re looking for,” said Elfenbein. He uses an analogy — two houses that are identical except that one has a great view of the river. “Compare the prices of the two homes, and the difference must be the price of the view. The fact that the prices paid may deviate from their own respective averages the same way, speaks nothing as to the price of the view. Glassman and Hassett are saying that since those deviations are the same, the river view is free,” said Elfenbein.

There was another big mistake, the fund manager said, in the Glassman-Hassett model. “It’s impossible to have a one-time-only ratcheting down of the market’s dividend yield. The reason is that if long-term stock returns don’t change, as the authors do assume, a lower dividend yield will always create a commensurate increase in the dividend growth rate. As a result, there will always be a new higher dividend whose yield will always be in need of being notched back down,” he said. Their model would yield not a fourfold increase in stocks but an infinite increase. “This means the authors are actually insufficiently bullish and, moreover, they’ve mistitled their book,” he said.

The book isn’t totally useless, though. “In any case, their strategies are rather conservative: Buy and hold, diversify, don’t trade too much, don’t let market fluctuations rattle you, don’t time the market. All perfectly sound ideas and not specifically dependent on ‘Dow 36,000.’ ”

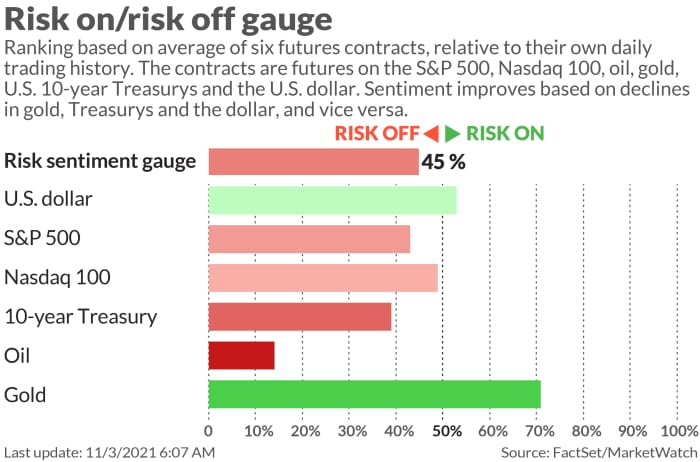

The chart

Speaking of Dow 36,000, where would the index been if the components hadn’t changed? The answer: a lot lower. David Rosenberg, the chief economist and strategist at Rosenberg Research, said the Dow has become more digital- and services-oriented. “The results are a fascinating illustration of just how much the change in constituents can influence investor returns — a reality that is even more important in the age of ETFs and passive investing.”

The buzz

The Federal Open Market Committee is set to announce it will reduce the rate of monthly Treasury securities by $10 billion per month, and the rate of mortgage-backed securities by $5 billion per month, and stop purchases altogether by June 2022. The key question is the degree to which the central bank, and Chair Jerome Powell in his press conference, lean against the market pricing of a rate hike by the middle of next year.

Ahead of the decision, ADP estimated 571,000 private-sector jobs were created in October.

The Treasury Department is set to announce issuance reductions at its refunding announcement. Deutsche Bank forecasts a reduction in gross offerings by $76 billion for the November-to-January quarter.

Bed Bath & Beyond BBBY,

Zillow Group Z,

Lyft LYFT,

Deere & Co. DE,

Glenn Youngkin was projected to win the Virginia governor’s race, a key Republican pickup in a state that voted against President Donald Trump.

The market

After yet another record-setting day — the 61st high for the S&P 500 SPX,

Random reads

In Australia, police found a 4-year-old who had vanished from a campsite 18 days earlier.

Meet the man who wants to become chief rabbi of Saudi Arabia.

Rafael Nadal played tennis with a 97-year-old (who sported a nice one-handed backhand).

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.