After a dazzling 2021 performance, here’s what contrarian investors are predicting for 2022, says Citi

The Federal Reserve laid its rate-hike cards on the table and the stock market stood up and cheered. And Wall Street seems ready to pick up where it left off for Thursday. At least for now.

While a hawkish turn from the central bank — three rate increases in the year ahead to tame inflation and a faster taper — removed hated uncertainty for investors, some aren’t sure all this euphoria makes sense. That’s as the omicron coronavirus variant appears may be ready to cause some trouble.

In our call of the day, Citi strategists have tracked how aggressive, contrarian market moves have done this year — they largely crushed it — and their bets for the year ahead.

First, the backdrop on contrarian picks, which strategists Robert Buckland, Mert Genc and Beata Manthey said dates back to pre-COVID and Christmas lunches between clients and brokers that often included stock picking competitions. The more outrageously contrarian the better, as many chose bulls from the year’s biggest losers and bears from the winners.

Here’s a look at that strategy for this year, with picks taken from the MSCI AC World Index. It shows bullish bets on oil and bank stocks paying off, along with shorts on frothy tech stocks such as Zoom Video ZM,

The contrarians also made winning bets on other assets — long oil, high-yield bonds, short gold, caution on emerging markets, though that same view on U.S. and other developed equities didn’t go well. The overall strategy would have returned a “healthy” 11%, said Citi

“Their longs benefited from global recovery. Their shorts benefited from the regulatory crackdown in China. But that doesn’t mean that contrarianism is a consistently winning strategy. In fact, it’s only delivered in 9 of the last 26 years,” said Buckland and the team.

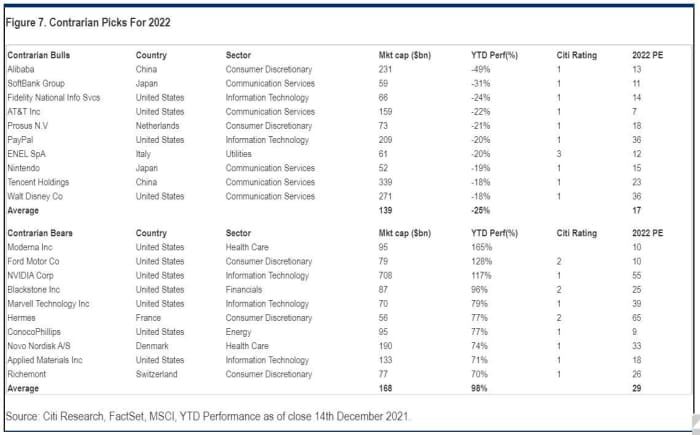

As for those 2022 bets, here’s the overall view:

“Contrarians are now positioned for global economic slowdown, which would help more defensive equities outperform. They could also profit from significant Fed tightening, which might derate expensive growth stocks. Chinese fiscal or monetary stimulus could also help contrarians in 2022,” said Buckland and the team.

Apart from another bearish bet on developed markets, contrarians would be shorting oil, the dollar and buying gold. Bull and bear stock picks are laid out in this chart, and note Citi said its own research colleagues are more positive on the former than the latter:

“Semiconductor shorts are a favorite sell, but our contrarian would also be calling against this year’s rebound in Ford F,

“A contrarian’s bullish sector calls on global utilities and consumer staples might also benefit from economic slowdown, as would bearish calls on energy and financials. Maybe our Christmas Luncher is looking for a policy error from the Fed,” said Buckland and the team.

The buzz

Social news website Reddit said it has confidentially filed paperwork with the Securities and Exchange Commission to go public. Naturally, the WallStreetBets crowd is all fired up.

More central bank action: the Bank of England surprised with a 15 basis-point rate hike, while the European Central Bank announced its emergency bond buying program will end in March, though regular bond buying will step up to smooth that over. As well, Norway’s Norges Bank hiked rates and the krone NOKUSD,

Home builder shares have been tearing higher this year, as evidenced by fresh data showing new-home construction demand surging. but Lennar LEN,

Also on the data front, weekly jobless claims jumped 18,000 to 206,000, but remain near a 52-year low. Still to come is the Philadelphia Fed manufacturing index, industrial production and the flash Markit manufacturing purchasing managers index.

With omicron in the backdrop, Apple AAPL,

Roblox stock RBLX,

Check out the latest MarketWatch podcast, featuring MarketWatch’s Editor-in-chief Jeremy Olshan who is talking to economists and the world’s top gamer, Ninja about what games can teach us about money.

Bruce Springsteen has reportedly sold his entire music catalog, including hits such as “Born in the U.S.A.” to Sony Music Entertainment SONY,

A tragic bouncy-house accident in Tasmania, Australia has left five children dead and several injured.

The markets

Stocks DJIA,

Top tickers

Here are the top tickers on MarketWatch, as of 6 a.m. Eastern.

| Ticker | Asset name |

| AMC, |

AMC Entertainment |

| TSLA, |

Tesla |

| GME, |

GameStop |

| DXY, |

U.S. Dollar Index |

| NIO, |

NIO |

| TMUBMUSD10Y, |

U.S. 10-year Treasury note |

| DJIA, |

Dow Jones Industrial Average |

| AAPL, |

Apple |

| ES00, |

S&P 500 Futures |

| NVDA, |

Nvidia |

The quote

“But all the things we do know are bad, the principal one being the speed at which this is moving. It is moving at an absolutely phenomenal pace.” That was the U.K.’s chief medical officer Prof. Chris Whitty’s omicron warning to limit social contacts, after daily new infections hit 78,610, the highest since the pandemic’s start.

Random reads

Song made entirely of bird sounds is busting the charts in Australia.

A pioneering female bus driver in Manchester says she’s about to lose her job for being too short.

You could retire off those old comic books

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.