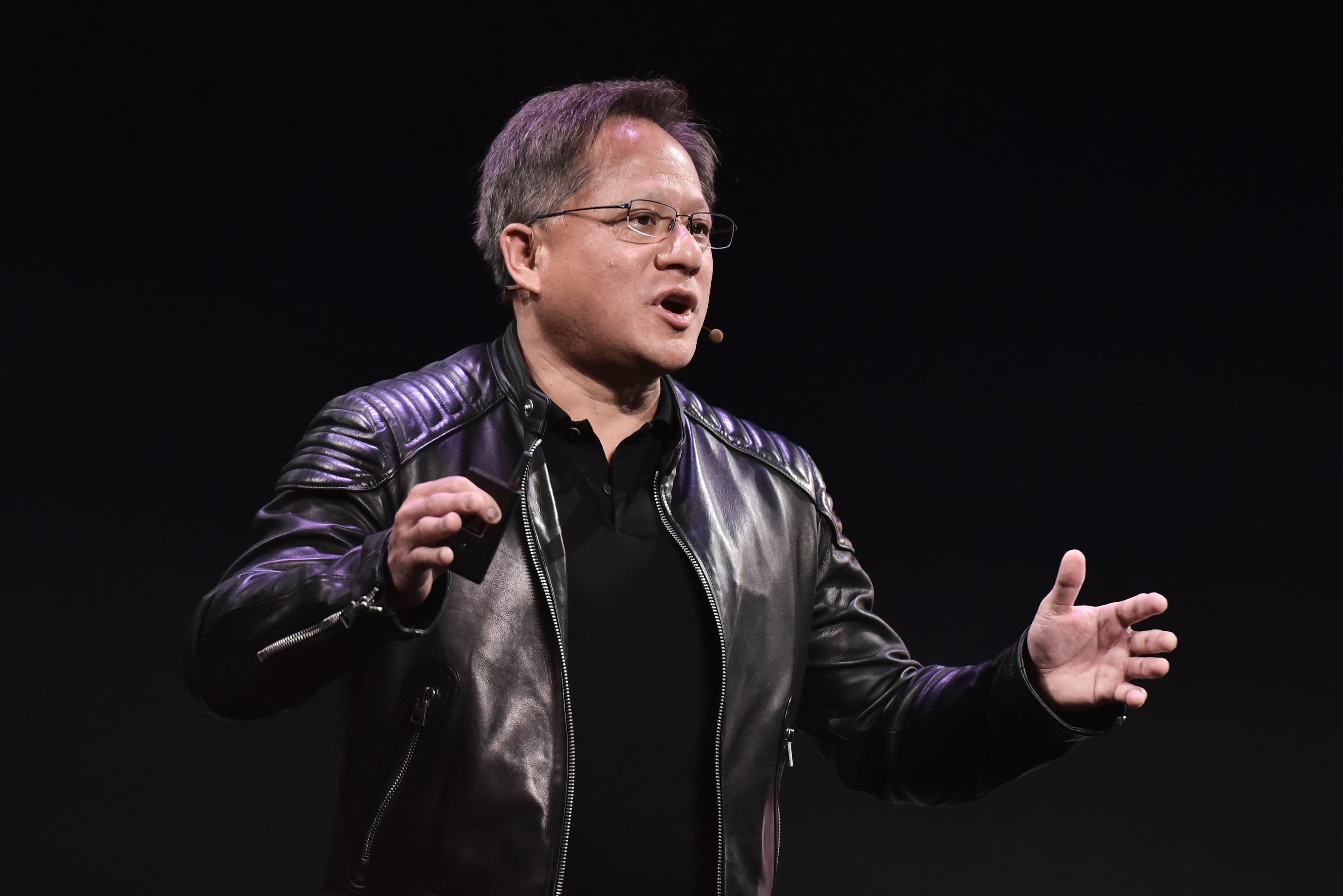

Nvidia CEO Jensen Huang wearing his usual leather jacket.

Getty

(This article was sent first to members of the CNBC Investing Club with Jim Cramer. To get the real-time updates in your inbox, subscribe here.)

What I am looking at November 18, 2021:

- Nvidia (NVDA) earnings… Nvidia will be the next $1 trillion company… the question is, will it be the first $10 trillion company?… our entire economy will be run on their GPUs!… well, not the entire, but anything that is digital will touch Nvidia IP: cars, workers, science and best of all, things that only CEO Jensen is thinking about including whole industries that don’t yet exist… greatest inflation fighter ever?

- Cisco (CSCO) says orders great but supply chain suppresses profits… is that reasonable or do we just want a company that has no supply chain issues with good growth?… supply chain issues are the kiss of death this Q because so many companies have figured out a way around them… See Skyworks CEO on Mad Money last night…

- Endeavor (EDR) upgraded from hold to buy at JPMorgan… live events, sports, tv and film… Citi and Deutsche raise PT

- Boeing (BA)… JPMorgan goes hold to buy … says fairly defined path and China Max certification now in view… The Chinese have to recognize that there simply is NO reason not to approve… sunk cost so to speak

- Baird likes TJX Cos. (TJX)… is this the best of the moment for apparel?… Victoria’s Secret (VSCO) very positive, too

- Tilray (TLRY)… Barclays starts with a sell rating… analyst says investor expectations are too high… Canopy Growth (CGX) is started as a neutral

- Macy’s (M)… it is a new customer story… digital curated marketplace… I hope it is going to the omniverse.. .This is a real turn because it also includes debt paydown… has right inventory… supply chain bottlenecks being dealt with… and the cadence is very strong…today’s TJX?

- Roblox (RBLX)… Stifel goes from $121 to $134 price target… predicts it could reach one billion active users… need to know more about Nvidia and Roblox

- Activision Blizzard (ATVI)… how much trouble really?… JPMorgan goes from buy to hold and Baird cuts price target from $82 to $74… has this company gone rogue?

- Kohl’s (KSS)… another good Q… don’t’ forget they got Sephora this Q… makeup and skincare starring… perhaps readthrough to Ulta (ULTA), and Bed Bath & Beyond (BBBY)… positive readthrough.

- Crowdstrike (CRWD)… has healthy cloud native biz… Davidson says stay the course

- Alibaba (BABA)… disappointing earnings even after guidedown… time to acknowledge that there is more than just one Amazon there—Pinduoduo and JD.com

- Enphase Energy (ENPH)… multiple price target raises after investor day

- Multiple PT boosts on Lowe’s (LOW)… So LOW, HD, M, KSS, Victoria’s Secret… winners

- Best Buy (BBY)… will be the next big one…earnings next week… Wells Fargo raises price target from $125 to $135… sees great risk reward

- How about Williams Sonoma (WSM) after the close?… If Kohls and Macy’s are good then WSM should be best in show and reports tonight

he CNBC Investing Club is now the official home to my Charitable Trust. It’s the place where you can see every move we make for the portfolio and get my market insight before anyone else. The Charitable Trust and my writings are no longer affiliated with Action Alerts Plus in any way.

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Typically, Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If the trade alert is sent pre-market, Jim waits 5 minutes after the market opens before executing the trade. If the trade alert is issued with less than 45 minutes in the trading day, Jim executes the trade 5 minutes before the market closes. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. See here for the investing disclaimer.

(Jim Cramer’s Charitable Trust is long NVDA, CSCO, BA.)