Where is the missing Kumtor gold?

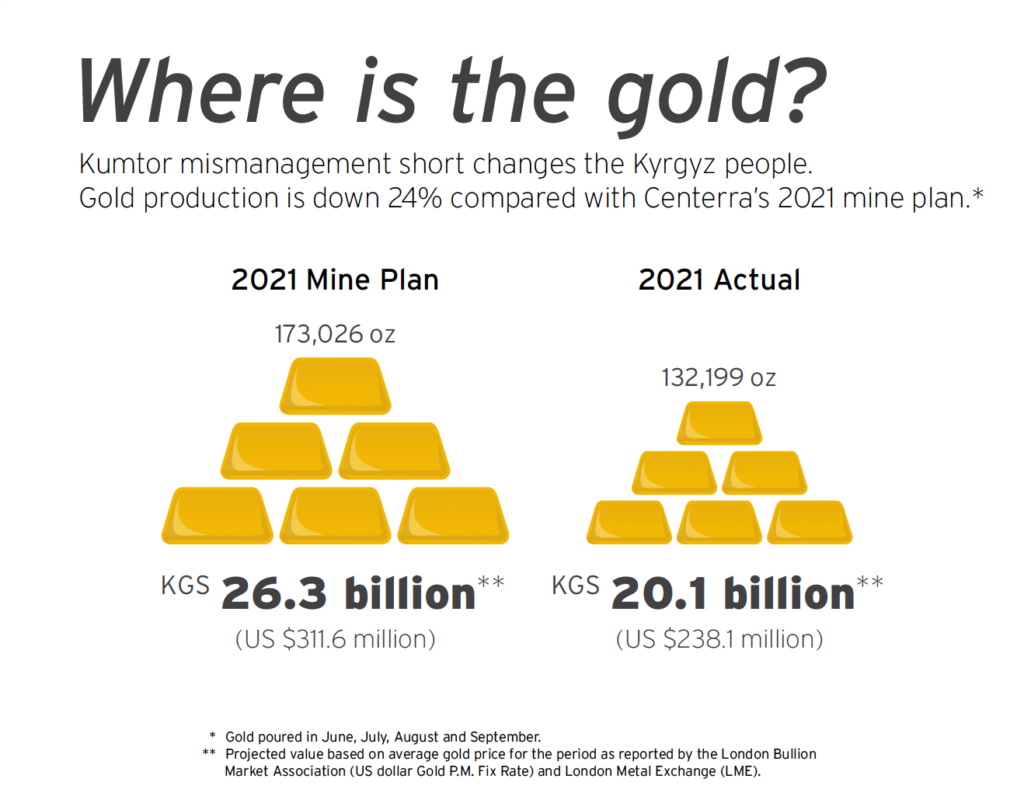

“In particular, gold output plunged more than 24% below Centerra’s approved 2021 mine plan over the period between June and September,” Centerra says in an emailed statement.

“That means the external management poured about KGS 6.2 billion ($73.5 million) less gold, based on the average gold price for the period.”

Centerra also takes issue with the current management’s refusal to publish any production data or other indicators of the mine’s output since the last public update crossed the wires on June 25.

“When Centerra was in control of the mine, the Kumtor Gold Company (KGC) released timely, accurate and detailed information about its operations – including how much gold was produced and sold. Despite calls for transparency from members of parliament, the “external management” has refused to publish any production data or other indicators of the mine’s output,” says Centerra.

Centerra wants to know where Kumtor’s missing gold is?; why hasn’t KGC published any operating results since the government seized the mine?; how does the government intend to make up for falling gold production?; who is buying the gold, and where are the proceeds?; how much is Tengiz Bolturuk [the current mine manager] being paid to run such a failing operation?; why won’t the government allow an independent assessment of the condition of the mine?

“Kumtor plays a critical part in the Kyrgyz economy, and we again urge the government to allow Kyrgyz and international journalists to visit the mine and get answers to these and other questions,” says Centerra.

Bloomberg Law reported on October 21 that KGC won a significant victory against Kyrgyzstan in the US bankruptcy court to borrow up to $10 million. It defeated the Kyrgyz government’s objection to the loan request.

KGC, a subsidiary of Toronto-based Centerra, filed for bankruptcy in June after the central Asian country seized control of the company’s mine after passing a law that enhanced state power.

According to Bloomberg Law, Kyrgyzstan was challenging Kumtor’s right to bankruptcy protection in the US, saying the court shouldn’t allow the loan until the country’s motion to dismiss the case was heard early next year.

However, the lender lien will remain unenforceable until the case dismissal issue is resolved.

Late August Centerra said it had obtained photographic evidence that there then at least 40 meters of water at the bottom of its seized Kumtor gold mine in Kyrgyzstan and “abnormally” large amounts running down the pit walls, which it said could lead to catastrophic events.

At C$9.43 apiece, Centerra’s Toronto-quoted equity is down about 36% in the year to date, capitalizing it at C$2.8 billion (US$2.26 billion).