The Baltic Dry Index (BDI) is a composite measure of the cost of shipping dry bulk commodities, such as coal, iron ore and grains, by sea, and is considered a bellwether for global economic activity.

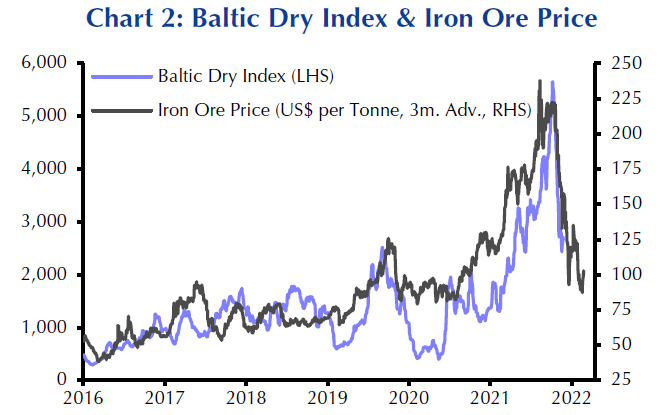

After tripling since the start of the year, the BDI has now fallen by just over 50% since its early-October peak.

According to a new report by Capital Economics, the drop in the BDI is related to the recent plunge in the price of iron ore.

“Some commentators have pointed to the slump in the Baltic Dry Index as a sign that shipping bottlenecks are easing. But we think it is more a symptom of lower Chinese steel output and plunging iron ore prices,” said Capital Economics Chief Commodities Economist Caroline Bain.

“The decline in the BDI has not been mirrored in other shipping cost indices. Container shipping costs have dipped recently, but they remain historically very high.”

Iron ore typically accounts for around 20-30% of the dry bulk trade and China consumes around two thirds of the world’s seaborne iron ore.

China’s monthly steel production has been falling since July after seeing double-digit growth in the first half of the year, as strict output controls and curbs on power usage dented both supply and demand.

In a recent report, Fitch Solutions said the iron ore rally is over and revised down its price forecast from $170/tonne in 2021 and $130/tonne in 2022 to $155/tonne and $110/tonne, respectively.

“For now, China’s iron ore imports have held up relatively well given the downturn in steel production, but stocks at ports are rising and we think it is just a matter of time before imports plunge,” said Bain.

(With files from Reuters)